Hello, dear colleagues!

China has not left the information pages of the mass media in recent days. The fact that they have strained relations with the United States of America is well known, and this primarily concerns trade relations. There were reports that the trade deal between the US and China will be terminated, however, US President Donald Trump in his usual manner in his Twitter gave a rebuttal to these rumors. Trump hopes that the Chinese side will not refuse to fulfill all the terms of the agreement. Let me remind you that relations between the United States and China deteriorated after the American leader accused the PRC of distributing COVID-19, as well as after the topic of Hong Kong.

The European Union, in turn, is also concerned about trade relations with China and wants Beijing to provide European companies with equal and fair conditions to work in China.

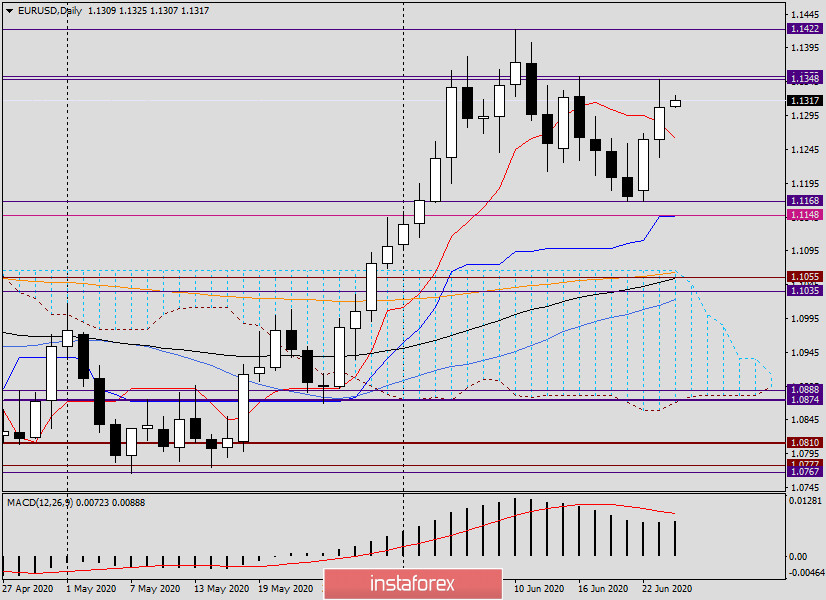

Daily

Meanwhile, on the currency market, the main pair of EUR/USD continued its upward dynamics yesterday and ended Tuesday's trading at the level of 1.1307, which is very symbolic of the prospects for continued growth. It is also worth noting that as a result of strengthening, the quote confidently overcame the Tenkan line of the Ichimoku indicator.

This morning, the main currency pair of the Forex market is still trading without a clearly defined direction, slightly strengthening. If the previous two-day growth continues, the targets for euro bulls will be the resistance levels of 1.1353 and 1.1422. At the same time, overcoming the last mark will open the way to the important psychological and technical level of 1.1500, just below which the maximum trading values were shown on March 9 this year.

But the bears on EUR/USD now have a more complicated task. To take control of trading on the pair, players on the downside need to return the price to the Tenkan line, then break through the support at 1.1168 and 1.1148, where the Kijun line of the Ichimoku indicator is located. Judging by the mood of market participants and the technical picture on the daily timeframe, it is more likely that the growth will continue. However, it is necessary to take into account today's events. These are indices from the IFO on current conditions, expectations, and the business climate in Germany. This section of statistics will be published at 09:00 (London time). No statistics are expected from the US today, however, Open Market Committee members Evans and Bullard will deliver their speeches at 17:30 (London time) and 20:00 (London time), respectively.

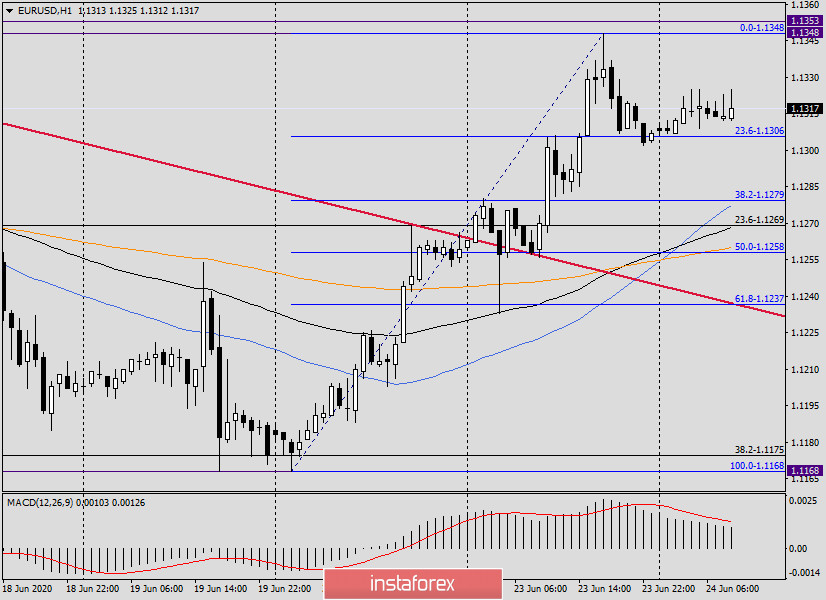

H1

The hourly chart clearly shows that the pair broke through the red resistance line of 1.1422-1.1353 at the second attempt. After a technical pullback to the broken line, the growth continued and reached the level of 1.1348, from which a quite natural and expected pullback to the landmark mark of 1.1300 took place. At the time of completion of this article, the pair demonstrates strengthening and is just eager to continue it. If the wishes coincide with the opportunities, the nearest goal of the bulls for the euro will be a strong price resistance zone of 1.1348-1.1353. To achieve higher goals, a true breakout of the mark of 1.1353 is required, with mandatory fixing above this level.

If you stretch the grid of the Fibonacci tool to the growth of 1.168-1.1348, we see that the pair has already given a pullback to the first level of 23.6 from this movement, after which it turns up, showing its readiness to continue moving in the north direction. In order not to beat around the bush for a long time, I will indicate my personal opinion about the current direction of EUR/USD. I believe that the pair will continue to grow, so the main trading idea is to buy from current prices or after another pullback to the area of 1.1315-1.1300. Purchases at more favorable prices can be searched for in the case of a short-term decline in the price zone of 1.1280-1.1260. But, if the pair is fixed at 1.1300 and can not continue to rise, the upward scenario will be in question.

For sales, you need to wait for the reversal patterns of candle analysis in the resistance zone of 1.1348-1.1353, and open short positions only after such signals appear!

Good luck!