The Bank of England will announce today its decision on interest rates, as well as its assessments on the UK economy, which will affect the direction of the pound. Bulls have long been waiting for a powerful shot up, but the negative macroeconomic data for April had prevented it. In addition, negotiations between the UK and EU remain unclear, so a bullish mood on the pound is still uncertain.

Market participants are expecting the Bank of England to increase its bond purchase program today by another £ 100-150 billion, which may support the economy and strengthen the position of the pound. Such additional volume will not only help stimulate the real sectors of the economy, but also finance the budget deficit, which has grown significantly due to the costs associated with the coronavirus pandemic.

There is also a chance that the regulator will lower the interest rates to negative values today, as Governor Andrew Bailey has recently stated that such a scenario cannot be ruled out. But before that, they would resort first to other measures related to leading indicators and control over the yield curve of government bonds. Such a decision will unfortunately lower the demand for the British pound, which could turn into a collapse to the lows of June.

Thus, any statements given by the Bank of England today will surely control the direction of the pound in the trading chart.

As for the technical picture of the GBP / USD pair, a breakout from the support level of 1.2450 will resume the bearish mood in the market, but an increase above the resistance level of 1.2600 will lead to a new rising wave that would update the highs to 1.2690 and 1.2800.

EUR / USD

As for the euro, bulls are actively defending the level of 1.1215, so strong factors are needed to be able to break through it.

Fed Chairman Jerome Powell delivered another speech yesterday, which once again emphasized that the current fiscal support is positively affecting the economy, so it would be unreasonable for the Congress to quickly curtail support measures. Of course, further support for the unemployed and small businesses is a good idea, but the situation on the labor market will not change if the aid measures were reduced. An increased unemployment benefits in some form will have a positive impact in the short term, but it is unlikely to be the right decision after the completion of the current support measures that were taken due to the coronavirus pandemic.

With regards to interest rates, Powell said that there is mixed evidence that negative rates can provide incentives, so lowering it to negative values right now is inappropriate for the United States.

Powell also reiterated his stance on the Fed's balance sheet, which, in his opinion, does not present and will not present risks for inflation or stability in the future. He said that the Fed will keep most corporate bonds on the balance sheet until maturity.

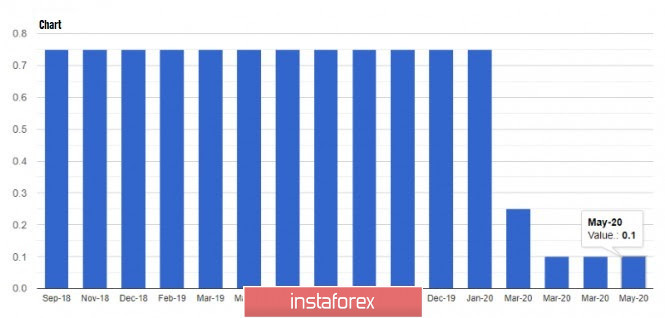

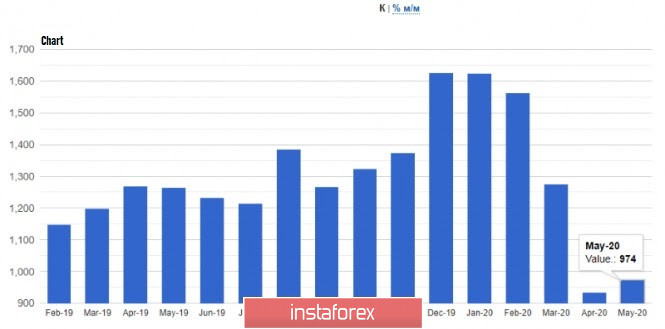

As for macroeconomic reports, the weak data on house constructions in the US (for May) did not affect the market much. According to the report, bookmarks of new homes increased by 4.3% in May, as compared to the previous amount of 974,000 last month. Economists expected the index to grow to 1.09 million. Building permits also increased by 14.4% and determined to about 1.22 million.

As for the technical picture of the EUR/USD pair, the bulls need to work on returning the quotes to the middle of the side channel 1.1285, so that the quotes will be able to come back to the upper border at 1.1350. However, if the bears are stronger today, a breakout from the weekly low 1.1215 will occur, which will put significant pressure on the euro and lead to the descent to 1.1160 and 1.1100.