Everything turned out even worse than one could have imagined. The Bank of England has quite routinely expanded its quantitative easing program and hinted at the possibility of lowering the refinancing rate. But it did so in such a terrifying way that it would be better if it simply announced that the refinancing rate would be reduced to zero by the end of the year. Instead, the BoE decided to remind everyone of the amazing oddities with unemployment, the incredible stability of which runs counter to macroeconomic dynamics and other indicators of the labor market. The regulator decided to close the issues caused by this mismatch, assuring everyone that this is just a temporary statistical anomaly and soon we will see a significant increase in unemployment. But this was not enough for the BoE, so it also decided to add that restoring the labor market will be extremely difficult and long. This means that the economic recovery will be quite protracted. What can be taken as a hint that the refinancing rate may well be reduced to negative values. So it is not surprising that the pound somewhat fell more actively than expected.

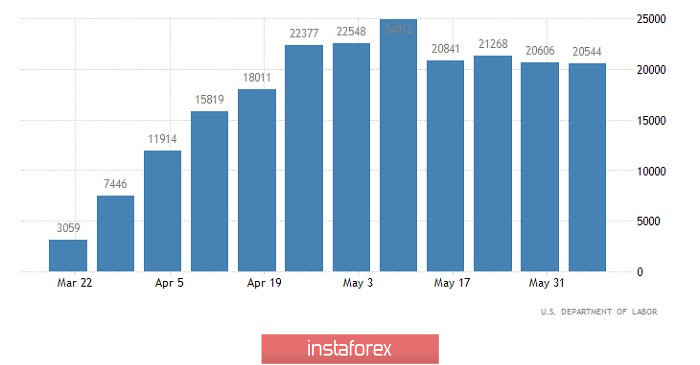

But do not think that there are such problems only in the UK. If the country is only getting ready for all this, then in the United States they are enjoying the slow and dull recovery of the labor market right now. This is perfectly demonstrated by the dynamics of applications for unemployment benefits. The number of initial applications for unemployment benefits decreased from 1,556,000 to 1,508,000. A reduction was forecasted to 1,150,000. The number of continuing claims decreased from 20,606,000 to 20,544,000. A decrease to 20,000 thousand was expected. Other in other words, the total number of applications has remained approximately the same, and given that the values are incredibly large and several times higher than normal and familiar, we can even say that this is not so much about a slow recovery or stabilization, but about a gradual deterioration of the situation. But everyone has become accustomed to this, so this did not affect the mood of investors. After all, if this is already happening in the United States and you can measure and evaluate the scope of this fascinating process. What exactly will happen in the UK is not yet clear and uncertainty is frightening.

Continuing Unemployment Claims (United States):

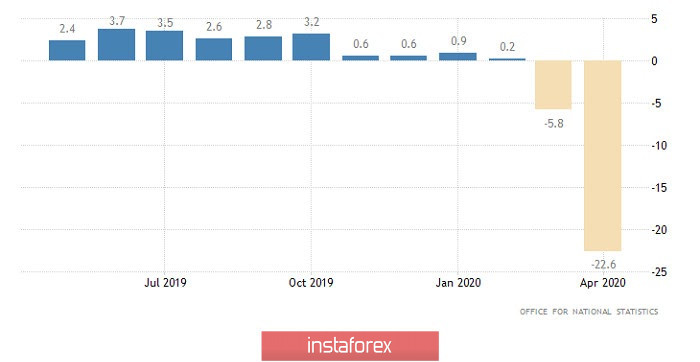

Data on retail sales will be published in the UK today, which may at least slightly help the pound. The decline in retail sales should slow down from -22.6% to -18.0%. The values are just terrifying, but the dynamics, albeit with a stretch, are still positive. Against the background of the Bank of England board meeting, the pound needs at least some hint of optimism and a bright future.

Retail Sales (UK):

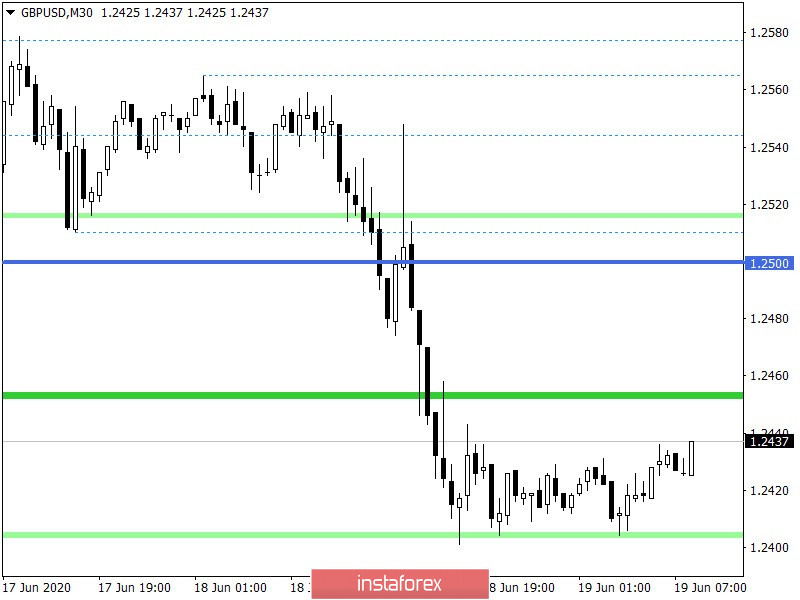

In terms of technical analysis, we see the inertial movement caused by the information and news background, during which the quote managed to overcome the variable level of 1.2500 and go down to the level of 1.2401, where the quote slowed down, forming stagnation within 1.2401/1, 2443. In fact, the quote continued the recovery process relative to an earlier upward trend, where the output is more than 50% at the moment.

Considering the trading chart in general terms, the daily period, it is worth noting that the price movement occurs in the range 1.2150//1.2350//1.2620, which means the clock frequency has remained unchanged.

It can be assumed that the process of inertial-downward movement locally exhausted short positions, as a result of which a temporary pullback may occur in the direction of 1.2475. The most suitable moment to enter the market could be on a breakout of a slowdown of 1.2401/1.2443.

We specify all of the above in a trading signal:

- We consider long positions higher than 1.2445, towards 1.2475.

From the point of view of a comprehensive indicator analysis, you can see that the indicators of technical instruments on hourly and daily periods signal a sale due to a rapid downward movement and consolidating the price below the level of 1.2500.