Stock indexes of the Asia-Pacific countries are growing steadily on Tuesday morning, the growth is supported by positive data from China. The PMI in the manufacturing sector rose to 50.9p, which turned out to be better than expected, while the growth in the services sector was even more pronounced - 54.4p against 53.6p in May. A solid economic recovery in China reduces fears of relatively weak global economic growth and contributes to lower demand for risky assets.

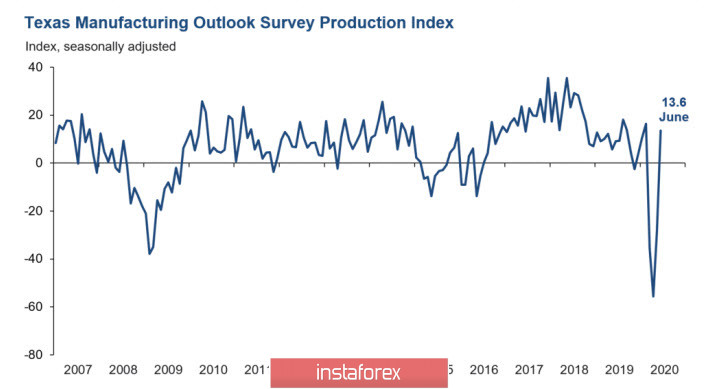

Exchanges in the US closed the day before with strong growth, which was supported by an unexpectedly strong increase in expected home sales transactions by 44% and the PMI of the Federal Reserve of Dallas, which went into positive zone after three months of decline.

Today, volatility is possible due to a number of speeches - the report of the Minister of Finance Mnuchin is expected, in which he will assess the current economic situation, as well as a statement by J. Powell in Congress.

The mood of the market is closer to neutral. Fears regarding another pandemic wave have not yet led to a full-fledged panic, and positive news about the speed of recovery in the global economy has not yet found real fulfillment. Thus, players are waiting - this is perhaps an adequate assessment of the current situation. It is necessary to assess the impact on the markets of the Fed's redemption program of corporate bonds, which started on Monday.

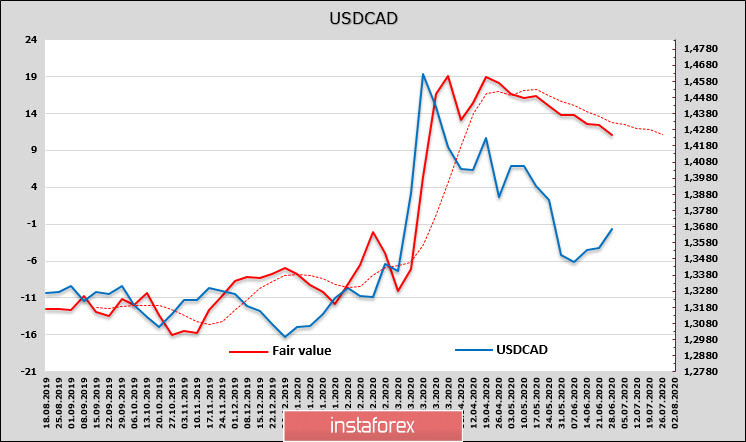

USD/CAD

The industrial product price index rose in May by 1.2% after four consecutive months of decline, while the commodity price index rose by 16.4%/ The main reason for the growth is the recovery of oil prices.

CAD remains vulnerable even against the backdrop of cautious growth in optimism, primarily due to fears of a recovery in demand in the US that is too weak than the market expects.

Players continue to systematically reduce the short position and it declined by another 345 million during the reporting week. The dynamics of the estimated price continues.

It should be noted that positioning for the Canadian currency does not give a clear answer about the further direction. The estimated price is still directed down, which is in favor of the loonie and at the same time, significantly higher than the spot price, which is in favor of the dollar. Weak statistics do not contribute to a further decline in the pair, so trading in the range with a small margin of bulls looks a little more likely - the pair may go slightly above the recent high of 1.3714, but this growth has all the signs of a correction and is unlikely to be positive. The growth of panic moods can strengthen the dynamics, but there are no noticeable prerequisites for this on Tuesday morning.

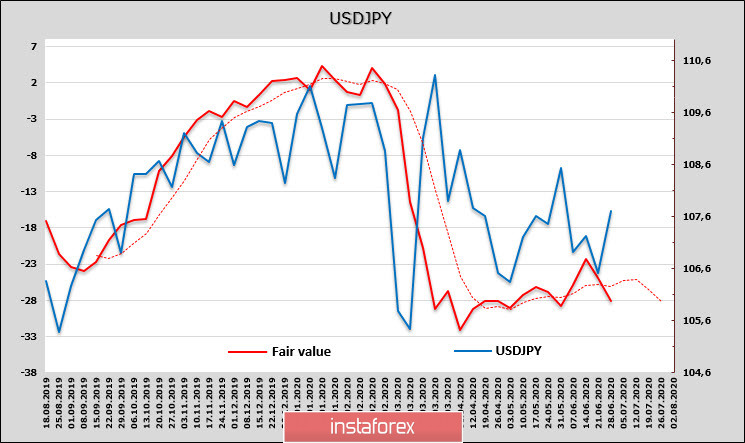

USD/JPY

Amid positive reports from China, the state of the Japanese economy looks more and more alarming. The growth of retail sales in May, despite the release from restrictive measures, turned out to be very modest, there is a decline of 12.3% year-on-year, which is worse than forecasts and clearly does not help to reduce deflationary pressure.

The unemployment rate in Japan is very low, and even an increase of up to 2.9% (which is worse than the forecast of 2.8%) looks clearly advantageous relative to the subsidence of the labor market in Europe or the United States. However, the reliability of the labor market does not help the real sector in any way – industrial production in May declined again, and this time, by 8.4% (worse than forecasts), or 25.9% yoy.

At the same time, fear of the second wave is growing in Japan. On June 28, 60 new cases of infection were recorded in Tokyo, but at this stage, the authorities do not intend to introduce new restrictive measures.

The worse for the economy, the better for the yen. The total long position on the yen increased by 0.647 billion and reached 3.222 billion. This is not the strongest advantage among the G10 currencies against the dollar, but the dynamics in favor of the yen. The estimated price has declined again.

Given the dynamics of the estimated price and rising concerns over the second wave of the pandemic, the yen leaving the downward range is becoming highly possible. Another attempt is possible to rise to the recent maximum of 107.89, after which a downward reversal will take place and the low of 106.06 will be updated.