Good day, dear colleagues!

Although the results of yesterday's meeting of the Bank of England coincided with the forecasts of experts, the British currency significantly sank against the US dollar. Let me remind you that the Bank of England kept the main interest rate at the same level of 0.10%. At the same time, the asset purchase program, to eliminate the negative consequences of COVID-19 for the British economy, was increased by 100 billion to 745 billion pounds.

It would seem that everything is within market expectations, and the fall of the "British" should not have been so significant. However, the volatile and speculative pound collapsed. This factor was somewhat unexpected, although, knowing the nature of the British currency, it is not particularly surprising.

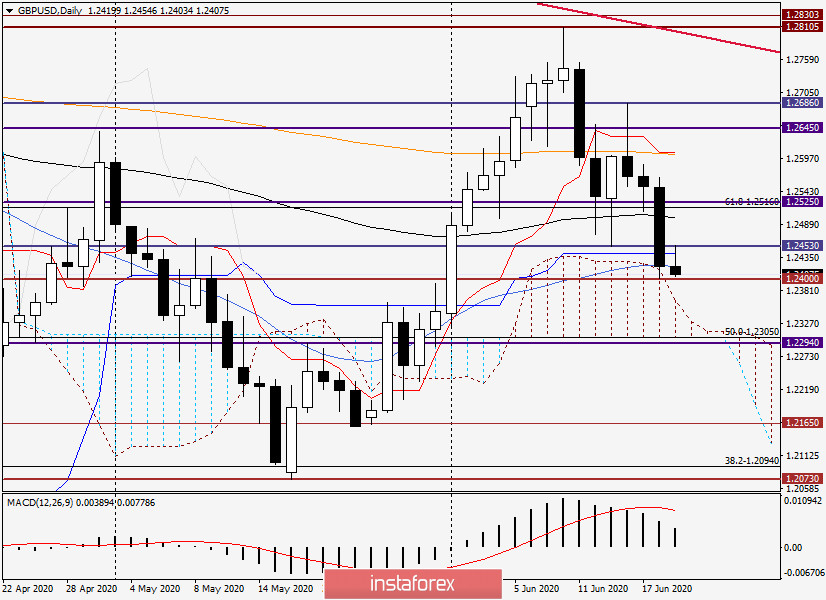

Daily

As a result of yesterday's fall, the previous lows were updated at 1.2510, the 89 exponential moving average was broken, the significant support level of 1.2453, and the Kijun line of the Ichimoku indicator. The last factor, in my opinion, is the most important, since Kijun has long held the quote back from further decline.

There were even attempts to break through the 50 simple moving average and enter the limits of the Ichimoku cloud, but its upper limit and 50 MA triggered a rebound of the pair, and trading ended at 1.2420. By the way, this is a fairly strong technical level, which has repeatedly had a significant impact on the price dynamics of the instrument, so this closing price, in my opinion, is not accidental.

At the time of writing, the GBP/USD pair has already tested the strength of another important mark of 1.2400, and also managed to roll back to the support level of 1.2453 broken yesterday. At the moment, the trading is held in the range of 1.2403-1.2453. After such a negative reaction to the quite predictable decision of the Bank of England, it is time to expect a further weakening of the British currency against the USD.

If the pair falls below the level of 1.2400, then the next target for bears on the pound will be the mark of 1.2346, where the weekly Kijun line runs. However, the weekly chart of GBP/USD will be considered on Monday, after the closing of weekly trading. In the meantime, let's switch to smaller timeframes and see what interesting options there are for opening positions.

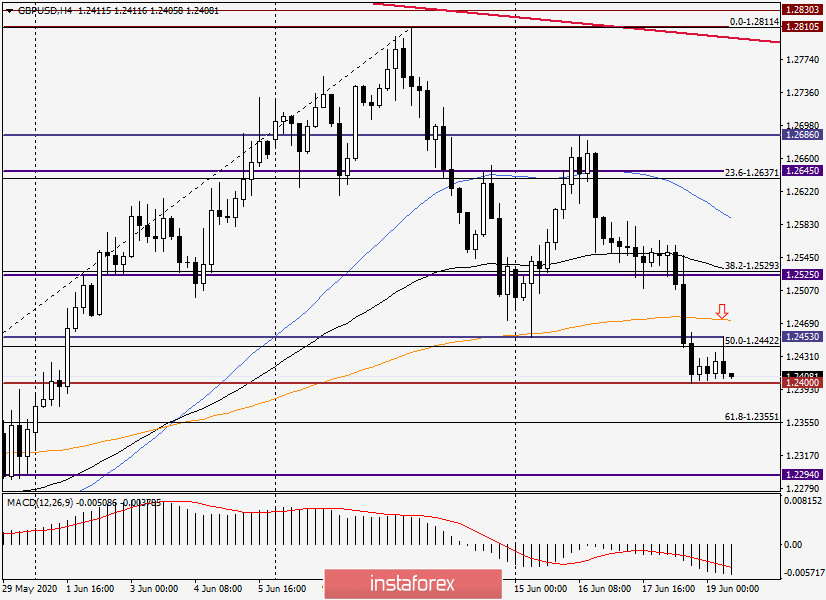

H4

This chart clearly shows consolidation near the important level of 1.2400. Usually, this is followed by a fairly strong directional price movement. In our case, it is most likely that sterling will continue its downward trend. At the same time, do not forget that on the last day of weekly trading before the weekend, profit-taking occurs. In this regard, a corrective pullback to yesterday's fall is not excluded. If this happens, it is possible to rise to 200 EMA and 89 EMA, which are located at 1.2474 and 1.2533, respectively.

On the other hand, taking into account trading levels, a pullback was already given to the broken support of 1.2453, after which the pair turned around, demonstrating its readiness to continue the downward trend. In other words, you could try to sell the pound from current prices, if not for the strong technical level of 1.2400. Since this level is strong support from it at any moment there may be a rebound or to start a deeper pullback. However, traders who are trading at the breakout levels can try to sell GBP/USD at the breakout of 1.2400 with a goal in the area of 1.2360/50. Naturally, it is better to sell at more favorable prices after a corrective pullback to the area of 1.2450-1.2475. The question is: will it be? It is quite a good decision to postpone plans to open positions on Monday when a full analysis will be conducted taking into account the closing of the current trading week.

Have a nice weekend!