The euro managed to maintain its position against the US dollar and other world currencies after today's reports on business sentiment in France and the expectations of the V-shaped recovery of the German economy, as evidenced by the IFO indices.

The mood in the business community of France in June this year has improved markedly. However, there are fears that the growth is associated not with fundamental reasons, but purely with the technical effect that could occur after the quarantine measures were lifted. French companies still experience problems associated with stringent sanitary rules and requirements, as well as against the background of lack of orders and the availability of funding. The persistence of high uncertainty with the further prospect of the spread of COVID-19 also affects moods, since the introduction of additional requirements for social distance will clearly not benefit the economy that is returning to life, which will necessarily affect the indicators for the 3rd quarter of this year.

According to Insee, a state statistics agency, the business sentiment index in France rose to 77 points this June from 71 points in May but still remains below the long-term average of 100 points. Economists predicted that in June the index would be 76 points. Today's June Ifo reports also gave traders hope for the euro to recover in the near future, as the German economy is expected to follow a V-shaped path. The revival of economic and social activity will certainly contribute to this. However, the main growth driver was the abolition of quarantine measures. According to several leading economic agencies, it is still difficult to assess all the permanent damage that the crisis has caused to the German economy.

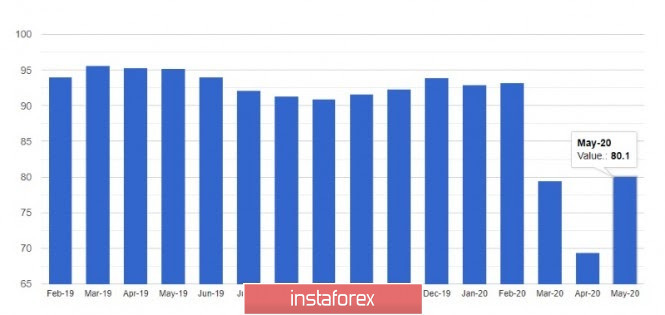

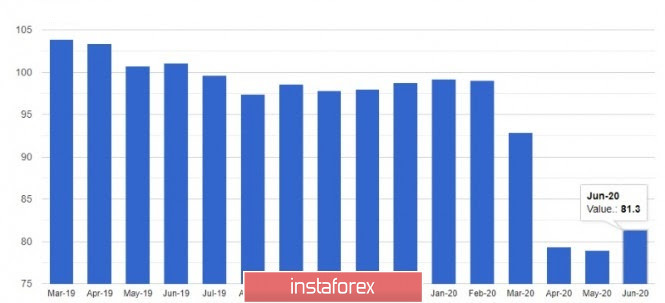

According to the data, the Ifo business sentiment index in Germany in June of this year rose to 86.2 points against the revised upward May value of 79.7 points. Economists had expected the index to reach 84.3 points in June. The index of assessment of current conditions also gained weight and was at the level of 81.3 points against 78.9 points in May. The expectations index jumped immediately to 91.4 points against 80.5 points in May, which indicates the continued optimism of companies in the future.

As for the technical picture of the EURUSD pair, it has not changed much in the morning after an unsuccessful attempt by sellers of risky assets to put pressure on the euro. However, the bulls are also not all right with the direction. For the further recovery of risky assets, a breakthrough in the area of 1.1320 is necessary, which will only increase the demand for the trading instrument and lead to the renewal of the highs of 1.1380 and 1.1440. If the pressure on the euro continues in the afternoon, then, most likely, the active struggle will unfold again in the support area of 1.1270, but larger levels are seen slightly lower, in the areas of 1.1235 and 1.1170.

Nzd

Today, the Reserve Bank of New Zealand left the official interest rate unchanged at 0.25%, which fully coincided with market expectations. Immediately after that, a number of comments were made on the state of the economy, which negatively affected the positions of the kiwi in relation to the greenback.

The decision of the RBNZ to leave the bond purchase program unchanged in the amount of 60 billion New Zealand dollars also led to increased pressure on the couple, as many market participants expected that the program would be expanded due to the difficulties that the economy faced during the height of the coronavirus pandemic. The RBNZ said that while in New Zealand it was possible to restrain Covid-19, the volume of state fiscal stimulus, however, will be slightly larger than previously expected since significant economic difficulties await the country ahead. The regulator is also skeptical of the recent strengthening of the New Zealand dollar, which has put additional pressure on export earnings. The RBNZ does not refuse assistance and is ready to provide additional incentives if necessary,

As for the technical picture of the NZDUSD pair, despite the decrease in the trading instrument, trade remains in a fairly wide side channel, and the trend to strengthen the kiwi may continue in the near future. However, for this, the bulls need the most confident support protection of 0.6400, as well as the breakdown of local maximums in the region of 0.6600, which will lead to a new bullish trend in the areas of 0.6680 and 0.6760.