On Tuesday, the European currency was supported by macroeconomic data that exceeded economists' forecasts. The preliminary PMI for France's manufacturing sector from Markit rose to its highest level in almost two years, to 52.1 from May 40.6. A similar indicator for Germany increased to a 3-month high, to 44.6 from 36.6.

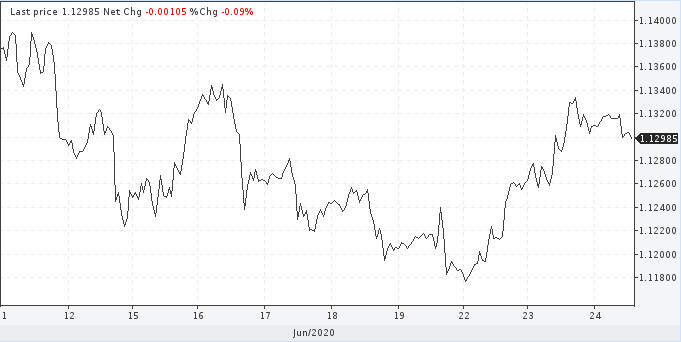

Moreover, preliminary PMI for the services sector in France rose to 50.3 from 31.1 in May, and to 45.8 from 32.6 in Germany. A value above 50 indicates an increase in activity. "Eurobucks" fully recouped the losses of the previous week and brought the EUR/USD pair to the level of 1.1340. This growth of the Euro was somewhat unexpected. Thus, the weekly goal of buyers was reached in just two days. Today, traders' expectations are related to the publication of the German IFO business climate index for June, where growth was expected to reach 85 p. However, the indicator exceeded the forecast, reaching 86.2 p., which was a pleasant surprise for fans of the single currency.

The overall impression of macro data was marred by a statement from the ECB's chief economist. According to Philip Lane, strong economic data is now mistaken for a confident economic recovery. The Eurozone will need a long time to recover from the crisis caused by the coronavirus pandemic.

On Wednesday, EUR/USD buyers slightly loosened their grip, allowing the exchange rate to enter the negative zone.

EUR/USD

It can be noted that in early June, the main pair approached a local peak in the region of 1.1420, after which its decline was observed. On Tuesday, growth resumed, but it is still unclear how the sharp jump to the weekly target above 1.13 will end. Market players are counting on a favorable scenario, expecting the European currency to make new attempts to break through the resistance near the round level of 1.15.

Now, investors are most worried about the economic recovery. All the efforts of the authorities to stimulate growth, along with the aggressive monetary policy of the ECB, had a rather favorable effect on the mood of traders in relation to the euro, ensuring a reduction in the risk premium in it.

In general, the level of uncertainty has a place to be, since the issue of the spread of coronavirus infection has not been fully resolved. However, a new lockdown in the United States is unlikely. The increased workload of hospitals may make the authorities think about introducing quarantine measures, but so far, this is not happening. America is limited to symbolic measures in the form of a mandatory mask regime.

Given the extent to which the world economy has been affected by the earlier quarantine measures, countries will use this practice again cautiously and only when necessary. All this makes it possible to hope that the risk appetite will remain relatively stable.

Over time, the focus of the market may shift to inflation, which is one of the factors of upward dynamics of the EUR/USD pair. It is worth paying attention to the fact that the monetary incentives of the European regulator look the most modest in comparison with the efforts of the United States.The Fed's measures will put pressure on the dollar's position in the long term.