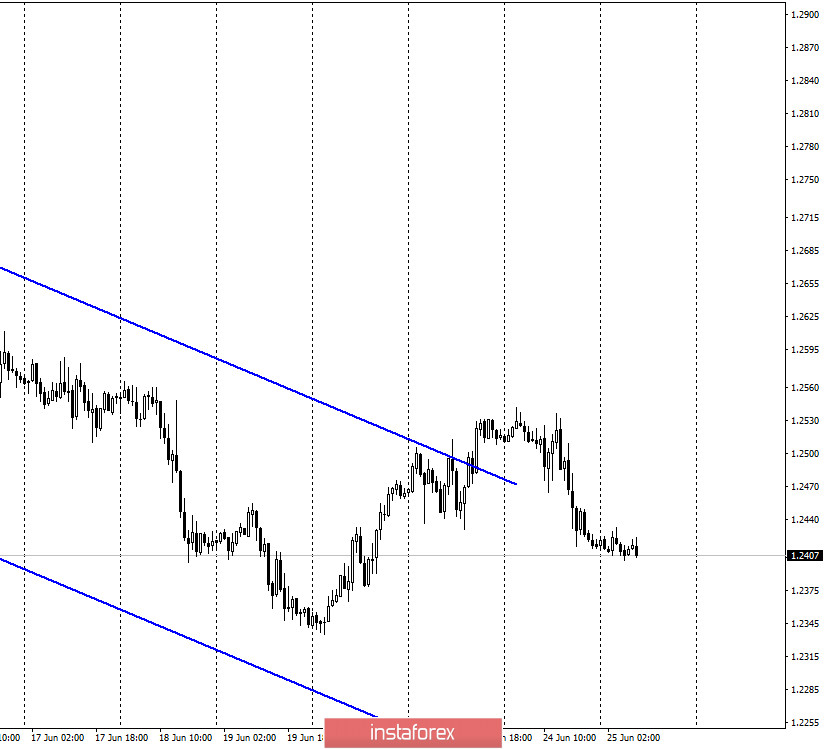

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair performed a reversal in favor of the US dollar and began the process of falling, as did the euro/dollar pair. Moreover, the "claims" and assumptions for the pound/dollar pair are the same. After the pair's quotes completed the consolidation above the descending trend line corridor, the traders had the right to count on the continuation of the growth of quotes of the pair. Instead, however, the fall began immediately. At the same time, this drop does not mean that the growth process is completed without really starting. Already today, with the help of weak news from America (if they are weak), bull traders can start buying the pair again, which will lead to the expected growth. The information background from the UK is absent, and from America – negative. Traders' fears are increasingly linked to the second wave of the COVID-19 epidemic. Therefore, the prospects for the US dollar are now absolutely unclear.

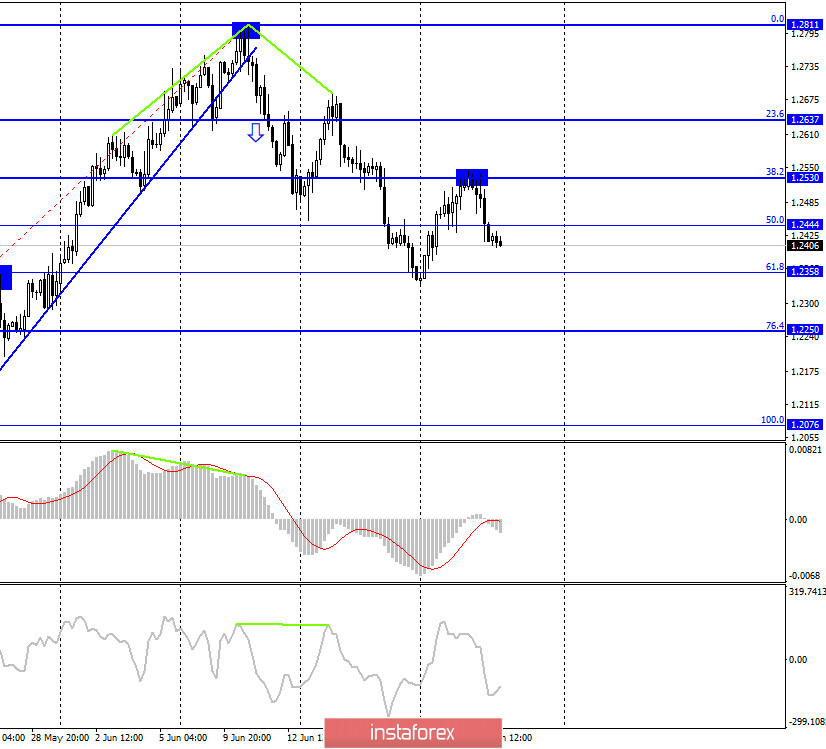

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair rebounded from the corrective level of 38.2% (1.2530), turned in favor of the US dollar, and began the process of falling towards the corrective level of 61.8% (1.2358). The rebound of the pair's exchange rate from this Fibo level will work in favor of the British currency and resume growth in the direction of the corrective level of 38.2%. Closing quotes below the Fibo level of 61.8% will increase the probability of a further fall in the direction of the next corrective level of 76.4% (1.2250).

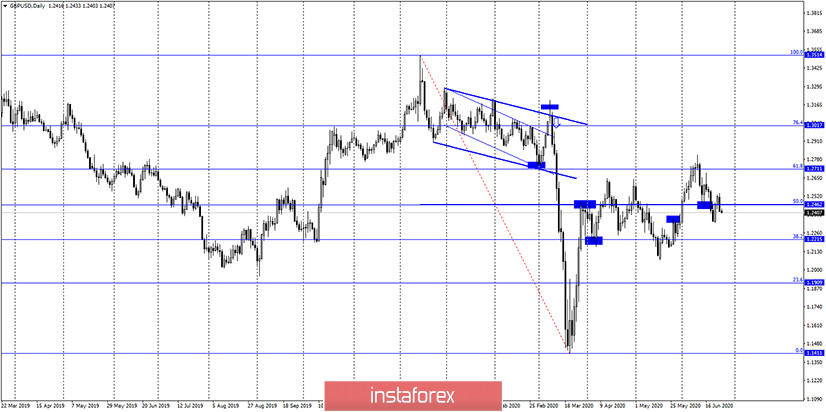

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a new reversal in favor of the US currency and anchored under the Fibo level of 50.0% (1.2462). Thus, the process of falling can be continued in the direction of the corrective level of 38.2% (1.2215).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

No economic reports were released in the UK and the US on Wednesday. Thus, the information background did not affect the mood of traders.

News calendar for the US and UK:

US - change in the volume of orders for long-term goods (12:30 GMT).

US - change in GDP for the quarter (12:30 GMT).

US - number of initial and repeated applications for unemployment benefits (12:30 GMT).

On June 25, there will again be no important reports in the UK, while there will be three in the US. Thus, in the second half of the day, the information background can strongly affect the mood of traders, and even change it to "bullish", since strong data from America is not expected.

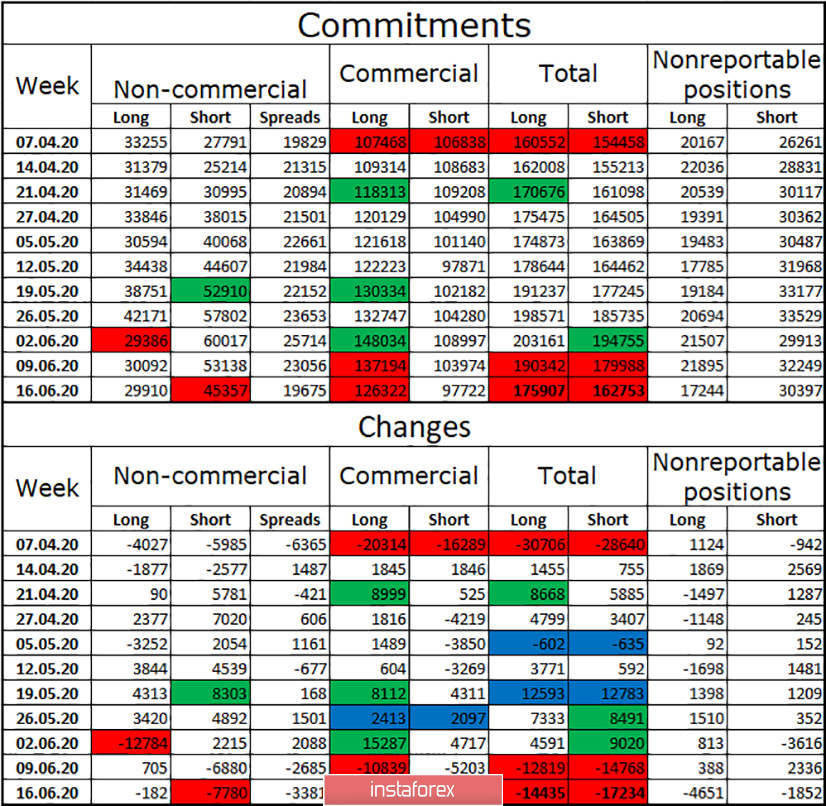

COT (Commitments of Traders) report:

The latest COT report showed the second consecutive strong reduction in short contracts among the "Non-commercial" group - by 7,780 units. This same group of large traders also got rid of long contracts. Thus, among speculators, the British did not cause any interest in the reporting week. Also, the "Commercial" group got rid of short and long contracts. And in total (the "Total" group), about 32 thousand contracts were also lost. A week earlier, let me remind you, it was -25 thousand. Thus, the major market players now do not buy the pound and do not sell it. Most likely, assets are being transferred to other more interesting currencies. However, this is not the euro, which also shows a reduction in the reporting week. The deadline for the latest report is June 16. After this date, the pair fell into a zone of turbulence and changed direction almost every day.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound today with the goals of 1.2358 and 1.2250, as the rebound from the level of 1.2530 was performed on the 4-hour chart. At the same time, I recommend being careful with sales, as the hourly chart continues to indicate possible growth. I recommend opening new purchases of the pair after closing above the level of 1.2444 with a target of 1.2530.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.