The Japanese yen is trading mixed in relation to major world currencies, but the strengthening trend prevails. This is facilitated by the information background and macroeconomic data. Traders were enthusiastic about the growth of the index of business activity in the services sector, which jumped to 42.3 points from 26.5 points earlier. Although US data were also positive, the dollar did not show a proper reaction, which may be due to internal US problems.

As for the pair USD / JPY, while a mixed background is forming here, quotes may decrease due to falling rates in the interbank lending market. Demand for dollar loans in New York and London fell sharply, the most deplorable situation in the United States. So, the Fed in the past few days has characterized repo auctions as failed due to the lack of applications. A colossal amount of dollar liquidity was pumped into the financial system, and bankers, one might say, are now sitting on bags of money.

An upward trend is also likely. The USD / JPY pair, as we know, historically correlates with the US securities market, which is actively recovering. Last night, the NASDAQ Composite Index set a new growth record. Market players continue to buy US securities, even though the yield on short-term bonds is at least 0.5% per annum. With such low profitability, you won't earn money, and so they opt for stocks.

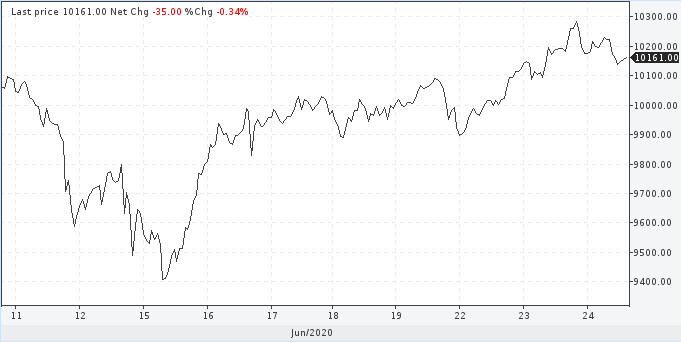

Meanwhile, US stocks are selling again today. Fears about the second wave of the pandemic periodically roll over investors. In general, they are justified as in some states, there is a serious increase in the number of infections, which may force authorities to impose quarantine. Coronavirus mortality rates in the United States are significantly higher than in other countries. Investors fear that restrictions may be placed on the way companies operate.

NASDAQ

The risk of a second wave of the pandemic exists and may push the currency market towards the old model of risk aversion and the purchase of protective assets, including the US dollar.

From a technical point of view, the USD / JPY pair continues to be traded within the correctional formation between the levels of full and intermediate Fibonacci retracement. There are still signals for sale, so you should pay attention to short positions. Resistance levels are at 106.80 and 107.88, and support is at 105.73, 104.20.

USD / JPY