The data released today on the eurozone provided significant support to the European currency, which continued to restore lost ground last week against the US dollar. The British pound has also grown, as business activity there has been able to recover sharply and please market participants.

By now we can say that by June business activity in many countries of the eurozone will recover, but it will be quite far from pre-crisis levels. Perhaps, France was most surprised by its indicators, where both the production index and the service sector index returned to the territory above 50 points, which indicates an increase in the activity. In Germany, things are not as good as economists had expected, but everything is recovering quite rapidly after the removal of quarantine measures.

According to the report, the composite index of purchasing managers in Germany indicated economic recovery in June this year amounting to 45.8 points compared to 32.3 points in May. However, the index still remains below the level of 50 points, which means that, at best, recovery is slow. Markit noted that many companies reported a high level of uncertainty, although many of them had already resumed their work after quarantine. Most of the problems remain in the field of catering and tourism business. Some companies attribute their problems to low or pent-up demand, while others report cancellation or postponement of orders.

The index of business activity in the manufacturing sector in Germany determined to 44.6 points, while the service sector rose to 45.8 points against the May figures of 36.6 and 32.6 points.

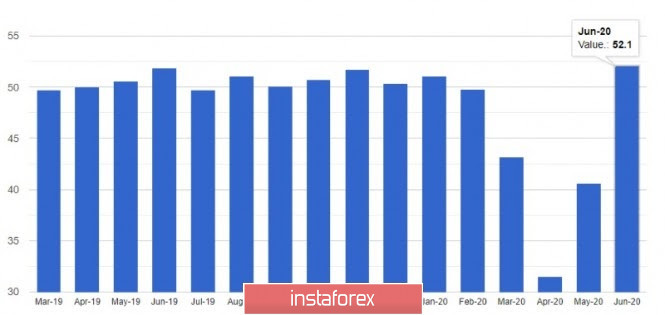

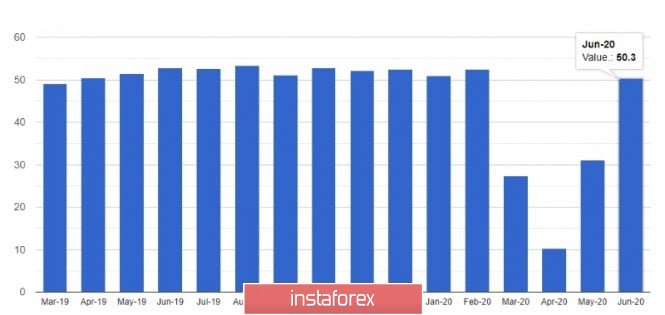

As I noted above, France has fully returned to the growth of business activity, since all its indicators have exceeded 50 points. The index of business activity in the manufacturing sector proportion to 52.1 points against 40.6 points in May, while the index for the service sector jumped to 50.3 points against 31.1 points in May. Although all the data is still preliminary, the euro has strengthened its position against the greenback amid growing optimism and expectations of a more rapid recovery of the eurozone economy in the second half of the year.

If we take the indicator as a whole for the eurozone, then the growth of preliminary indices is also recorded. This suggests that the economy of the monetary union continues to rapidly gain momentum after the bottom, which was reached in April this year. Such an active recovery of the indices will also suggest that the reduction in GDP in the 2nd quarter will not be as terrible as expected.

The preliminary composite index of purchasing managers for the Eurozone PMI in June completed to 47.5 points compared to 31.9 points in May. Economists had expected growth to only 40.9 points. Most likely, the service sector has recovered due to the removal of the quarantine and isolation measures. According to Markit, the index of PMI procurement managers for the eurozone services sector in June was at 47.3 points, previously it was 30.5 points and forecasts stated 40.1 points. The preliminary index of PMI procurement managers for the eurozone manufacturing sector jumped to 46.9 points in June against 39.4 points in May and a forecast of 43.0 points. Despite this, quite a lot of problems remain in the Eurozone, and proper financing and changes in the fiscal policy cannot be avoided. First of all, the policy should be aimed at stimulating demand, as is the case in Germany, as a result of which it was able to survive the crisis of the COVID-19 pandemic with minimal losses relative to other countries in the eurozone. According to economists, the total fiscal stimulus in the eurozone this year is about 4% of GDP, but 9% is needed to compensate for the permanent loss of income caused by COVID-19 pandemic.

As for the technical picture of the EURUSD pair, the bulls so far follow yesterday's scenario and continue to open long positions in the euro. Now they are aimed at the resistance level of 1.1350, a breakthrough of which will lead to new highs in the areas of 1.1420 and 1.1465. In the case of a downward correction of the trading instrument in the afternoon, you can still count on support in the region of 1.1280, from which today the morning growth of risky assets continued.

GBPUSD

The pound sterling did not manage to break above weekly highs even after data on improving the indices of supply managers from the service sector and the manufacturing sector.

According to the IHS Markit report, the UK economy is likely to return to growth in the near future, especially considering the fact that quarantine and isolation measures, as well as distance measures, have been practically canceled. Even in the morning forecast, I mentioned Great Britain's foodservice to return operation by July this year. Pubs and restaurants will begin their work on July 1. Hairdressing salons with hotels will also open. The requirements for maintaining a two-meter distance will also be reclined. Such measures will necessarily lead to the restoration of economic activity, which will add some optimism to consumers and improve leading indicators for the future.

All this strengthens the belief that the economy will recover more actively, although demand remains rather weak, as indicated by a sharp reduction in current orders and a drop in new ones.

According to the data, the PMI supply managers index for the UK manufacturing sector in June rose to 50.1 points from 40.7 points in May, but the index for the service sector did not reach 50 points and measured to only 47.0 against the May 29 value. 0 pips Economists predicted a production PMI of 47.0 in June and a service index of 41.5.

As for the technical picture of the GBPUSD pair, in order to continue the upward correction, the bulls need to try to protect the important area of 1.2430, this particular area is where activity was noticeable today after the statements given by Trump's adviser on trade about breaking the trade deal with China. If there are no new purchases when approaching this range, it is best to postpone long positions in the trading instrument until the support level of 1.2380 is updated, where the bottom line of the current correction upward channel is passing now. A breakthrough of this range will surely return large sellers to the market, betting on a further fall of the pair in the short term. In any case, only when the resistance level of 1.2500 is broken will add optimism to the buyers of the pound sterling which may lead to a test of new highs around 1.2580 and 1.2680.