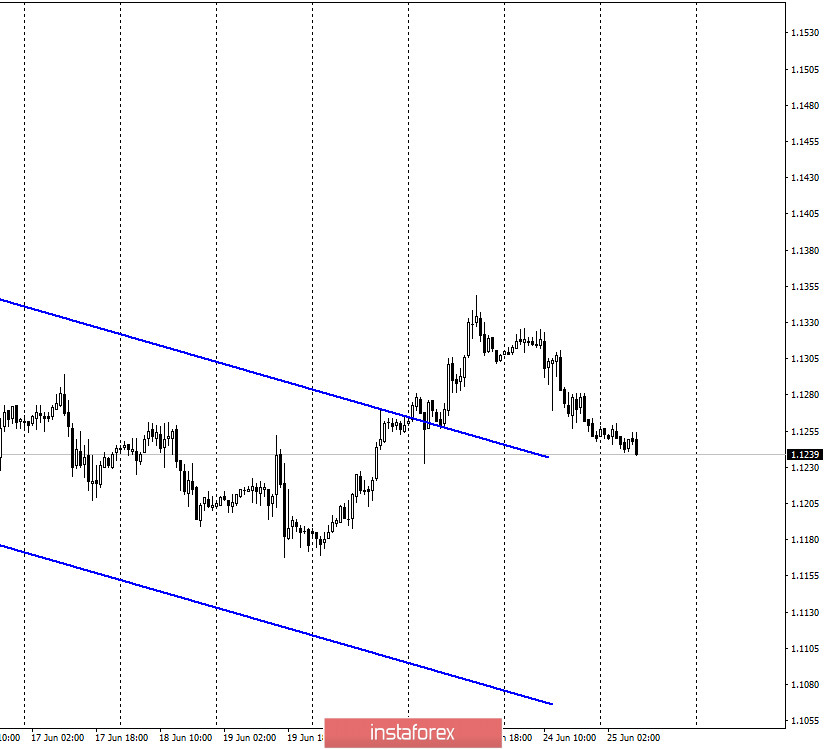

EUR/USD – 1H.

Hello, traders! On June 24, the euro/dollar pair turned in favor of the US currency and started a new process of falling, although it had previously closed over the downward trend corridor and, thus, the mood of traders should have changed to "bullish". However, in reality, the US dollar is growing again, although the reasons for this are becoming less and less every day. In America, the second wave of the coronavirus pandemic has begun. It started when the first one wasn't over yet. However, Donald Trump was in a hurry to "open" the economy, now we see what this rush has led to. However, not only Donald Trump is to blame. "Black Lives Matter" rallies have been held across the country for almost a month. And rallies are a large number of people in a limited space, where not everyone wears masks and no one adheres to social distance. Thus, the current 30-35 thousand new cases every day are the results of public unrest and short-sighted policies of Donald Trump. At the same time, the US President began his campaign tour of American cities. He gathers people at stadiums, speaks to the public and the threat of infection of his supporters with the coronavirus does not worry him too much.

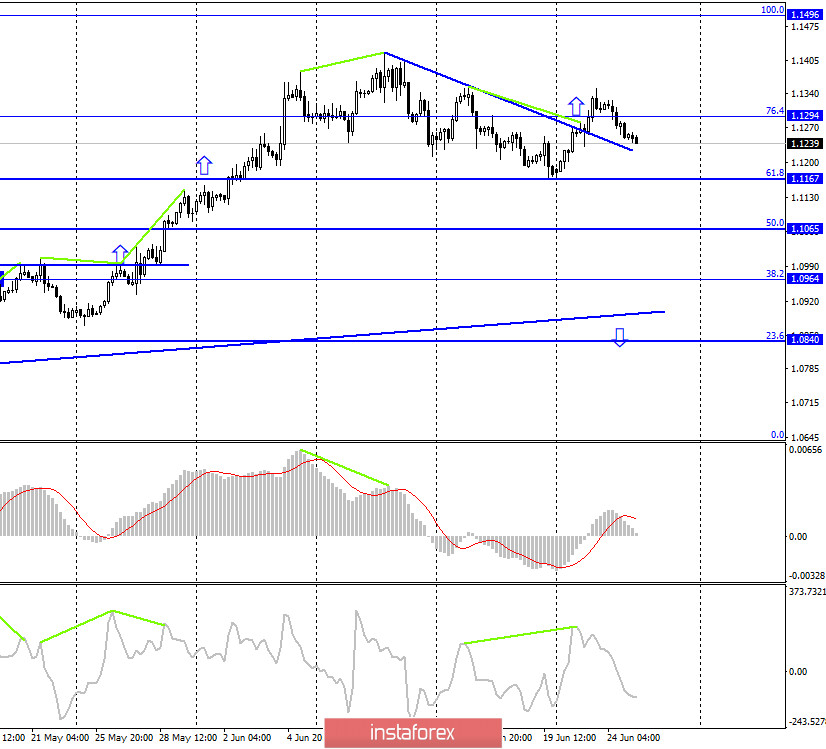

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair also performed a reversal in favor of the US currency and anchored under the corrective level of 76.4% (1.1294). Thus, the fall in quotes can now be continued in the direction of the corrective level of 61.8% (1.1167). No new emerging divergences are observed in any indicator today. Closing quotes above the Fibo level of 76.4% will again work in favor of the European currency and allow traders to expect some growth in the direction of the corrective level of 100.0% (1.1496). I would like to note that in the last week, traders are unable to determine their mood.

EUR/USD – Daily.

On the daily chart, the euro/dollar pair again performed a reversal in favor of the US dollar and again performed a close under the corrective level of 127.2% (1.1261), which again allows traders to expect a fall in the direction of the Fibo level of 100.0% (1.1147).

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair rebounded from the lower line of the "narrowing triangle", which still allows traders to expect growth in the direction of the 1.1600 level (the upper line of the "triangle"). However, the lower charts are now in a more bearish mood, so working out this goal is being postponed for now.

Overview of fundamentals:

On June 24, the European Union and the United States did not publish a single important economic report. There was also little other news.

News calendar for the United States and the European Union:

US - change in the volume of orders for long-term goods (12:30 GMT).

US - change in GDP for the quarter (12:30 GMT).

US - number of initial and repeated applications for unemployment benefits (12:30 GMT).

On June 25, the EU news calendar is again empty, and three fairly important reports will be released in the US at once. I recommend paying special attention to GDP for the first quarter, as if the final value is below -5.0%, this may return the "bullish" mood to the market.

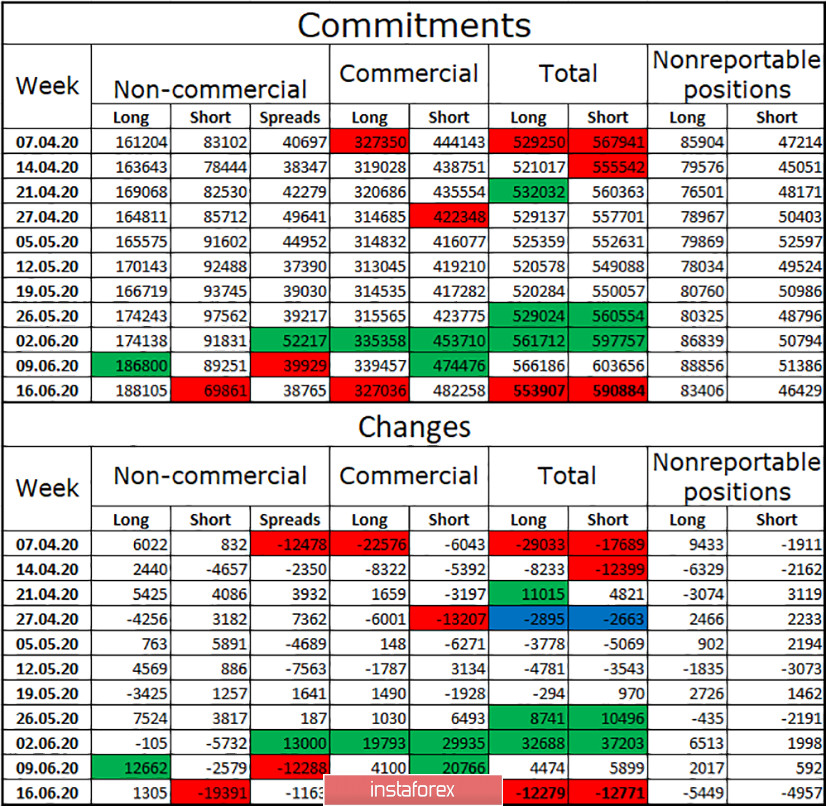

COT (Commitments of Traders) report:

The latest COT report, released last Friday, showed very interesting changes. First, the "Non-commercial" group, which is considered the most significant, has been actively getting rid of short-term contracts for the euro during the reporting week. It seems that this was the reason for the growth of the euro currency in the reporting week (until June 16). Large traders seldom opened long contracts. Second, hedgers "picked up" not all the contracts dropped by speculators, increasing only 7783 contracts for sale, but getting rid of 12,500 contracts for purchase. In total, the euro currency lost 25 thousand contracts. Thus, major market players lost interest in the euro currency during the reporting week in any case. The current week for the dollar and euro is ambiguous. One or the other currency is growing without a clear advantage.

Forecast for EUR/USD and recommendations to traders:

Today, I recommend buying the euro currency with the goals of 1.1405 and 1.1496, if a new close is made above the level of 76.4% (1.1294). Today, I recommend considering the pair's sales with a target level of 61.8% (1.1167).

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.