The US dollar rose, amid news that retail sales and industrial production in the US have started to recover. However, the speech of Fed Chairman Jerome Powell was a sobering event, as the Fed head did not make any good forecasts for the future, pointing out only the problems that had to be addressed.

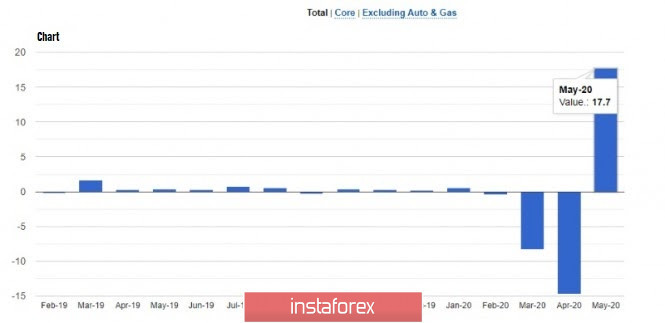

According to the report published yesterday, retail sales grew in May this year, recording a much better figure than the forecasts of economists. This indicates that the US economy is likely to have passed the bottom and will soon begin its active recovery after the coronavirus pandemic. This increase in retail sales was the strongest record in history, but this was due to the same collapse caused by the quarantine measures. The growth was recorded immediately in all categories, from online sales to sales of clothing and furniture, which, for example, grew immediately by 188% compared to April. Thus, from the data presented by the US Department of Commerce, retail sales in the US increased by 17.7% in May this year, and total retail sales total to $ 486 billion. Economists expected retail sales to grow 7.7% in May from the previous month.

Industrial production in the US also pleased traders because its rise indicates an active economic recovery after the pandemic. According to the report published by the Federal Reserve, after a record drop in April, industrial production rose by 1.4% in May, good but still lower than the expected 2.6%. This suggests that the damage given by the quarantine measures was much more serious than expected, as data for April was revised downward to -12.5%. The largest growth was observed in the manufacturing industry where production grew by 3.8% in May, which is actually a pretty good signal since it accounts for most of the total. Meanwhile, production in the mining and utility sectors continued to fall in May this year, with capacity utilization at 64.8%, lower than economists forecast of 66.7%.

Such strong macroeconomic reports supported the US dollar yesterday at the beginning of the US session, but the speech of Fed Chairman Jerome Powell dragged it back down slightly. His statements spoke a lot on the US economy, monetary policy, and the labor market, but his forecasts and expectations were quite restrained, which indicates that the Fed will likely retain its current monetary policy for quite a long time. Such a stance decreased the strength of the US dollar.

Powell also noted in his speech that some of the latest economic data indicate stabilization and signs of moderate economic growth, most likely pertaining to the latest labor market data and retail sales growth, which are the main economic driver. However, there is still considerable uncertainty in the scope and scale of economic recovery, so the Fed Chairman intends to continue to use available tools to support recovery. Thus, the Fed will keep rates at low levels until it is sure that the recovery is in full swing.

As for inflation risks, there are no signs of sharp growth due to the current low interest rates, and there is a high chance that inflation will remain below the target level of 2% for some time. Nevertheless, Powell expects inflation to reach 2% as soon as the economy recovers. However, since significant uncertainty remains with regards to the time and strength of the recovery, the Fed will continue to be as transparent as possible in terms of implementing emergency support measures.

The Fed chairman also emphasized the fact that medium and small businesses, which received additional financial assistance, suffered the most from the pandemic, so the recovery of some sectors of the economy will be rather difficult, prolonging the confidence of restoration in the economy.

With regards to the labor market, Powell said that he expects to see impressive data soon, as unemployment is sure to decline amid weakening social distance measures.

At the end of the speech, Powell tackled the increasing Fed balance sheet, which "doesn't fit into any gates" after the adoption of such extensive emergency assistance programs for the economy, aimed at supporting business and the public. Powell assured the markets that the increase poses no threat to inflation and financial stability, so the issue does not cause him concern at this point of time.

"The Fed will focus on providing the necessary support to the economy for as long as necessary, and only then will it think about reducing the balance," Powell added.

Regarding the control of yield curve, Powell hastened to assure that the Fed has not yet made any decision regarding this issue, as it does not want to distort the functioning of the corporate bond market in any way. Powell also reiterated that negative interest rates are not attractive to the US economy.

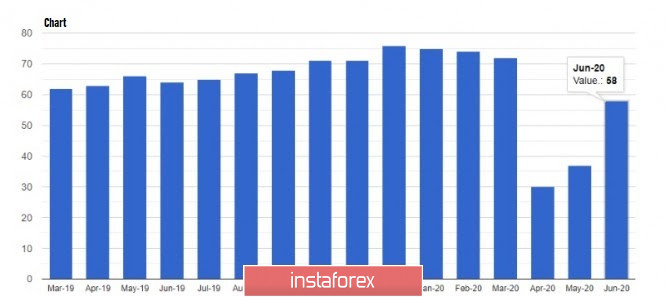

With regards to other macroeconomic data, the National Association of Home Builders revealed that the housing market index rose to 58 points in June 2020, much higher than the economists forecast of 46 points. A number of reports on the construction sector and the housing market are to also come out today, which will be very positive and can strengthen the position of the US dollar in the afternoon.

Meanwhile, the reports on US retail sales were ignored by the market, even though the data from the Goldman Sachs and Retail Economist indicated an increase in the index of about 3.9% over the week from June 7 to 13. Redbook, on the other hand , noted a decrease in US retail sales by -2.4% for the first 2 weeks of June.

As for the technical picture of the EUR / USD pair, the bulls need to return the quotes to the middle of the side channel 1.1285, as only after this will it be possible to count on a return to the upper border in the area of 1.1350. However, if the bears turn out to be stronger today, a breakout from the weekly lows in the area of 1.1215 will put significant pressure on the euro, and this will lead to the drop of the quotes in the areas 1.1160 and 1.1100.