To open long positions on GBPUSD, you need:

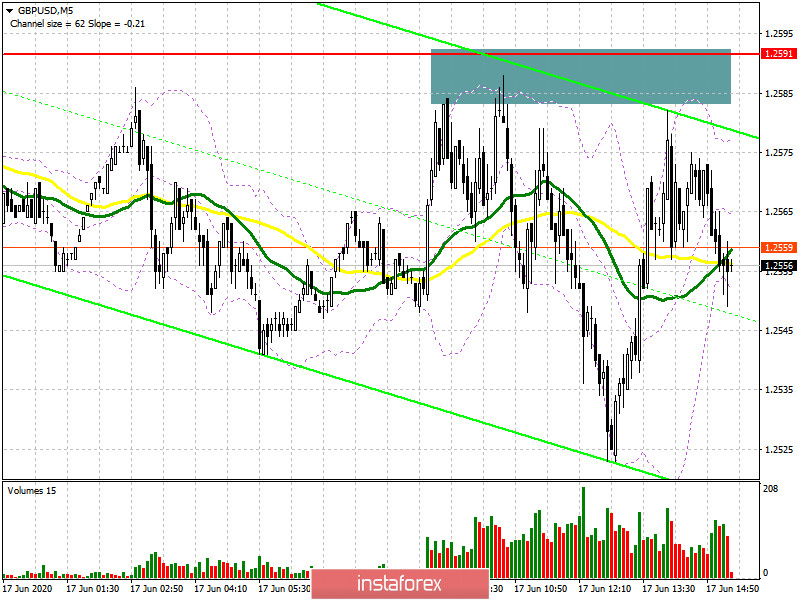

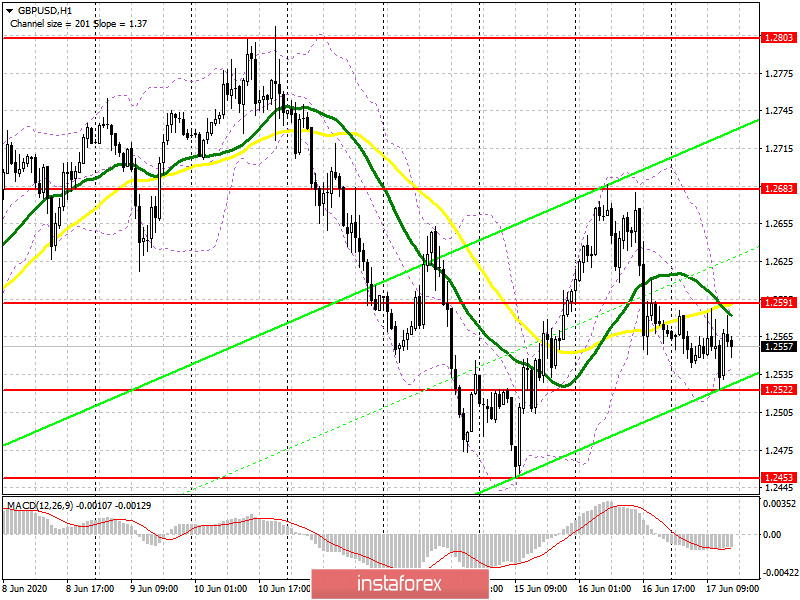

The bulls got close to the morning resistance of 1.2591 several times, however, they did not manage to get beyond it. If you look at the 5-minute chart, you will see how each time, and there were only three attempts, the bears actively acted when approaching the level of 1.2591, which eventually formed a sell signal and led to a decrease in the pound in the first half of the day. However, it was not possible to achieve a larger fall and as a result, the bears hit a new intermediate resistance of 1.2522. From a technical point of view, nothing has changed for buyers. The same return to the resistance level of 1.2591 is required, and this will happen only after weak fundamental statistics on the US economy. Only a break of 1.2591 will lead to repeated growth of the pound in the area of this week's maximum of 1.2683, where I recommend fixing the profits. The longer-term goal remains the area of 1.2801, an update of which will indicate the resumption of the bullish trend formed in early May this year. If the pressure on the pound returns, it is best to return to long positions only after updating the support at 1.2522 and forming a false breakout there. You can buy GBP/USD immediately for a rebound only at the minimum of the week - 1.2453.

To open short positions on GBPUSD, you need:

Vague inflation in the UK, which coincided with the forecasts of economists, left the market on the side of sellers of the pound. Now the focus will be placed on the report on the US economy, which may cause a repeat test of support 1.2522, the breakdown of which will only increase pressure on the pound, however, it will not lead to a break in the bullish trend. To do this, sellers need to cope with a more serious level of 1.2453, from which a large increase in the pound occurred this week. A good signal to open short positions in the second half of the day will also be the formation of a false breakout in the resistance area of 1.2591, in the area of which the moving averages also pass. If there is no activity on the part of sellers in this range, it is best to postpone sales until the resistance test of 1.2683, counting on a rebound of 30-40 points within the day.

Signals of indicators:

Moving averages

Trading is below the 30 and 50 daily averages, which indicates that the bear market will continue in the short term.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break in the lower border of the indicator at 1.2522 may lead to a decrease in the pound. Breaking the upper limit of the indicator in the area of 1.2590 will strengthen the demand for the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20