Latest COT report (Commitments of Traders); Weekly prospects for GBP/USD

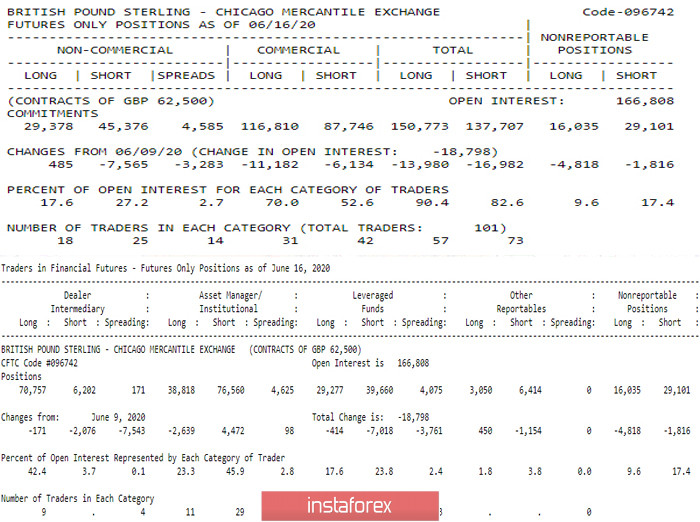

The latest COT report (Commitments of Traders on 06/16/20.) showed a decline again in open interest in the pound (166.808 against 185.606). At the same time, it is noteworthy that major players were reducing positions on almost all fronts. The Commercials group was still more actively parting with long positions (long -11.182 and short -6.134), while Non-Commercial slightly increased its long positions (485), but at the same time, it significantly shortened its short positions (-7.565) as last time. The indicative percentage ratio of the positions of the largest dealers and brokers (Dealer Intermediary) from the financial report (42.4 against 3.7) was formed this time not due to the growth of interest in the pound, but due to a sharp decline in positions in all directions. A change in the structure of this indicator affects its value.

Main conclusion

The COT report shows that as a result of the uncertainty and hesitation noted last time, most major players prefer to refrain from the pound, leveling their risks by pausing in investments.

Technical picture

The chart cannot take a break and actively contract simultaneously in both directions. Due to the fact that the long positions got to a greater extent both from the Commercials group and from Dealer Intermediary, we are witnessing the emergence and development of a downward correction. An important support zone 1.2305 - 1.2460 (daily cloud + weekly cross + monthly short-term trend) is currently being tested. Developing above the supports will provide some advantage to the players on the rise, who will be able to build further plans. In this case, the closest prospects and landmarks will be 1.2570-95 (daily Tenkan + monthly Kijun) and 1.2736 - 1.2812 (weekly cloud and maximum extreme). For players to increase, the strengthening of positions after consolidation under the supports (1.2305-1.2460) will consist in updating the minimum of the last month (1.2073).

In the lower halves at the time of analysis, an upward correction is developing which has already left an important level behind the central pivot level of the day (1.2380) and move quickly to resist the weekly long-term trend (1.2507). A price consolidation above will allow us to consider the formation of rebound from the met supports of the upper time intervals. Moreover, stopping and completing the correction may help to restore the downward trend and further strengthen the players to decline. The intraday supports today are 1.2306 (S1) - 1.2267 (S2) -1.2193 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)