Hello, dear colleagues!

If we sum up the interim results of the current weekly trading on the main currency pair of the Forex market, then, as expected at the beginning of the current five-day period, EUR/USD continued its downward movement.

Investors' minds are influenced by fears of the second wave of COVID-19, as well as improving macroeconomic data from the US, which shows the recovery of the world's leading economy after the spring coronavirus pandemic. Of course, it is too early to talk about a complete victory over COVID-19, however, the signs of economic recovery in the US are obvious.

So, yesterday it became known that the number of Americans who applied for unemployment benefits, although it came out worse than expected, however, it improved compared to the previous figure of 1566 (revised from 1542) and amounted to 1508.

In Europe, the process of approving the stimulus package proposed by the European Commission continues. Here, as they say, there is no unity. The debate continues. Several countries are opposed to providing assistance grants to the EU states most affected by the pandemic.

Looking at today's economic calendar, you can select data of the USA with trade balance, as well as speeches by senior monetary officials of the Federal Reserve System (FRS), among which stands out the speech of Powell, which is scheduled for 18:00 (London time).

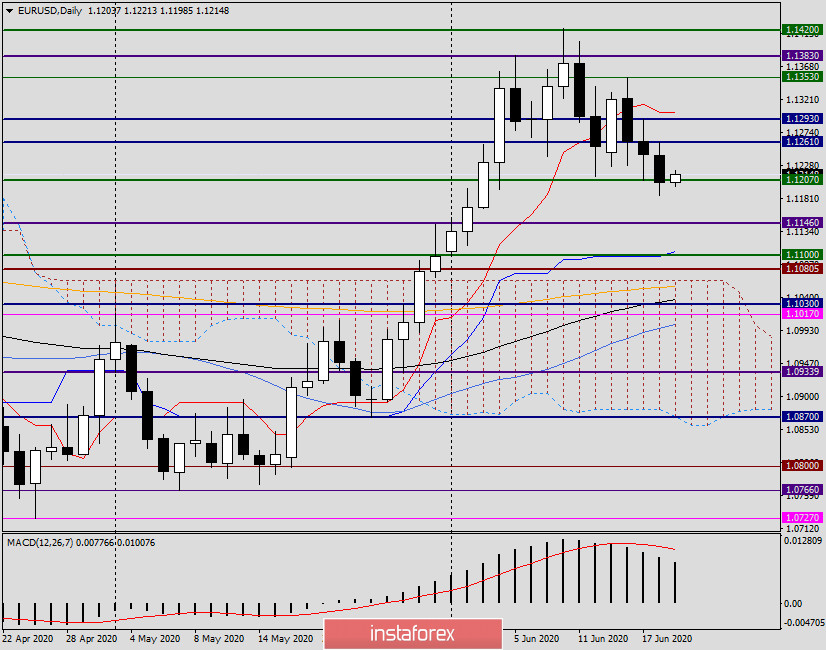

Daily

Turning to the technical picture of the euro/dollar, it is worth noting that the significant technical level of 1.1200 again stood, and Thursday's trading ended at 1.1204. On the last day of current trading, positions can be adjusted. Investors will likely start fixing positions before the weekend and the pair will grow slightly. If this happens, the nearest targets of the euro bulls will be yesterday's highs at 1.1261, and higher highs on June 17 at 1.1293 and the Tenkan line of the Ichimoku indicator, which runs at 1.1303.

Closing daily and weekly trading above 1.1300 will give hope for further strengthening of the main currency pair. If the day and week end under another very important mark of 1.1200, next week we should expect a continuation of the downward scenario.

H1

On the hourly chart, the pair is traded in a descending channel with parameters: 1.1353-1.1258 (resistance line) and 1.1227 (support line). At the time of writing, trading takes place near the resistance line of this channel. The pair shows moderate growth, and most likely, there will be an attempt to break the upper border of the channel. In this case, the situation for EUR/USD bulls is complicated by finding the moving averages used above the channel's resistance line: 50 MA, 89 EMA, and 200 EMA. I can assume that the breakdown of the upper border of the descending channel will be false, and the pair will turn to decline from one of the moving averages.

Trading recommendations for EUR/USD:

Taking into account the increased demand for the US currency and the technical picture on the higher timeframes (we will consider the weekly one on Monday), I consider the main trading idea to be sales, which can be tried to open on attempts to go up from the hourly descending channel, from the moving averages. I suggest considering opening short positions from 1.1230, 1.1245, and 1.1255. It is more aggressive and risky to sell from the current price of 1.1215, however, the risk of running into a rebound is high. Despite the probability of a corrective pullback, I recommend that you refrain from buying today.

Good luck!