Latest COT report (Commitments of Traders); Weekly prospects for EUR/USD

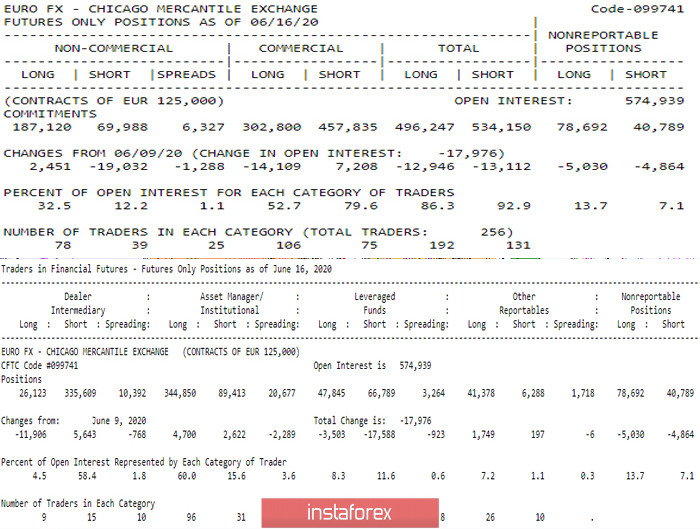

According to the latest COT report (Commitments of Traders on 06/16/20), open interest in the euro has declined (574.939 against 592.915). It should be noted that the final positions of major players received a decline in both directions (long -12.946 and short -13.113), but at the same time market participants, referred to as Non-Commercial, continued to get rid of short positions as much as last time (-19.032), but the Commercials group emphasized the elimination of long positions (-14.109). The dominance of closed positions is also characteristic of statistics from the largest dealers and brokers (Dealer Intermediary), which, although they increased again the percentage gap in positions (58.4 against 4.5), they did this, unlike last time, not by increasing the number of contracts in both directions, but by sharply reducing and closing positions in one of the directions. Therefore, the percentage preference in this group will most likely begin to change the structure in the near future.

Main conclusion

The predominance of mass closing of positions in the report indicates that it is time to fix the result. The current trend needs to be reviewed and thus, changes are possible.

Technical picture

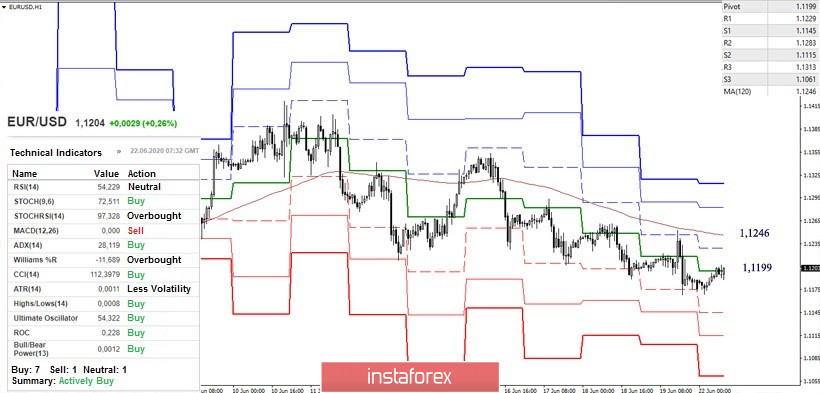

Over the past trading week, a downward correction has been developed. The daily forming cloud stopped expanding, taking a horizontal position, while support for the daily short-term trend works on the downside of the players, being located at 1.1295 in the form of resistance. During the weeks, the bears managed to reach a good result by returning to the weekly cloud (Senkou Span B 1.1225) and outlining a reversal trend of a deep decline from the combination of the last three weekly candles, which could affect further trend preferences. The last decade of the month has begun, so attention will now be directed to the formation of the final monthly result. For players to increase for the coming week, the main guidelines and tasks are reduced to go again into the bullish zone relative to the weekly cloud (1.1225) and regain support for the daily short-term trend (1.1295), with the further prospect of updating two important maximum extremes (1.1422 and 1.1496). It is important for players to go down in the near future to turn the current daily correction into the beginning of a daily trend change. For this goal, it is possible to retest the passed Tenkan (1.1295) without updating the correction maximum (1.1422), and continue to decline, the main value at which will have the result of testing the important support zone 1.1065 - 1.1110 (daily cloud + daily Kijun + weekly gold cross Ishimoku + lower border of the weekly cloud + monthly Tenkan).

The key resistance of the lower time intervals today are at 1.1199 (central Pivot level) and 1.1246 (weekly long-term trend). A consolidation above will affect the current balance of power in the lower halves, giving preference to the restoration of positions by players on the increase. Leaving the correction zone H1 and updating the minimum of the last week (1.1168) will return relevance to the support of the classic Pivot levels, which are located today at 1.1145 - 1.1115 - 1.1061.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)