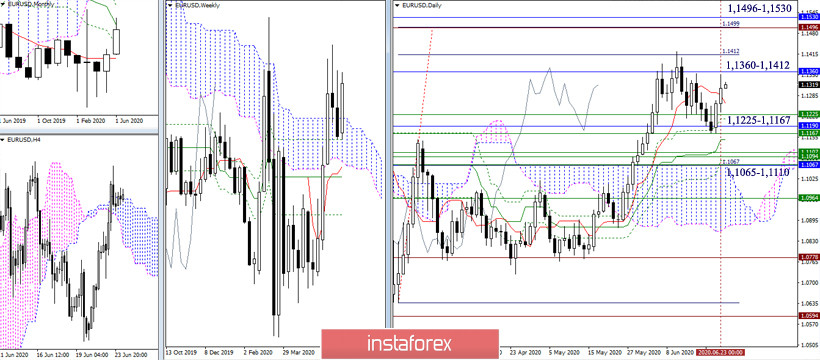

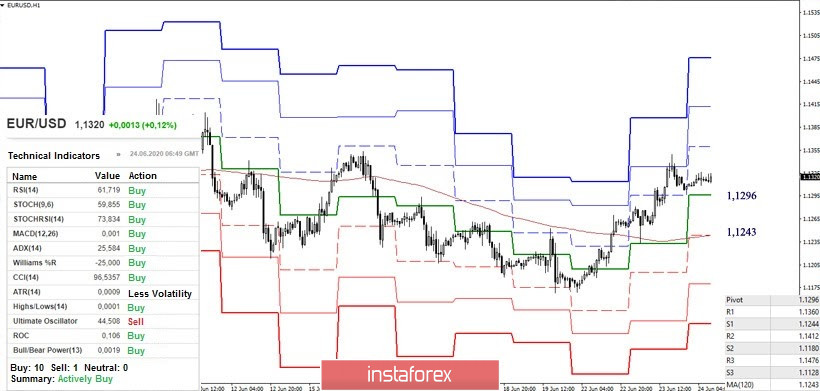

EUR / USD

The pair rebounded from the met support zone and is now testing the zone of influence of the monthly medium-term trend (1.1360). To exit the correction zone and restore the daily upward trend, players need to break through the resistance 1.1360 - 1.1422 (monthly Kijun + maximum extreme of the current correction) to increase. After that, the next upward reference will be the zone 1.1496 - 1.1530 (100% goal fulfillment for the breakdown of the daily cloud + maximum March maximum + monthly Fibo Kijun). In the case of the completion of the upsurge and the return of the bearish sentiment, the pair expects a wide zone of support again from various levels of Ichimoku at upper time intervals, which can now be grouped as follows: 1.1225 - 1.1167 and 1.1065-1.1110.

At the moment, the advantage is on the side of the players to increase due to the analysis of technical tools in the lower halves. Leaving the zone of the current correction will return the resistance to relevance, they are located today at 1.1360 (R1) - 1.1412 (R2) - 1.1476 (R3) inside the day. If the downward correction deepens, the pair will be waiting for key support of the lower halves at 1.1296 (central Pivot-level of the day) and 1.1243 (weekly long-term trend). A consolidation below can level all the recent achievements of players to increase and return bearish sentiment to the market, so it is advisable for players to increase now to keep the correction within the lower halves, without returning to testing the supports of the higher halves.

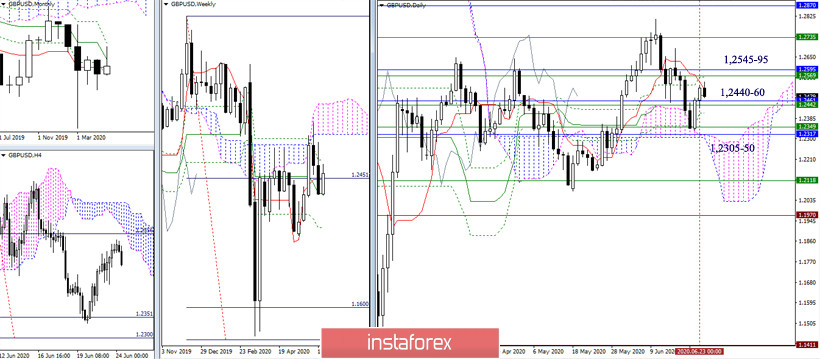

GBP / USD

With the development of the movement of the pair, several zones of support and resistance have now formed. The pair rose to the strengthened resistance zone (1.2545-95) since the beginning of the week, combining several significant levels at once (daily Tenkan + weekly Fibo Kijun + monthly Kijun). The following landmarks are now 1.2735 - 1.2812 - 1.2870. The zone of attraction and support of 1.2440-60 (Tenkans of the month and week) today has direct participation and influence on movement. The area of 1.2305-50 (daily cloud + weekly Kijun + monthly Fibo Kijun) continues to be the most important and strengthened support.

The pair is currently testing the key levels of the lower halves - the central Pivot level (1.2493) and the weekly long-term trend (1.2463). Saving these levels on the side of the players to increase gives them advantages, but it must be considered that the resistance of the upper time intervals hinders the strengthening of bullish sentiments (1.2545-95). A consolidation under the levels will contribute to the formation of a complete rebound from the resistance encountered and the return of bearish advantages, but the further development of the situation under the current conditions will rest again against the levels of high halves (1.2460-40).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)