The European currency interpreted the mixed results of the June EU summit in its favor. After some hesitation, the market came to the conclusion that "the glass is more likely half full than empty", after which interest in the euro resumed, especially against the background of an overall increase in risk sentiment. Meanwhile, a weakening dollar, which is under the yoke of its own problems, cannot oppose itself to a single currency. Even at the start of yesterday's trading, the eur / usd pair was in the middle of the 11th figure, while now the price is approaching the borders of the 13th price level. The northern impulse is due to several fundamental factors - here are good macroeconomic reports and the encouraging position of the ECB in the context of a legal dispute with the German Constitutional Court.

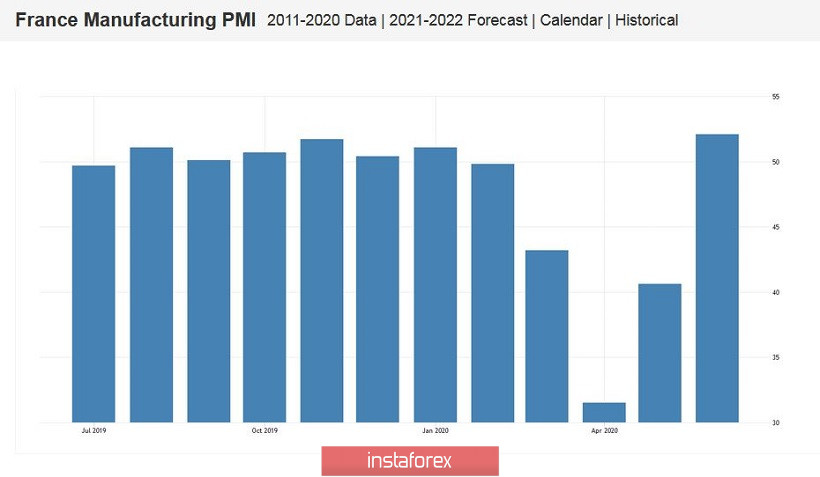

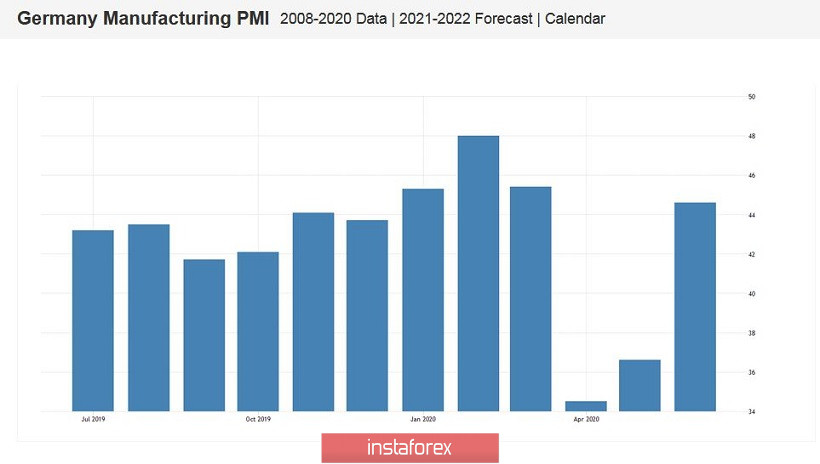

Let's start with the statistics. Today, PMI indices have been published in key European countries, which for the most part are in the green zone. For example, in France, the index of business activity in the manufacturing sector exceeded the key 50-point mark and reached 52.1 points (annual maximum) for the first time since January of this year. A similar situation has developed in the provision of services: the indicator has risen to 50.3 points. The German figures, although they remained below the 50-point value, still turned out to be much better than the forecasted values: in the German manufacturing sector, the PMI index rose to 44.6 points (with a growth forecast of 41 points) and almost to 46 points (while a modest increase of up to 40 points was expected) in the services sector. The pan-European PMI indices repeated the trajectory of the above indicators, providing additional support for the single currency.

This support is also supported by the position of the European Central Bank regarding a legal dispute with the German Constitutional Court. According to the vice president of the Central Bank, Luis de Guindos, the regulator is ready to cooperate with German legal institutions in resolving the situation, "which threatens the participation of the largest eurozone economy in the ECB stimulus program." According to him, the ECB is ready to provide the Bundesbank with the necessary information to resolve this issue and is ready to attract German institutions, "if this does not threaten its independence."

Let me remind you that in May, German Themis announced that the quantitative easing program (which was resumed last fall) partially violates the German Constitution. At the same time, the judges did not "cut off the shoulder", allowing the European Central Bank to justify its decision within three months and prove that it did not exceed its authority. Otherwise, the court would prohibit the Bundesbank from participating in this program. At the same time, the judges did not agree with the arguments of the European Court of Justice, which legalized QE two years ago. In other words, the judges questioned the legality of the program.

At first, the ECB leadership adopted this court decision "with hostility", stating that the jurisdiction of the German court does not extend to the European Central Bank. But, as we see, the position of the European regulator has somewhat softened at the moment. Perhaps, this is due to the fact that Andreas Foskule, who headed the German Constitutional Court over the past 10 years, resigned. His successor, Stephan Harbarth (previously the deputy head of the court), is rumored to be more pro-European. He is a companion of Angela Merkel, and recently held a rather high party position (from 2009 to 2018, was a member of the Federal Executive Council of the Christian Democratic Union).

Thus, the European currency has enough reason for its further growth. But the dollar, in turn, failed an attempt to recover. The dollar index was trying to return to the area of the 97th figure this morning, which ended in nothing. The index not only returned to its previous position, but also updated the weekly low. Trump's decision to temporarily suspend the issuance of work visas to some foreign workers did not inspire investors, although the White House believes this step will help reduce unemployment in the country. However, there is another side to the coin: for example, H-1B visas (which are now banned) are very common among giant companies such as Amazon and Google, as well as Microsoft and Facebook. Therefore, many business representatives and the US Chamber of Commerce have already criticized this move by Trump, saying that it will make it difficult to restore the country's economy.

All this suggests that theEUR/USD pair retains the potential for its further recovery. The pair's bulls only need to consolidate above the level of 1.1290, which buyers have already tested today. In this case, the price will be located above all the lines of the Ichimoku indicator, which will form a bullish signal "Parade of Lines" on the daily chart. In other words, when the price consolidates above the level of 1.1290, one can consider long positions to the intermediate resistance level of 1.1400 and above - 1.1422 (three-month high). The support level is the lower line of Bollinger Bands on D1, which coincides with the upper border of the Kumo cloud and corresponds to the level of 1.1070.