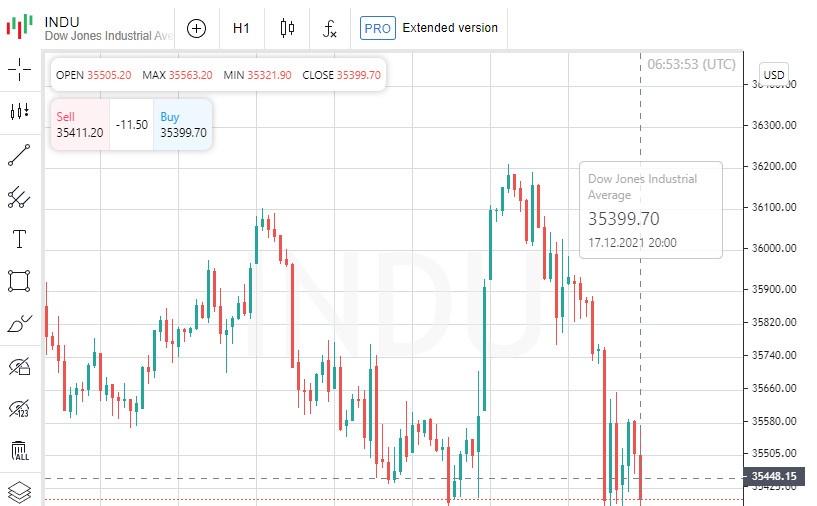

The Dow Jones Industrial Average fell 1.48% on Friday and ended trading at 35365.44 points.

Standard & Poor's 500 dropped 1.03% to 4620.64 points.

Meanwhile, the Nasdaq Composite lost less than 0.1% to 15169.68 points.

By the end of the week, the Dow fell 1.7%, the S&P 500 fell 1.9%, and the Nasdaq Composite fell 3%.

Earlier this week, the Federal Reserve System (FRS) decided to accelerate the pace of winding down its asset-buying program and signaled its readiness to raise rates several times next year. In addition, the Bank of England was the first among the world's leading central banks to raise its key rate to 0.25% from 0.1%.

Meanwhile, Andrew Brenner of NatAlliance Securities believes that the sharp decline in the US stock market was caused rather not by fears of tightening monetary policy, but by other reasons. In particular, he points out that Friday was the so-called Quadruple Witching Day, when index and stock futures and options expire. On this day, there is often increased volatility in the market.

A strong decline on Friday was demonstrated by securities of financial companies. Quotes from Goldman Sachs Group Inc. fell 3.9%, while JPMorgan Chase & Co. fell 2.3%, quotations of the payment system American Express Co. fell 1.8%, quotations of Visa Inc. dropped by 1.2%.

General Motors shares tumbled 5.5% on news of the unexpected resignation of Dan Amman, head of the self-driving car business.

American chain restaurant operator Darden Restaurants fell 5%. The company released strong quarterly earnings, but gave a weak annual forecast and said its CEO, Eugene Lee, will step down next May.

Johnson & Johnson's capitalization fell 2.8% after the US Centers for Disease Control and Prevention (CDC) recommended that citizens get vaccinated with Pfizer or Moderna coronavirus vaccines instead of J&J vaccines because of the risk of blood clots.

Meanwhile, FedEx Corp. jumped 5% in trading after one of the world's largest transportation and logistics companies beat market expectations in adjusted earnings and revenues and improved its full-year forecast.