Good day, dear traders!

The main event for the pound/dollar currency pair will be today's decision of the Bank of England on the interest rate. As most experts expect, the rate will remain at 0.10%, however, the volume of asset purchases under the quantitative easing program may increase to 200 billion pounds.

At the same time, hints of the introduction of a negative interest rate or the fact of such a rate may put significant pressure on the British currency. This scenario seems unlikely, however, it is still not worth completely ruling it out.

There may be significant developments regarding the UK's exit from the European Union. British Prime Minister Boris Johnson suggests that the agreement has a chance to be reached in July. At the same time, the German leadership expects to reach an agreement on Brexit in September. I would like to note that in both cases it is much earlier than December 31, 2020. That is the date by which the Brexit issue should be settled. In any case, the issue of Britain's exit from the European Union is very difficult. Everyone understands this very well. Some issues need to be resolved, such as the issue of fishing.

If we draw a line under the fundamental part of the review, then today at 13:30 (London time), initial applications for unemployment benefits in the United States will be published, which may affect market sentiment and the dynamics of the GBP/USD currency pair. And at the moment, the picture is as follows.

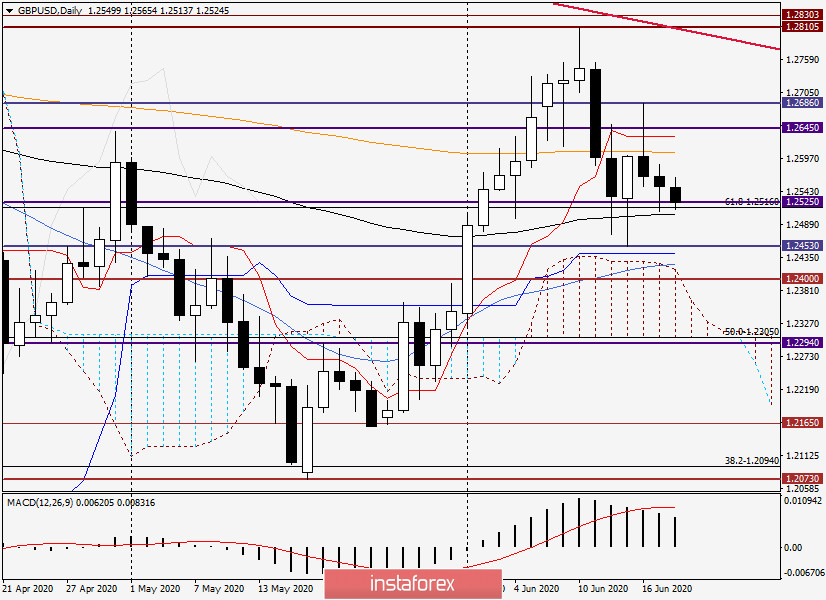

Daily

Yesterday, the pair traded in different directions. After the initial growth and reaching the level of 1.2587, the quote fell to 1.2510, where it was able to correct, and Wednesday's trading ended at 1.2551.

Bulls on the pound were not able to raise the rate above 1.2600 and gain a foothold above this level. I believe that this is a big negative for them, and now the downward prospects of the pound are viewed more clearly. This is exactly what is happening at the moment. The pair is under pressure and is trading near 1.2520. I would like to note at once that this is a very strong and significant technical zone for the market. If today's session closes below 1.2500, the subsequent pressure on the British currency will only increase. It is characteristic that just above 1.2500 there is an 89 exponential moving average, which has repeatedly supported the price and did not allow itself to breakthrough.

The ascending scenario will continue to be relevant only in the case of an alternate breakdown of the 200 EMA and the Tenkan line of the Ichimoku indicator. Naturally, after this, the bulls for the pound still have a lot to do to keep the market for the pound/dollar under their control, but first, you need to return trading above the indicated indicators.

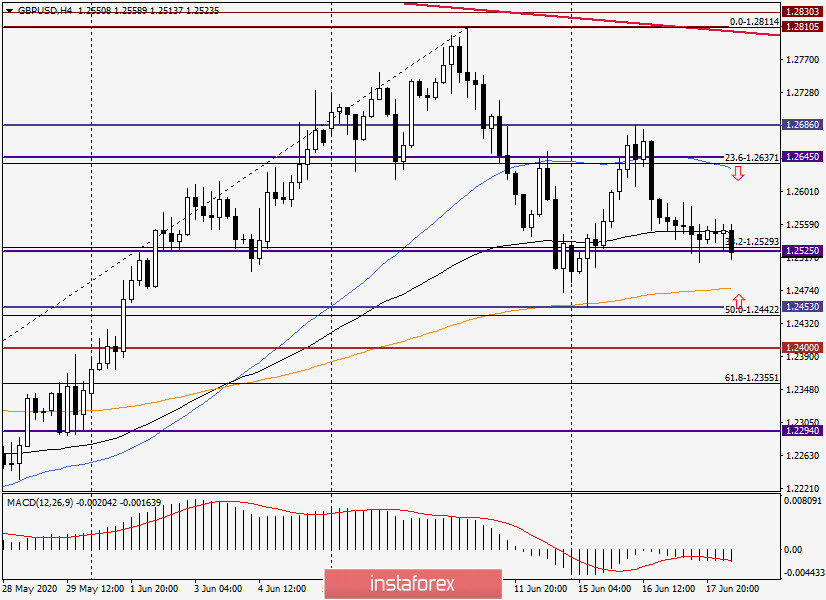

H4

Looking at a series of Doji candles with long shadows, you can conclude that the market is waiting for some driver and can not yet decide to choose a direction. It is possible that such a driver will be the Bank of England's decision on rates, which will be announced at 12:00 (London time). At the same time, the bank's minutes and the scope of the asset purchase program will be published.

I assume that after the publication of these releases, sharp multidirectional movements are possible. Alternatively, you can try selling after a short-term price flight to 1.2630/40, and buying after an equally short-term fall to the area of 1.2460/50. Those who do not want to take risks are better off staying out of the market. This is also a position. No one knows what the reaction of investors will be to the decisions of the British Central Bank.

Good luck!