Good day, dear colleagues!

Yesterday's strengthening of the US dollar did not pass by the pound/dollar currency pair, which did not meet expectations and could not continue to grow.

In recent days, market participants' expectations regarding the continuation of agreements between the UK and the European Union have resumed. Let me remind you that all the agreements and details of the UK's exit from the EU must be completed by the end of this year. However, the COVID-19 epidemic seems to be making a difference. It seems that the parties have reached a significant part of the preliminary agreements, however, they are in no hurry to implement them. Well, okay, this is the subject of a separate article, and in this one we will analyze the pound/dollar currency pair directly.

The speech of Federal Reserve Chairman Jerome Powell before the Banking Committee of the US Senate was discussed in more detail in today's article on EUR/USD. If you are interested, you can read it. In a nutshell, both Powell's speech and yesterday's statistics from the US provided support for the US currency. The dollar bulls were particularly pleased with the data on retail sales, which turned out to be quite strong.

Today at 07:00 (London time), a large block of macroeconomic statistics from the UK was released. The most important indicator is the consumer price index, which was released within the forecast values.

In the evening, at 17:00 (London time), the second part of the semi-annual report on monetary policy of Fed Chairman Jerome Powell will be held. It is unlikely that the head of the Federal Reserve will be able to surprise the markets with anything else, however, it is definitely worth taking this event into account. A little earlier, at 13:30 (London time), data on bookmarks of new homes and construction permits in the United States will be released. Not an important statistic, but still.

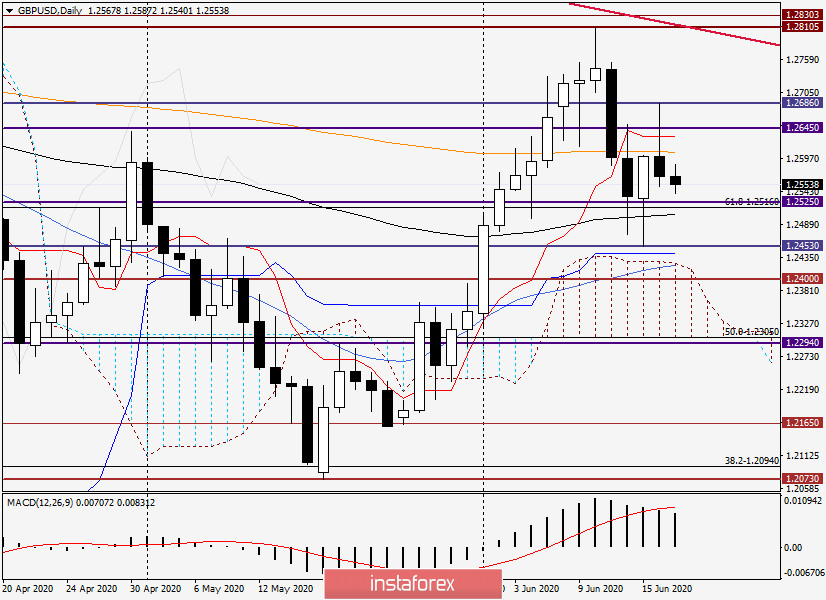

Daily

As can be clearly seen on the daily chart, the pair failed to overcome the 200 exponential moving average and the Tenkan line of the Ichimoku indicator. After the pound soared to 1.2686 on rumors of progress in the Brexit topic, there was a sharp reversal, as a result of which all growth was leveled. Moreover, the quote moved into negative territory, and trading on June 16 ended at 1.2568.

At the moment of writing, the pound/dollar is trading without a certain direction with an extremely slight decrease. The nearest resistance is still represented by the 200 EMA and the Tenkan line, which are at 1.2607 and 1.2632 respectively. I venture to assume that while the pair is trading below the significant mark of 1.2600, it is a stretch to count on the growth of the "British". Even if the auction closes above 1.2632 (Tenkan), then you will have to overcome strong resistance from sellers at 1.2686, where the highs of yesterday's trading were shown.

If the pound bears continue to put pressure on the quote, the nearest target will be the area of 1.2525-1.2500, where there is a strong technical level and the black 89 exponential moving average is located. In the absence of a clearly defined direction, let's look at a smaller time frame to look for options for trading within the day.

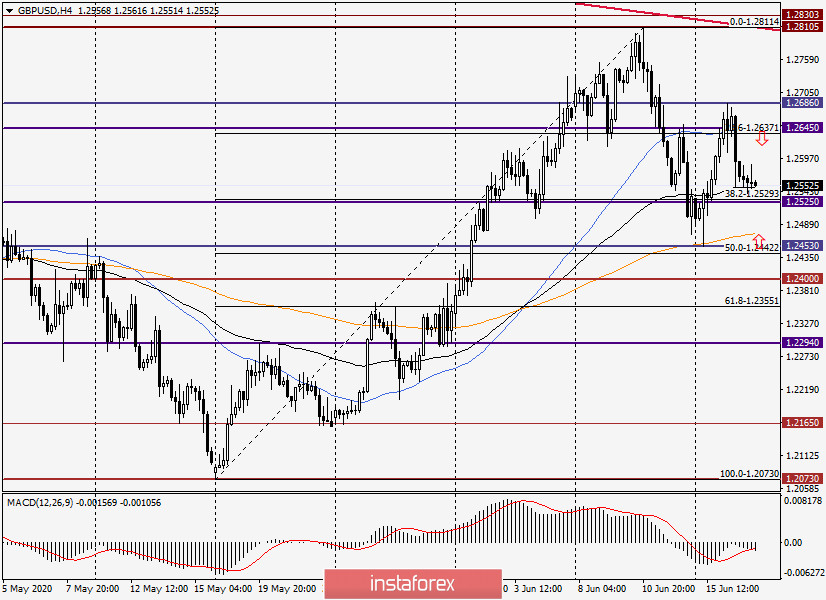

H4

In order not to put things on the back burner, I will immediately go to the trading recommendations for GBP/USD.

So, I recommend considering sales if a reversal pattern of candle analysis appears near 1.2645, which will signal a likely decline in the exchange rate. As you can see, here is the level of 1.2645, 50 MA, and 23.6 Fibo from the growth of 1.2073-1.2811.

It is better to plan purchases at lower prices, around 1.2473-1.2453. There are 200 exhibitors here, as well as the support level. While the pair is held above 89 EMA, it is more aggressive and risky to try to buy sterling from current prices. This is the choice of each of you.

Good luck!