Technical analysis recommendations for EUR/USD and GBP/USD on June 17

Economic calendar (Universal time)

6:00 Consumer Price Index (UK)

6:00 Manufacturing Price Index (UK)

6:00 Retail Price Index (UK)

9:00 Consumer Price Index (Eurozone)

12:30 Building Permits (US)

12:30 The volume of construction of new houses (USA)

14:30 Crude Oil Reserves (USA)

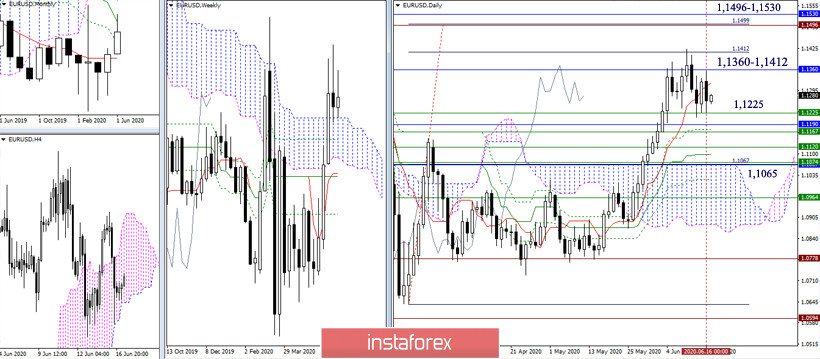

EUR / USD

All the achievements of the players to increase yesterday were leveled by the opponent, but the support zone did not allow them to achieve more. The situation remains in the previously designated areas. From the upper half, the development of resistance rise is limited by 1.1360 - 1.1412 (monthly Kijun + last week's maximum) and 1.1496 - 1.1530 (maximum of the March high wave + 100% working out of the daily target for breakdown of the cloud + final boundary of the monthly dead cross of Ichimoku). On the other hand, various levels from a fairly wide support area of 1.1225 - 1.1065 (weekly cloud + daily cloud + daily levels of Ichimoku crosses daily, weekly, monthly times) will limit bearish activity from the lower half.

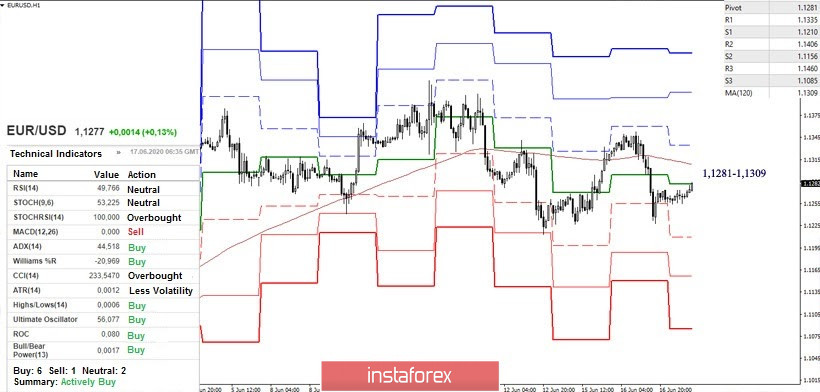

Yesterday, the key levels on H1 declined to the side of the players. However, they failed to update the minimum, and the opponent returned the situation to testing levels again. The central pivot level of the day (1.1281) and the weekly long-term trend (1.1309) now act as resistances. The probability of the occurrence of lateral movement, with the center of gravity in the form of key levels, indicated earlier, remains relevant. The support for the classic pivot levels are located today at 1.1210 - 1.1156 - 1.1085, while resistance are at 1.1335 - 1.1406 - 1.1460.

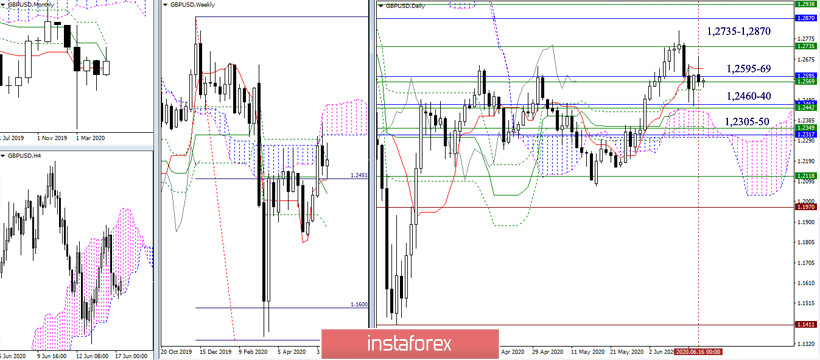

GBP / USD

The rebound formed on Monday did not receive confirmation and development. The pair returned to the attraction zones of levels 1.2595 - 1.2569 (monthly Kijun + weekly Fibo Kijun). The previously identified support 1.2460-40 (weekly and monthly Tenkan + daily Kijun + upper cloud border) - 1.2305-50 (lower border of the daily cloud + weekly Kijun + monthly Fibo Kijun) and resistance 1.2735 - 1.2812 - 1.2870 (the lower border of the weekly cloud + monthly Fibo Kijun + maximum extreme) retain their location and significance today.

Players on increase did not manage to secure a firm consolidation above and deploy the moving. As a result, the key levels (the central Pivot level + the weekly long-term trend) are the object of attention and upcoming testing again. The levels today are located in the area of 1.2602-14.In turn, support for classic pivot levels are now bearish intraday indicators and are located at 1.2517 - 1.2467 - 1.2382.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)