The dollar index continues to fluctuate in the range of 96.6-97.6, alternately starting from the borders of the specified band. The US currency was under pressure at the beginning of the trading week amid a renewed interest in risky assets. However, the situation changed again in the second half of Monday: the dollar rose throughout the market.

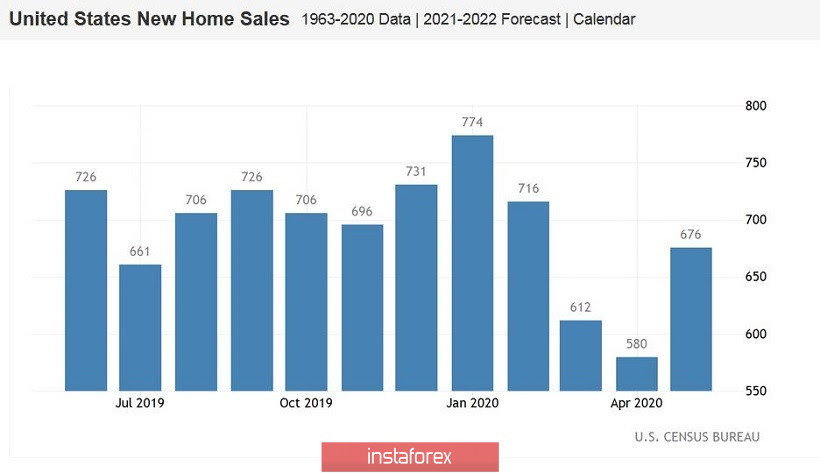

The reason for the greenback's growth was the release of generally secondary macroeconomic data in the real estate market of the United States. An impressive increase in the indicator helped dollar bulls regain their positions and even approach the ceiling of the mentioned range. We are talking about the volume of outstanding transactions for the sale of housing. This is an early indicator of business activity in this area. It was deep in the negative area for two months (in March and April), however, the May figures surprised with its growth: the index jumped from -21% to + 44% in monthly terms. This release only affects the dollar with significant fluctuations, and yesterday was just that case. It is also worth recalling that last week very good data were published on the sale of housing in the primary US market - this figure also jumped to 16% in May with a growth forecast of 3.5%.

In other words, the US housing market is showing signs of recovery, and this fact served as a formal reason to strengthen the dollar. At the same time, the indicated fundamental factor is unlikely to help dollar bulls exceed the resistance level of 97.5 - this requires a more powerful information driver. The focus will be on two mainstream topics - the pace of the spread of coronavirus in the United States and the Nonfarm.

It should be noted here that the United States will celebrate a national holiday on Friday - Independence Day, so key labor market data, which was traditionally published on Fridays, will be released on Thursday (and on the last trading day, US sites will be closed accordingly).

Nonfarm will have a strong impact on the dollar. Let me remind you that the previous release, which was published earlier this month, made an ambiguous impression. Many components came out better than expected, reflecting positive trends in the labor market. In particular, instead of the indicator of employment growth, it jumped by 2.5 million, while most experts predicted a further decline in this indicator. The unemployment rate rose to 13.3%, while the consensus forecast was at 19.5%. At the same time, the inflation component of Nonfarm payrolls, the level of average hourly wages, disappointed.

According to the general forecast, Nonfarm in June will show a stronger result. The rate of growth in employment should jump to three million, and the level of average hourly earnings in monthly terms may come out of the negative area, reaching the level of 0.2% (that is, to reach the pre-crisis level). The indicator of employment growth in the manufacturing sector of the economy may show a weaker result, although not as disastrous as the previous months.

Thus, the day after tomorrow, macroeconomic data that are quite important for the dollar will be published, so the current strengthening of the US currency may be temporary. In addition, the coronavirus still plays the role of first fiddle for the greenback, or rather, the panic moods that are associated with the spread of COVID-19.

The situation is very ambiguous here. On the one hand, the epidemiological situation in the United States is clearly getting worse – last week there was a record for the number of new cases detected per day: 45,457 new carriers of the virus were detected per day on June 24. The wave of the pandemic has now covered the southern states of the US. The situation is particularly dire in Arizona, Arkansas, California, North and South Carolina, as well as in Tennessee, Florida and Texas. In five states, there are more patients with coronavirus in hospitals than at any time during the entire period of the epidemic. On the other hand, the White House still remains calm. In particular, US President Donald Trump recently stated that the increase in the number of newly detected cases of COVID-19 is due solely to the fact that more tests are being conducted in the country every day. He made it clear that the country will not return to full lockdown mode. This information was repeatedly confirmed by other representatives of the White House – for example, Larry Kudlow and Steven Mnuchin. In addition, yesterday, the Chinese pharmaceutical group Sinopharm announced a successful trial of a potential coronavirus vaccine in humans. All the volunteers (and there were more than a thousand of them) had a positive immune response during the first and second phases. Trials of the drug will continue in the United Arab Emirates. If the effectiveness and safety of the drug is confirmed during the third phase of trials, production of the vaccine may begin in October.

Such contradictory signals does not allow the dollar to spread its wings – if earlier the panic mood of traders was associated exclusively with the growth of the number of infected, now the market is evaluating the appropriate reaction of the authorities. In the run-up to the presidential election, Trump does not risk re-closing the country to quarantine, while local tightening of restrictive measures do not worry investors.

All this suggests that the dollar index will continue to fluctuate within the above range of 96.6-97.6, reacting to the current information flow and being in anticipation of June Nonfarm data.

If we are directly talking about the euro-dollar pair, the situation here is also ambiguous. At the moment, the price is located directly below the average line of the Bollinger Bands indicator on the daily chart, and the trend indicators have not formed any clear and unambiguous signals. Buyers need to show character and gain a foothold above the 1.1270 mark – in this case, the Ichimoku indicator will form a bullish Parade of Lines signal, and bulls of the pair can consider long positions with the goal of 1.1370 (the upper line of the Bollinger Bands).