The global fuel demand is now on track to recover while oil production has been reduced. That is what I hoped for when I recommended buying Brent at $28 in late March and at $36.65 in early June. The forecasts turn out to be true as black gold rises to 3-month highs. These are the levels where Brent was last seen when the price war between Russia and Saudi Arabia broke out. Falling Brent prices dragged down the American grade WTI which collapsed into the negative territory and plunged below zero. After that, Moscow and Riyadh seemed to have realized that it was better to fight against competitors together rather than to stand on each other's way.

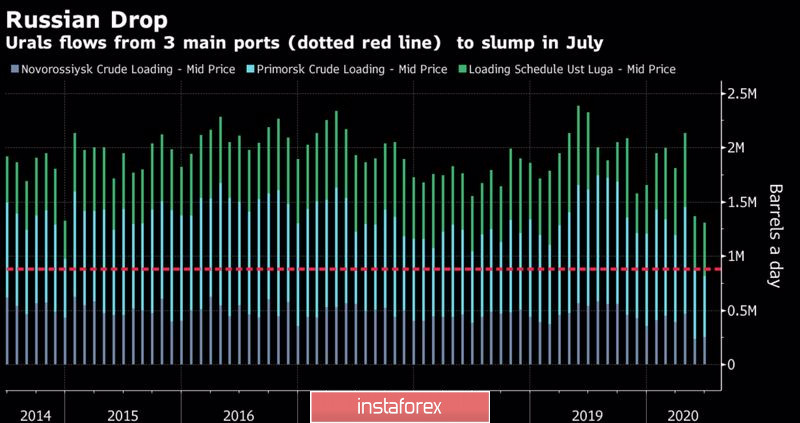

According to OPEC, countries that have failed to comply with the output cuts target of 9.7 million bpd are ready to compensate for the oversupply later on by increasing the volumes of their production curbs. We are talking about an additional 1.26 million bpd, a significant part of which will be undertaken by Iraq. Baghdad intends to reduce its oil production by an additional 573 thousand bpd in the period from July through September. Along with Iraq, Nigeria, Angola, Brunei, Gabon, and Kazakhstan presented their plans for fulfilling their obligations on production cuts. Russia is setting a good example. Within first 10 days of July, Urals oil producer is going to deliver just 880 thousand bpd from its ports in the Baltic Sea and Black Sea which is the lowest number since 2008.

Dynamics of oil supply from Russian ports

Before the pandemic, Moscow and Riyadh also made joint efforts to reduce production in order to stabilize oil market. However, only the United States benefited from this, as American shale oil production was steadily growing. Yet, the breakout of COVID-19 and the oil price war turned everything upside down. WTI's drop below zero has heavily hit US oil producing companies. They had to reduce the costs of exploring and developing new oilfields. Even now, US oil producers still need to make adjustments amid the fall in crude prices. This can lead to insolvency, not to mention the fact that business investments in the industry are likely to be cut. As a result, the development of new oilfields in the US may slow down over the next few years.

This is why Rystad Energy estimates that recoverable oil resources will drop by 282 billion to 1.9 trillion barrels, taking into account technological restrictions and fuel demand. By comparison, Saudi Arabia's proven oil reserves total 267 billion barrels. According to the Norwegian research company, the peak of the oil exploitation will be shifted from 2030 to 2028 or 2027 due to the pandemic.

At the same time, the global energy demand is rising. Positive macroeconomic statistics from the US, eurozone, and China prove this tendency. The recovery of the labor market, retail sales, industrial production, and business activity is happening at a much faster pace than previously expected. In addition, oil output is still limited but the OPEC+ agreement. Therefore, I would recommend keeping the long positions on Brent from the level of $36.65 and adding them on pullbacks. The marks of $47 and $51 per barrel will serve as the medium-term targets.

From the technical point of view, the North Sea grade continues to trade within the upward price channel and is heading for the target of 88.6% according to the Shark pattern. It corresponds to the mark of $51 per barrel.

Brent daily chart