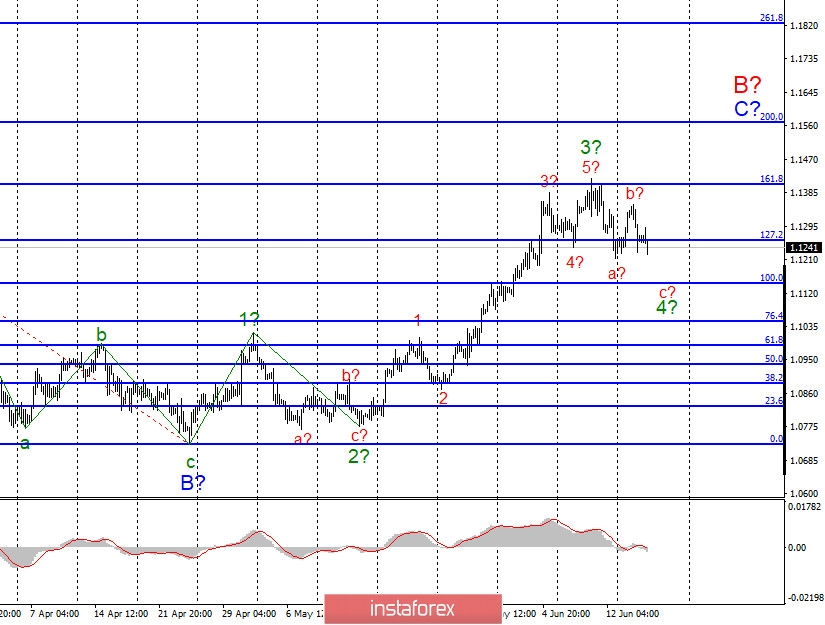

EUR / USD

On June 16, the EUR / USD pair again lost approximately 60 bps and thereby completed building supposed wave b to 4 in C in B. If so, then lowering the tool quotes will continue with the purposes arranged around levels and 100.0% 76.4% Fibonacci, under waves with a 4 to C to B. The upward trend remains uncertain, this that after the completion of construction of correctional wave I expect the construction of wave 5 in C in B.

Fundamental component:

On Tuesday, there were several interesting events and reports in America and the European Union. To begin with, Germany published a report stating that inflation continued to slow down, so a similar trend can be expected from European inflation. Retail sales in the US in May exceeded all forecasts almost twice, that is, they turned out to be much stronger than the markets expected. Thus, yesterday clearly favored the greenback, which was again in demand. In the evening, Fed President Jerome Powell made his first speech in the US Congress, during which he addressed many different issues. He noted that the economy has probably reached its bottom and may begin to recover, but warned the Banking Committee of Congress, to not expect a quick and complete recovery.

Powell added that it is very important to defeat the COVID-19 virus which continues to rage in the United States. Without this, he believes that economic activity cannot be fully restored. Moreover, the US economy requires new additional stimulus packages, in addition to those that are already in place. Even in the European Union today the consumer price index for May is higher, which amounts to 0.1% year-on-year. Given the importance of inflation, it was hardly to be expected that markets would increase demand for the euro. Today, Powell's second Congressional speech is expected which again can help the dollar grow slightly. However, it should be noted that both wave markings now suggest a fall in the greenback, which means that there is a conflict between the news background and wave analysis.

General conclusions and recommendations:

The EUR/USD pair is supposedly continuing to build the upward wave C in B. Thus, I recommend buying the instrument with targets located near the calculated marks 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for new upward signal from the MACD indicator, which can announce the completion of construction of a wave 4 in C in B.

GBP / USD

On June 16, the GBP/USD pair lost about 30 basis points. Thus, at the moment, the internal correctional wave of 3 or C presumably continues its construction. However, the current wave marking suggests a possible completion of the correctional wave and a new increase in the quotes of the instrument with targets above the 28th figure. At the same time, the news background may begin to put pressure on the pound sterling and cause a drop in demand for this currency, which may lead to the completion of the construction of the entire upward trend section, which dates back to March 19th.

Fundamental component:

On Tuesday a report was released on the UK showing data on the unemployment rate for the month of April at 3.9%, the number of applications for unemployment benefits in May was at 528 thousand and the change in average wages is 1%. It is worth noting that all reports, except for unemployment, were significantly worse than expected, but the markets did not respond to this data with sales of the pound sterling. Only later in the evening, when Jerome Powell spoke, did the dollar begin to grow. Today in the UK released an inflation report for May, which amounted to only 0.5% y / y. However, this is absolutely normal value of inflation in the current conditions. Let me remind you that inflation in the EU was less than - 0.1%.

General conclusions and recommendations:

The GBP/USD tool continues to build a rising wave. Thus, purchases remain valid with targets located near the estimated levels of 1.2844 and 1.3030, which corresponds to 61.8% and 76.4% Fibonacci. I recommend continues purchases of the pound sterling for each upward signal of the MACD indicator. Also, pay close attention as the tool may unexpectedly complete the construction of the upward trend section.