Popular celebrations with the burning of cars, looting of shops and even the theft of police horses were not in vain. Of course, all the protesters, and especially the rioters, took precautions, covering their faces with masks and carrying out their activities exclusively with gloves. However, these remedies were not medical, and instead of masks, there were bandanas and some rags instead of silicone gloves. And they used them repeatedly, instead of changing them every two hours. In general, the United States has received a new surge in the coronavirus epidemic, and a record number of new infections were recorded on Friday. And on Saturday, there were slightly fewer of them. But we already know all about this only at the weekend. In any case, the hottest heads immediately began to yell that this is the second wave, and soon all the restrictive measures that have not even been lifted yet will have to be introduced again and necessarily making them even tougher. And the most active alarmists are actively pointing fingers at a number of States that are doing just that now. This is especially true in Florida. In general, it is easy to guess that the week did not start in the best way for the dollar, and, driven by all these fears, it was actively losing its positions, although not for very long. By the evening, the market trends had completely changed.

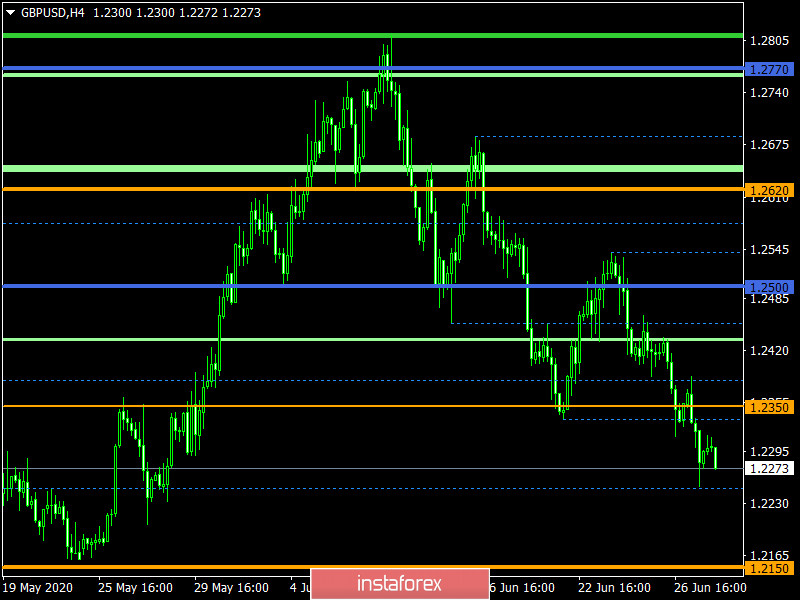

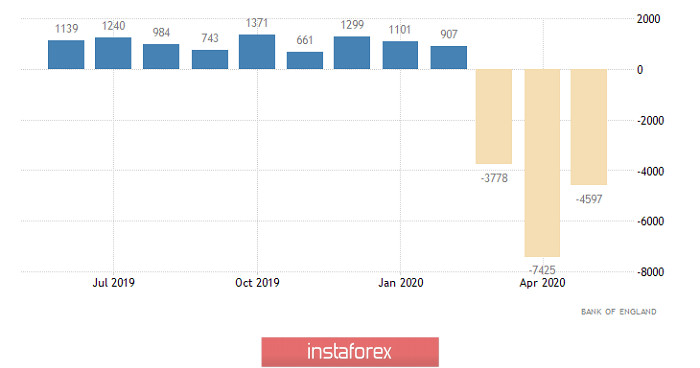

The pound was the first to give up its positions. And taking into account the fact that it grew for a relatively short time, it significantly weakened against the dollar at the end of the day. The reason for the weakness of the pound was the statistics on the lending market, which could only please the growth of 1.2 billion pounds of mortgage lending. However, the number of approved mortgages declined from 15.9 thousand to 9.3 thousand. Although, we expected growth to 26.4 thousand. In addition, the volume of consumer lending declined by 4.6 billion pounds. At the same time, the volume of consumer lending has been declining for three months in a row, and during this time, it has declined by 15.8 billion pounds. In general, there is nothing to be happy about the pound, so it was losing its position.

Consumer lending (UK):

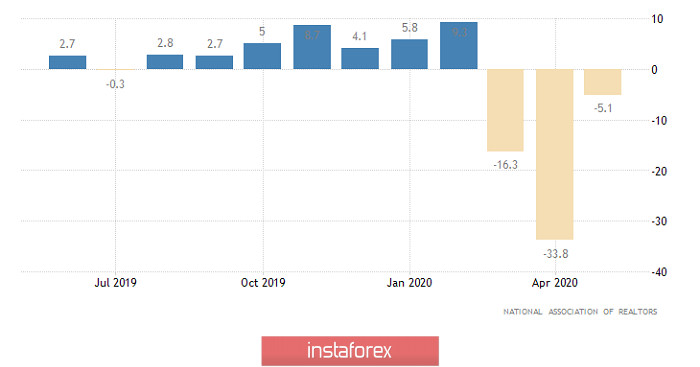

The single European currency held only until the publication of data on pending home sales in the United States. The fact is that a slowdown in their decline was predicted from -33.8% to -16.2%; however, it turned out that they slowed down to -5.1%. And all thanks to the growth of these, most unfinished deals in May went immediately by 44.3% with a growth forecast of 18.0%. All this suggests that June statistics will show an impressive increase in activity in the housing market. And you need to understand that the growth of the real estate market can occur only in conditions of an overall growth in consumer activity. That is, it is about restoring consumer demand in the United States at least about the beginning of this process. Thus, the growth of the dollar at the closing of the day should not be surprising.

Unfinished Home Sales (United States):

The pound started on a wrong track today. The total GDP data for the first quarter showed that the growth rate of 1.1% was replaced by a decline not of 1.6%, but as much as 1.7%. That is, it is still worse than expected. Moreover, when compared with the United States, where although there is a strong slowdown in growth rates, it is still too early to talk about the decline in GDP on an annualized basis. This will be reflected only in statistics for the second quarter. Thus, the UK is already in full swing recession. There is a high possibility that overall economic losses will be much more significant than in the United States.

GDP (UK):

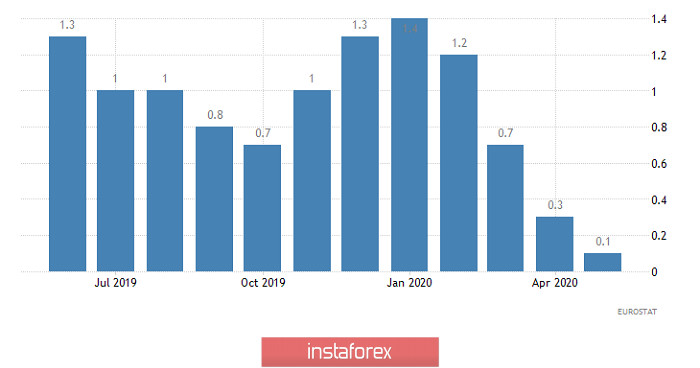

Nevertheless, with all due respect to the United Kingdom, investors are much more concerned with inflation in the euro area than Britain's GDP. Moreover, preliminary data should show its decline from 0.1% to 0.0%. This means that Europe has literally slipped into deflation. Moreover, Italy is already enjoying it, and it can only increase from -0.2% to -0.6% and we are talking about the third economy of the euro area. Nevertheless, it is highly likely that inflation in Europe will remain unchanged or even rise. For example, preliminary data on inflation in France have already been released today, where it declined from 0.4% to 0.1%. Yes, this is a slowdown in consumer prices, but they were expecting prices to fall by 0.2%. That is, deflation was predicted in France, but this did not happen. Besides, preliminary data on inflation in a number of eurozone countries were also published yesterday. So, in Spain, the pace of decline in consumer prices slowed down from -0.9% to -0.3% with a forecast of -0.5%. And in Germany, instead of a deceleration of inflation from 0.6% to 0.5%, its growth to 0.9% was recorded. And if the forecast for a slowdown in inflation in the entire euro area does not happen, which is quite likely, then a single European currency will receive an excellent incentive for growth. At the same time, it will drag along with other currencies.

Inflation (Europe):

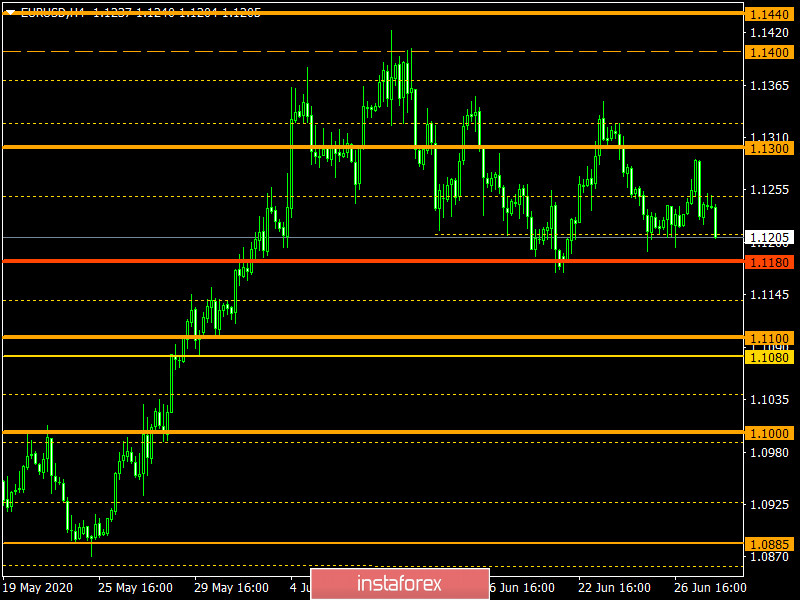

The euro/dollar currency pair found a foothold in the region of the range of 1.1180 once again, where it slowed down and formed a fluctuation. It can be assumed that the concentration of trading forces within the range of 1.1190/1.1240 will remain in the market, where it is necessary to consolidate below 1.1165 for primary changes.

The pound/dollar currency pair managed to maintain a previously set downward tact, eventually focusing below the mirror level of 1.2350. In the case of preserving the given mood, one should not exclude the move towards the values of 1.2200 - 1.2150, which will be considered as movement within the main range 1.2150 // 1.2350 // 1.2620.