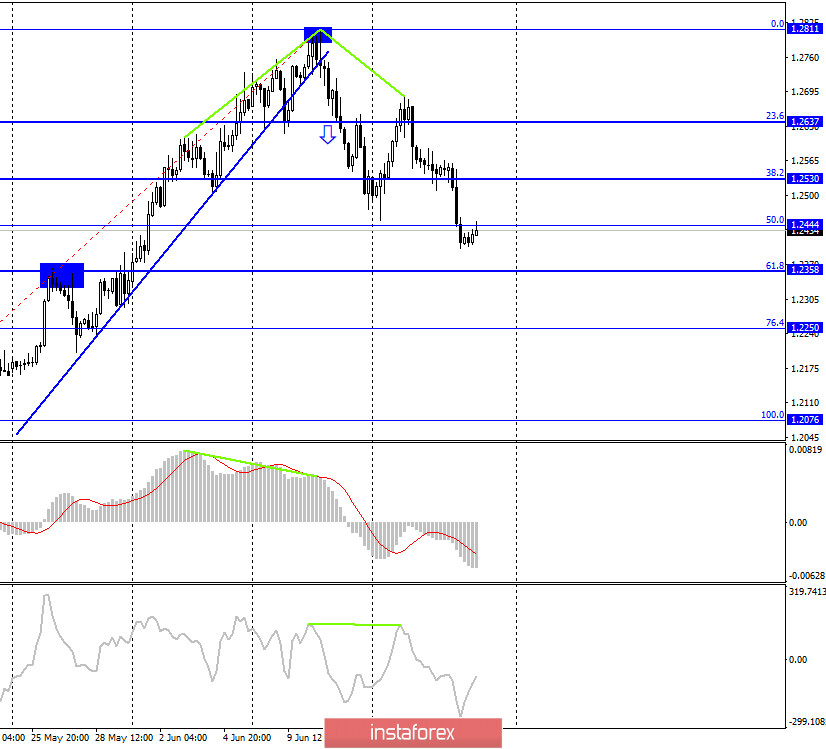

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair yesterday resumed the process of falling within the downward trend corridor, which continues to characterize the current mood of traders as "bearish". Thus, over the past day, the graphic picture has not changed at all and still suggests a drop in the British dollar's quotes. Until the pair closes above the corridor, the bears will remain the leaders. The Bank of England yesterday significantly contributed to the fact that the pound continued to fall. First, it was decided to increase the asset purchase program by 100 billion pounds. Second, Andrew Bailey, Governor of the Bank of England, tried to reassure traders by saying that more monetary stimulus is not required at this time. However, it seems that traders still did not believe him and considered that lowering rates to negative values is a matter of time. Today, the pound shows a desire to recover a little, which is possible, since there will be little news from the UK today. Only the evening speech of Jerome Powell can affect the mood of traders.

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair resumed the process of falling and secured under the corrective level of 50.0% (1.2444). Thus, the fall in quotes can be continued in the direction of the next corrective level of 61.8% (1.2358). Today, the divergence is not observed in any indicator. Closing the pair's rate above the Fibo level of 50.0% will allow traders to expect a reversal in favor of the British currency and some growth in the direction of the corrective level of 38.2% (1.2530).

GBP/USD – Daily.

On the daily chart, the pair's quotes continue the process of falling and closing under the corrective level of 50.0% (1.2462). More important now is the 4-hour chart, which also retains the "bearish" mood of traders.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

On Thursday, the results of the Bank of England meeting, which I wrote about above, became known in the UK. There was no further news from the UK. There is also no new information about the progress of negotiations between London and Brussels.

News calendar for the US and UK:

UK - change in retail trade volume with and without fuel costs (06:00 GMT).

US - Federal Reserve Board of Governors Chairman Jerome Powell will deliver a speech (17:00 GMT).

On June 19, the UK has already released a report on retail sales, which decreased in volume in May less than expected by traders. However, the pound failed to start growing on this news.

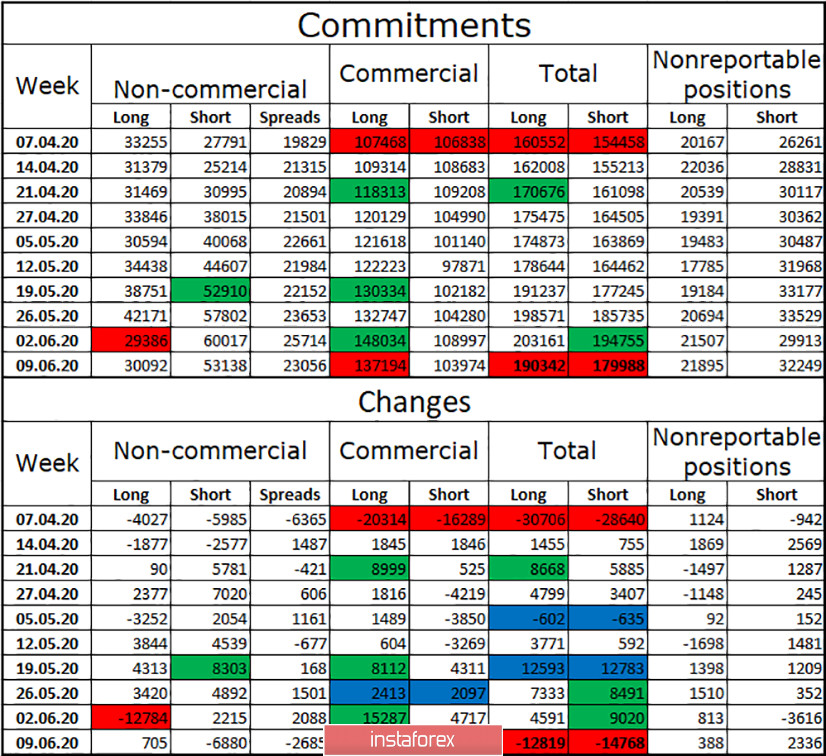

COT(Commitments of Traders) report:

The latest COT report showed a strong reduction in short contracts among the "Non-commercial" group. This same group of large traders opened 705 long contracts, but in total it turns out that they did not buy the British currency, but increased demand for it by reducing the number of sales of this currency. The "Commercial" group, which is less important, on the contrary, got rid of purchases of the pound, but at the same time getting rid of short contracts. In total, the number of long contracts and the number of short contracts decreased during the reporting week. The Briton continues to enjoy very dubious and weak interest among major players. However, this still allows it to grow from time to time, as it has in the past two weeks. Given the fact that speculators did not increase purchases of the British currency, I do not believe that it will continue its growth. This week confirms this assumption.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with the target of 1.2358, as it was fixed under the level of 50.0% (1.2444) on the 4-hour chart. I recommend opening purchases of the pair after closing above the trend corridor on the hourly chart with the goal of 1.2637.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.