The American real estate market has suddenly become a determining force, but with a negative sign. Apparently, some craftsmen were quite bored during the weekend and they decided to take a closer look at what was happening with mortgage loans, and the week began with absolutely terrifying messages. It turned out that the level of delay in mortgage almost equaled the record high level that was reached in 2011. The very fact that the level of delay has increased indicates that the real estate market is in extremely poor condition, and banks will obviously reduce the issuance of mortgages, as they face the risk of house removal from borrowers. And then you still need to understand where to put all these houses. In general, the picture is quite sad, but the worst thing about everything is that the situation that developed in 2011 was a direct consequence of the 2008 crisis. So, it turns out that then, from the beginning of the crisis, it took a little less than three years for the situation with mortgage loans to become disastrous and now, it only took a few months. And this suggests that before the onset of the current crisis, the economy was more like a weakness. We can safely say that all economic successes were something artificial. The American economy, in principle, has no margin of safety. All successes are based only on loans and the level of debt is incredibly high. And as soon as the next crisis began, and then the huge masses of people were not able to service their debts. Yes, this is true in relation to business. After all, an instant and unprecedented increase in unemployment is an initial consequence of the bankruptcy of countless small businesses. And frankly, the news about the level of delinquencies in mortgages suggests that reflections on the duration of the crisis and the way out of it are meaningless. It matters only if the economy and business have at least some margin of safety, and then it is important to understand the depth of this very crisis in order to try to predict possible losses. The more serious the crisis, the more bankruptcies and layoffs. But if there is no safety margin, the crisis may last at least one day. And apparently, this is exactly what the level of delays in the mortgage tells us.

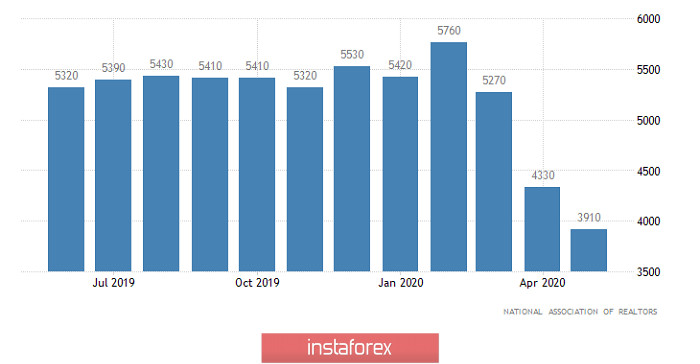

And if the day began with sad news regarding mortgages, then it ended with no less sad news about the sale of housing in the secondary market. These same sales declined by 9.7%, while they expected a decline of 2.0%. If 4,330 thousand houses were sold in April, then it was only 3,910 thousand in May. So these data largely confirmed the fears that arose after the information on the level of delay in mortgage loans.

Secondary Home Sales (United States):

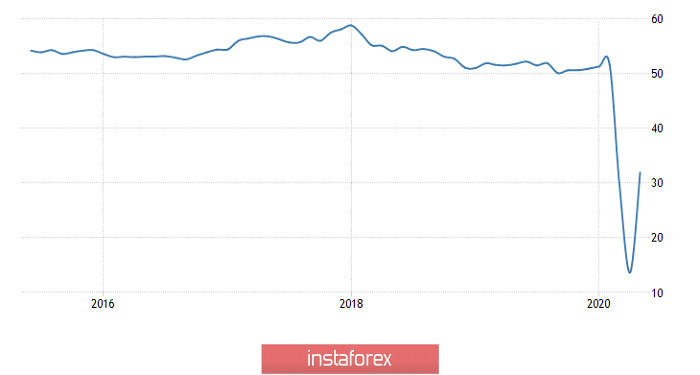

Today begins with the publication of preliminary data on business activity indexes in Europe, and expectations are extremely positive. After all, the index of business activity in the service sector should grow from 30.5 to 41.0. The production index can grow from 39.4 to 44.0. So the composite index should increase from 31.9 to 43.0. There is nothing surprising in this growth itself, as it is an elementary business response to the gradual removal of restrictions imposed due to the coronavirus pandemic.

Composite Business Activity Index (Europe):

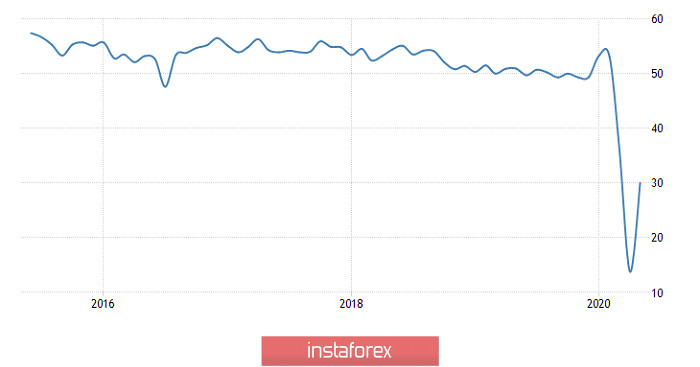

A similar picture is expected in the UK, where the index of business activity in the services sector should rise from 29.0 to 40.0. The index of business activity in the manufacturing sector can rise from 40.7 to 46.0. As a result, the composite index of business activity should rise from 30.0 to 43.0. Well, the reasons for the growth are exactly the same as on the other side of the English Channel.

Composite Business Activity Index (UK):

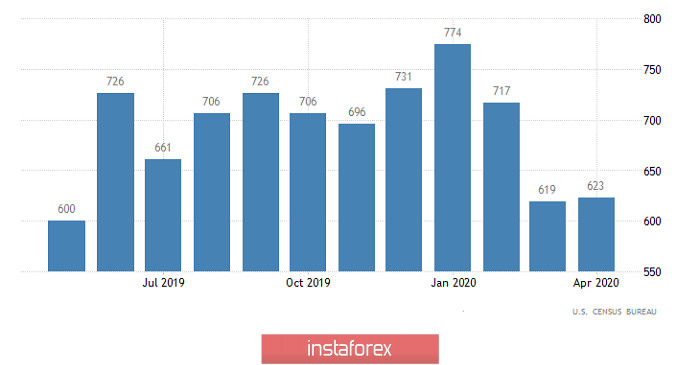

It seems that all this should contribute to the strengthening of the single European currency and the pound. But even if there is growth, it will turn out to be insignificant and very temporary. Indeed, restrictive measures are removed not only in the Old World, but in the New too. So in the United States, the index of business activity in the service sector can grow from 37.5 to 44.0 while the production index should increase from 39.8 to 47.0. As a result, the composite index is expected to grow from 37.0 to 44.0. And since all indexes are growing the same everywhere, what conclusions can be drawn? What to give preference to? That's right - not one of the currencies. But, it is here that the real estate market in the United States will come to the rescue. We are talking about sales of new homes this time, the number of which should increase by 2.5%. It is estimated that total sales should increase from 623 thousand to 635 thousand which should already give the dollar confidence. However, it is very likely that the data will turn out to be significantly worse than forecasts and instead of growth we will see a drop in sales. Just look at yesterday's events. All this suggests that there is simply no reason for sales to grow. So it is better to monitor the publication of the data itself and act on the situation, starting from what exactly the data will be.

New Home Sales (United States):

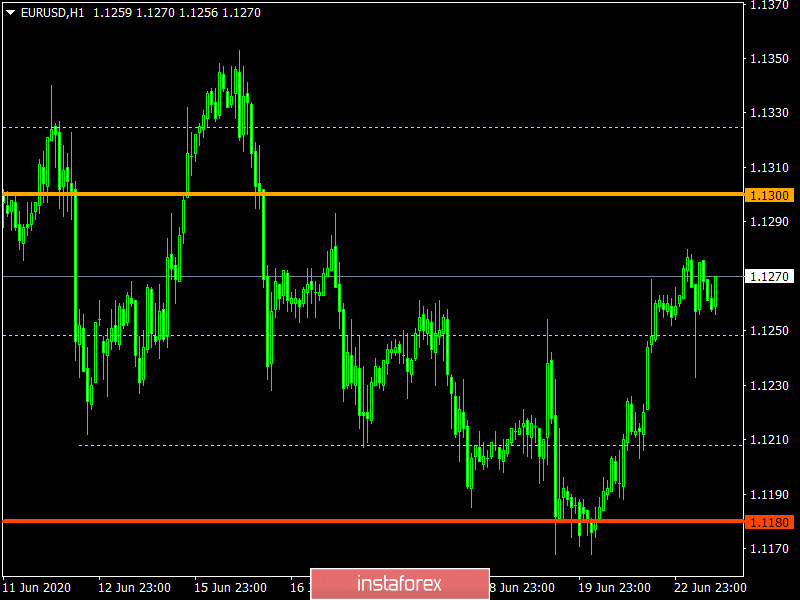

The euro/dollar currency pair, working out the range level of 1.1180 as a support, returned the quote to the area of 1.1250/1.1280, subsequently forming stagnation. It can be assumed that in case of price consolidation above the level of 1.1280, a path will open in the direction of 1.1300-1.1320. Otherwise, the stop may be delayed, slightly expanding the existing boundaries.

The pound/dollar currency pair rebounded from the support level of 1.2350, where a round of long positions appeared on a regular basis, which led the quote to a variable coordinate of 1.2500. A temporary price fluctuation can be assumed in the range of 1.1450/1.2500, where the best tactic is a strategy for the breakdown of established boundaries.