The New Zealand dollar in pair with the US currency is growing for the second day in a row, taking advantage of the weakness of the greenback. The US dollar index continues its downward movement on the background of increased interest in risky assets, while the kiwi is gaining momentum on the eve of the next meeting of the Reserve Bank of New Zealand. This fundamental picture allowed buyers of NZD/USD to return to the area of the 65th figure and indicate the main northern target - the mark of 0.6610, which corresponds to the upper line of the Bollinger Bands indicator on the daily chart. In early June, the pair's bulls were already besieging the borders of this figure, but did not even have time to test it – disappointing data on the growth of the New Zealand economy interrupted the "flight" of the kiwi. Nevertheless, investors remain optimistic about the prospects of the NZD/USD pair, and the current price dynamics serves as an additional confirmation of this. Let's try to find out whether this optimism is justified and whether there are chances for the New Zealand dollar to conquer the 66th price level.

Let me remind you that New Zealand became the first country in the world to officially win COVID-19. For 25 days (from the end of May to the middle of June), no cases of infection were registered there. Then the virus was still "brought", however, the situation was quickly stopped – to date, the total number of infected in the country is 10 (with a population of 5 million people). In total, only fifteen hundred patients were identified on the island state (22 of them died), which is negligible, considering the total number of people. This result allowed New Zealand to become the first country to lift almost all restrictions previously imposed due to the pandemic. By and large, the only ban to date remains the arrival of foreigners in the country. Therefore, a significant decline in the economy in the first quarter (-1.6% in quarterly terms and -0.2% in annual terms) did not greatly upset traders – the release had a limited impact on the market. Even subsequent comments by the country's Finance Minister that the main impact of the coronavirus on the economy will be in the second quarter were ignored by investors. After all, in the same speech, the head of the New Zealand Ministry of Finance noted that New Zealand "laid the foundations for recovery, restarting the economy earlier than predicted".

In fact, this postulate is where the NZD/USD pair is growing: secondary (but more operational) macroeconomic indicators indicate that the economy of the island state is gradually but surely recovering. For example, the index of business activity in the manufacturing sector rose in June to almost 40 points after a record May decline to 26 points. In the services sector, the PMI index also showed good dynamics, remaining above the key 50-point level. It is obvious that the above-mentioned releases have not yet fully reflected the restart of the economy – the July indicators should be much better.

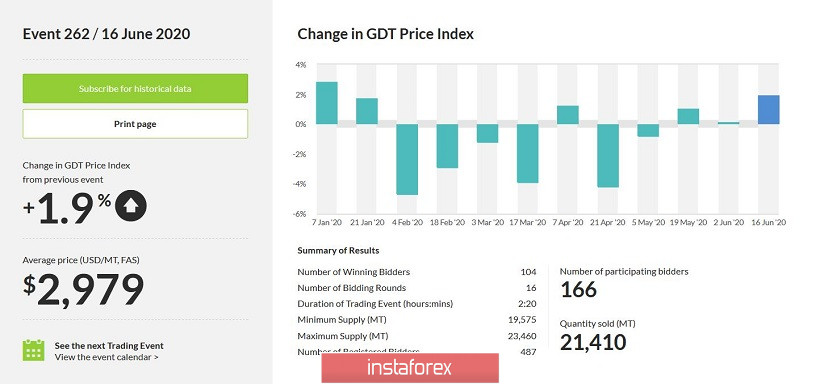

In addition, in June, the New Zealander received another "trump card" in the form of an increase in the price index for dairy products. At the first GTD auction in June, the auction closed in positive territory, although the index had previously shown a downward trend. At the penultimate auction (which took place on June 2), the indicator came out of the negative area and reached the level of 0.1%. The second June auction was held last week: this time the auction closed with a more significant plus: +1.9%. For the New Zealand economy, the cost of "milk" and the demand for it is quite important, so the current situation may have a corresponding impact on the mood of the RBNZ members. The island state exports powdered milk and other dairy products mainly to China and Europe, so recent trends indicate higher demand from them. In other words, everything is as in the expression "milk rivers, jelly banks" - sales of a strategically important product are growing, the economy is recovering, and the coronavirus has almost receded.

All this suggests that the Reserve Bank of New Zealand at its meeting tomorrow, first, will keep all the parameters of monetary policy in the same form, and secondly – will voice "restrained and optimistic" rhetoric. And although a number of experts have doubts about the second point (in their opinion, members of the RBNZ will try to verbally reduce the rate of the New Zealander), in my opinion, there is no reason to express pessimism. Therefore, the June meeting will either be a "pass-through" or will provide some support for the NZD/USD pair. Of course, there is a risk of a southern pullback if the New Zealand Central Bank decides to artificially lower the exchange rate of the national currency with the help of "dovish" rhetoric – but even in this case, it is advisable to consider long positions. The main goal of the upward movement is the mark of 0.6630 – this is the upper line of the Bollinger Bands indicator on the daily chart.