The latest COT report (Commitments of Traders). Weekly prospects for GBP / USD

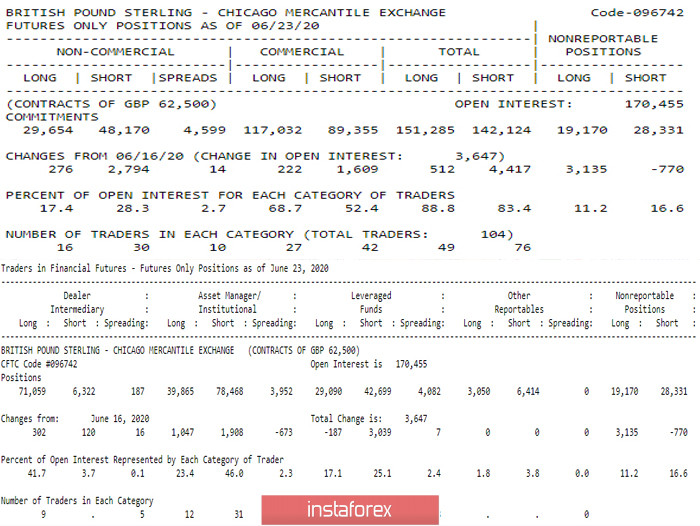

Open interest in the pound has somewhat stabilized and even increased according to the latest report of the COT (Commitments of Traders of 06/23/20), amounting to 170,455 against 166,808. It should be noted that large players are now in solidarity in their preferences and insist on maintaining and developing bearish sentiment. During the reporting period, they actively increased their short positions - the Non-Commercial group (long 276 and short 2,794), the Commercials group (long 222 and short 1609). As a result of such tactics, the final values of the general report for the last reporting period are almost equal (long 151,285 and short 142,124). A little more, and if the trend continues, the long-term priority will again shift to the side of the players to lower.

Main conclusion

Large players are ready to support the return to the market of bearish activity and performance.

Technical picture

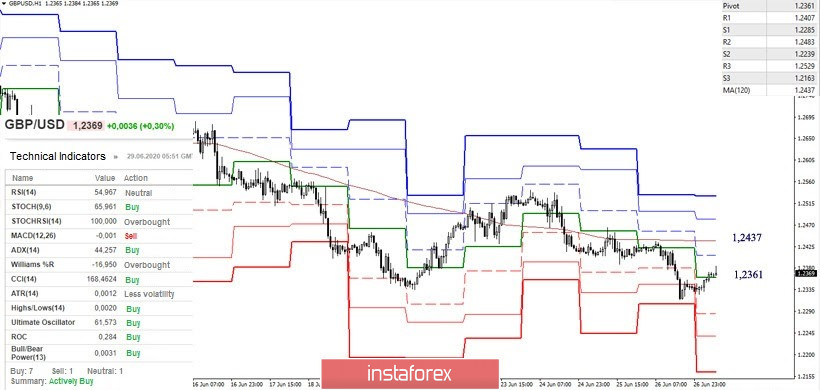

The technical picture draws attention to the fact that the development of the situation on the pound is now constrained by a number of supports. Major support is concentrated in the region of 1.2300-20. A breakdown of support will allow a more reliable foothold under the trend lines of the daily and weekly timeframes and will open up new prospects for strengthening bearish sentiment. Work on the supports and the formation of rebound due to their strength will allow players to increase in the current circumstances to save a chance for a further restoration of positions. This week, the result of the monthly candle for June will be formed, which is likely to be reflected in the next COT report, which will be published just after the end of the month.

At lower timeframes, there are currently advantages for the players to lower, however, the pair on H1 is in the zone of upward correction and tests the central Pivot level (1.2361) for strength. Leaving the correction zone and restoring the downward trend will allow us to pay attention to the support of the classic Pivot levels (1.2285 - 1.2239 - 1.2163). Successful bear strengthening may have far-reaching plans in this case. The preservation of the correction and its development will lead the pair to the struggle for a weekly long-term trend (1.2437). Fixing above may affect the current distribution of forces in the lower halves and indicate future prospects for strengthening bullish sentiment.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)