Markets grow by rumors and fall by facts. When the main bullish drivers are won back, there is a place for profit-taking, sales, which results in a correction. Best case scenario. The worst case is, the trend changes. In this regard, the fading of faith in the V-shaped recovery of the US economy, in an early victory over the coronavirus, as well as the euphoria over the large-scale fiscal and monetary stimulus of the EU and the ECB should have dropped the EUR / USD quotes significantly below the base of the 12th figure. Nevertheless, buyers are in no hurry to get rid of the single European currency, sincerely believing that soon it will have new trump cards on the horizon.

In times of crisis, fundamental ties collapse, but recessions do not last forever. Its departure into the past leads to the restoration of the traditional principles of economic analysis. If the epidemiological situation does not worsen, and the trade wars do not resume, and you want to believe in it, the question on the agenda will be: whose GDP will recover faster? Europe, at least, does not lose to the States. It was able to take control of COVID-19 faster, and the size of the fiscal stimulus in Germany is higher than in the United States with a GDP of 40%. According to OECD forecasts, the German economy will not sink as deep as the US economy in 2020.

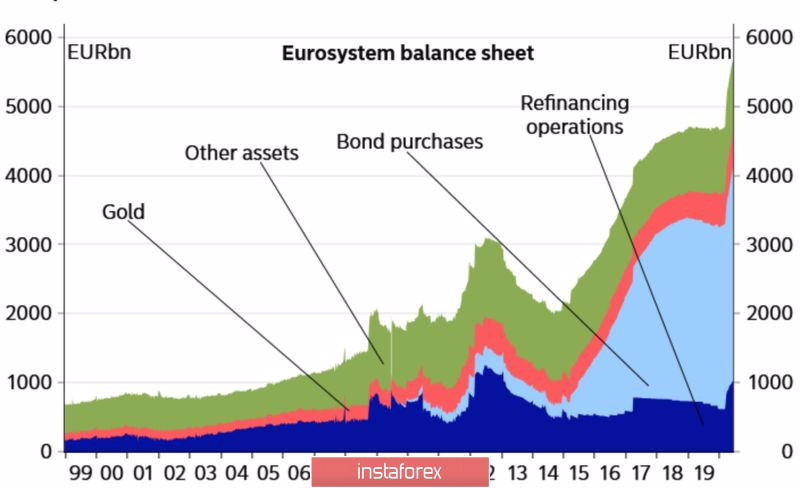

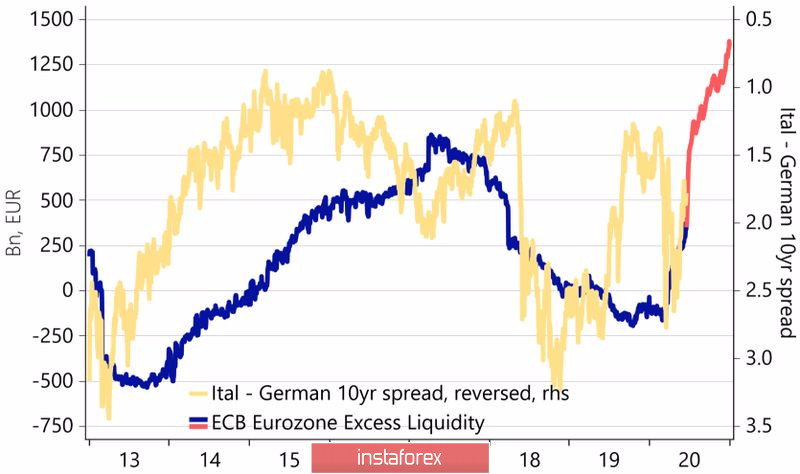

Yes, the Fed is making titanic efforts to save the economy, but the ECB is impressive. It managed to inject about € 1.3 trillion into European banks as part of LTRO long-term targeted lending programs and taking into account the more significant role of loans compared to bonds in the Eurozone. Its actions deserve a strong five. In fact, the regulator flooded the markets with cheap money, increased liquidity to record levels, which ultimately will lead to a narrowing of the spreads between Italian and German debt obligations, that is, to reduce European political risks to a minimum.

The dynamics of European liquidity:

The dynamics of liquidity and yield spread of bonds of Italy and Germany:

Hopes for a quick economic recovery and EU unity make the euro look good. Another thing is that this is not enough to restore the upward trend in EUR / USD. The efforts of both parties are needed. If the S&P 500 falls below 3000, the bulls will not be good for the main currency pair. Growing demand for safe-haven assets will allow the US dollar to feel the master of the situation on Forex.

However, the last thing Donald Trump needs on the eve of the presidential election is the fall of US stock indices as these are perceived as an indicator of the health status of the US economy and as its personal rating. In his election program, Trump will bet on the restoration of GDP and will do everything possible to make the stock market look good. This circumstance allows us to adhere to the previous strategy for buying EUR / USD on the rebound from key support levels at 1.1155 and 1.112.

Technically, on the daily chart of the main currency pair, the rollback continues in the direction of 38.2% and 50% Fibonacci from the AD wave of the "Bat" pattern.

EUR / USD daily chart: