The USD/JPY pair. The trend is still trading above the spot of 133.42 - 133.72. The one-hour chart is more upbeat for Dollar/Yen bulls.

Today, the USD/JPY pair has broken resistance at the level of 133.42 which acts as support now. Thus, the pair has already formed minor support at 133.42.

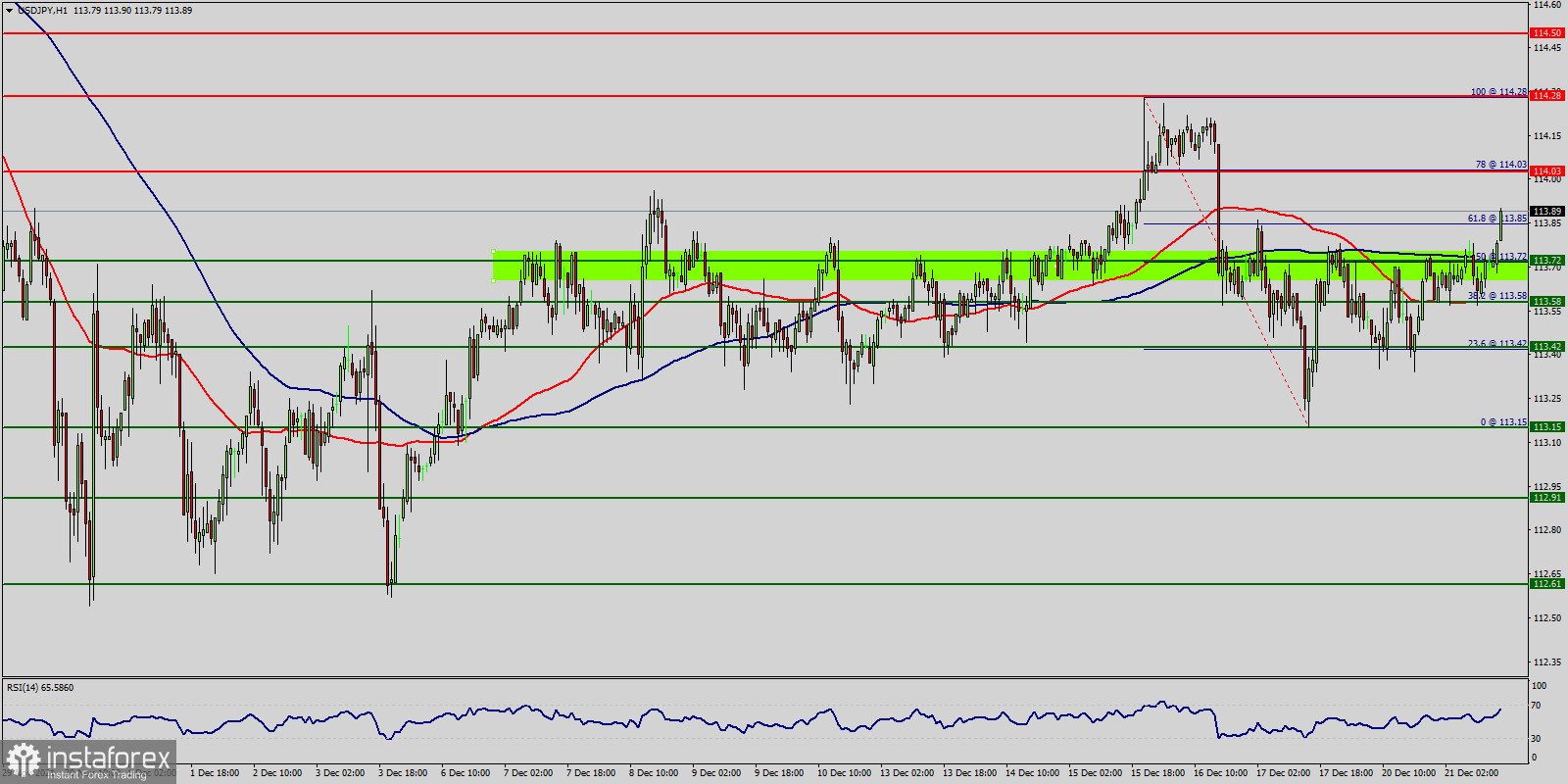

The strong support is seen at the level of 112.61 because it represents the weekly support 1. Momentum remains to the upside while the recent upswing has pushed cable above the 100 Simple Moving Average (EMA), while the Relative Strength Index (RSI) remains below 70 – outside overbought conditions.

So, the RSI and the moving average (100) are still calling for an uptrend. Resistance awaits at 114.03, which is the fresh swing high. It is followed by 114.28, last week's peak, and then 114.28, -(R3: 114.50).

Therefore, the market indicates a bullish opportunity at the level of 113.58 in the H1 chart. Also, if the trend is buoyant, then the currency pair strength will be defined as following: USD is in an uptrend and JPY is in a downtrend.

Buy above the minor support of 113.42 with the first target at 114.03 (this price is coinciding with the ratio of 78% Fibonacci, top, last bullish wave), and continue towards 1.4068 (the weekly resistance 2 : 144.28).

On the other hand, if the price closes below the minor support, the best location for the stop loss order is seen below 114.50; hence, the price will fall into the bearish market in order to go further towards the strong support at 113.58 to test it again.

Furthermore, the level of 113.15 will form a double bottom. Support is at 113.15, which held USD/JPY back earlier this week. It is followed by 112.91 and 1.1261.