Technical analysis recommendations for EUR / USD and GBP / USD on June 19

Economic calendar (Moscow time)

9:00 Retail Sales (UK)

9:00 Base Retail Index (UK)

9:00 Producer Price Index (Germany)

19:00 Speech by Fed Governor Quarles

20:00 Speech by Fed Chairman Powell

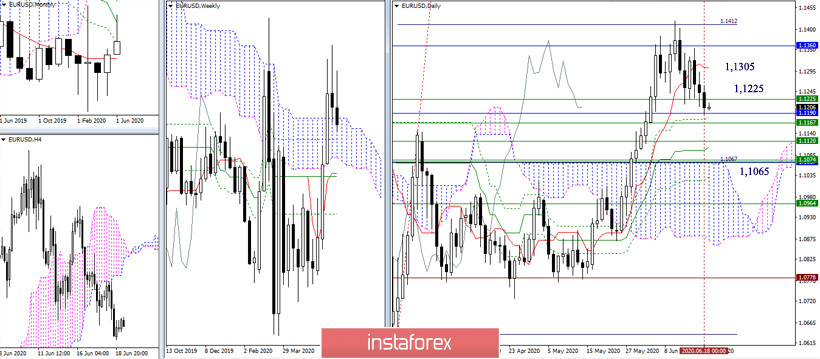

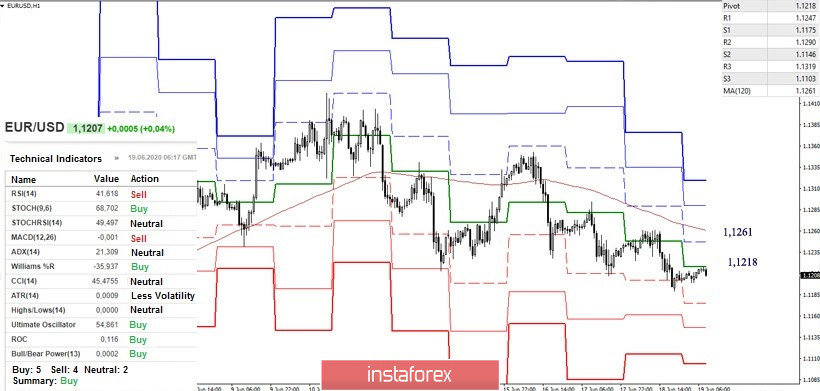

EUR / USD

Yesterday, the pair continued its correctional decline and went down to the next support level - monthly Fibo Kijun (1.1190). The current support area is quite wide and unites many strong levels - 1.1225 (weekly Senkou Span B) - 1.1190 (monthly Fibo Kijun) - 1.1167 (weekly Fibo Kijun) - 1.1120 (weekly Senkou Span A + daily Kijun - 1.1065 (weekly cross + monthly Tenkan + daily cloud). We are closing the week today. For players to increase, the final result is more important, and thus, it is advisable for them to stay in the bullish zone relative to the weekly cloud (1.1225).

In the lower halves, the main advantage continues to remain on the side of the players on the decline. The downward trends within the day now are the support of the classic Pivot levels - 1.1175 - 1.1146 - 1.1103. The pair is currently in the zone of the emerging upward correction again and is testing the first significant resistance of the lower time intervals - the central pivot-level of the day (1.1218). A price consolidation above will allow the correction to continue developing, making the next resistance a guideline - the weekly long-term trend, now located at 1.1261. A consolidation above which will confirm the formation of the rebound from the met supports of the higher halves (1.1190 - 1.1225).

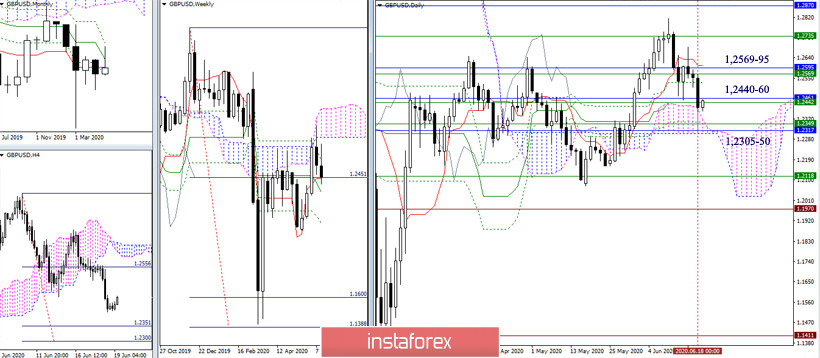

GBP / USD

The players to decline managed to leave the zone of attraction yesterday (1.2569 - 95) and closed the day below the following important supports (1.2440 - 60). The result is not bad. Today, on the last working day of the week, it is better for the bears to keep what they have achieved. Working below the supports (1.2440-60) shifts the interest in the following bearish landmarks - 1.2305-50 (target for breakdown of the H4 cloud + lower border of the daily cloud + weekly Kijun + monthly Fibo Kijun). If the pair returns to the zone of influence of 1.2569 - 95, yesterday's gains will be leveled, and the rebound will be formed from the met supports.

At the moment, the pound is on H1 in the process of developing an upward correction and is ready to start testing the first important resistance - the central Pivot level (1.2462). The next pivot point of the developing correction is the weekly long-term trend (1.2542). A break above may alter the existing balance of forces and to set new upside targets. The exit from the correction zone and the resumption of the downward trend will return the relevance to the support of the classic Pivot levels, which are located today at 1.2359 - 1.2297 - 1.2194.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)