Hello, dear colleagues!

Let's start the analysis of the main currency pair with the macroeconomic statistics that were published yesterday, and then we will indicate the data that will be published today.

On Monday, Germany provided preliminary data on consumer prices, which rose more than expected by economists: 0.9% (against the forecast of 0.6%) in annual terms and 0.6% (forecast of 0.3%) monthly. From the United States, a report was received on pending home sales transactions, which increased much more than the previous value and also ended up in the green zone.

Another interesting point that could support the single currency was the information that the ECB can increase the volume of the securities purchase program by another trillion euros. Let me remind you that after the last increase in the quantitative easing program by 600 billion euros, its volume is currently 1.350 trillion. The European Central Bank can take this step to minimize the negative consequences in the economy caused by the COVID-19 pandemic. The ECB also aims to achieve its inflation targets near 2%.

By the way, regarding the volume of bond purchases, the German Bundesbank thought that the ECB exceeded its authority. In particular, the German constitutional court came to this conclusion in May, but according to German Finance Minister Olaf Scholz, the ECB's QE program is proportional. In other words, the European Central Bank did not violate its mandate.

Today at 10:00 (London time), data on the consumer price index will be received from the Eurozone. From the US, a consumer confidence indicator will be published at 15:00 (London time), and Federal Reserve Chairman Jerome Powell is scheduled to speak at 17:30 (London time). Perhaps this is all that concerns the fundamental background, and now we can move on to the technical analysis of the main currency pair of the Forex market.

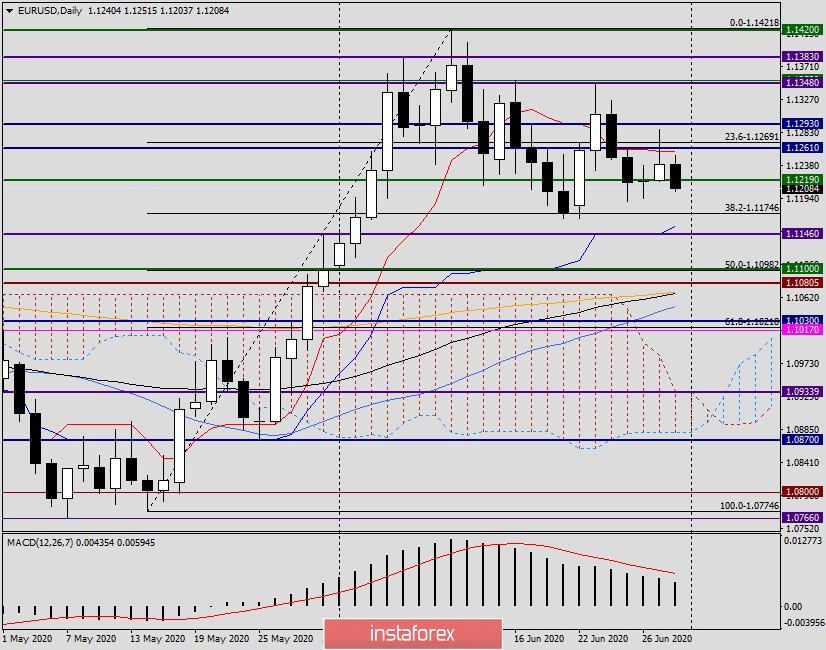

Daily

In yesterday's article on EUR/USD, it was recommended to look for sales after the pair's corrective rises. The nearest benchmark for opening short positions was called the price zone of 1.1240-1.1260, however, the pair managed to rise to 1.1287 yesterday. However, this is where everything ended for the euro bulls, after a rebound from this mark, Monday's trading ended at 1.1240.

At the moment of writing this article, the euro/dollar is declining, trading near 1.1225. If the downward trend continues, the next bear targets will be 1.1200, 1.1190, and 1.1165. In the event of a change in market sentiment and attempts to resume yesterday's rise, the pair's bulls will once again have to test the resistance of sellers at 1.1287 for a breakdown, and only in the case of a true breakdown of this mark can we expect a subsequent increase to higher prices.

However, in my opinion, the current situation is in favor of bears. First, yesterday's candle has a fairly long upper shadow, which is larger than the bullish body itself, which indicates the weakness of buyers of the single currency. Secondly, strong resistance is provided by the Tenkan line of the Ichimoku indicator, which runs at 1.1258.

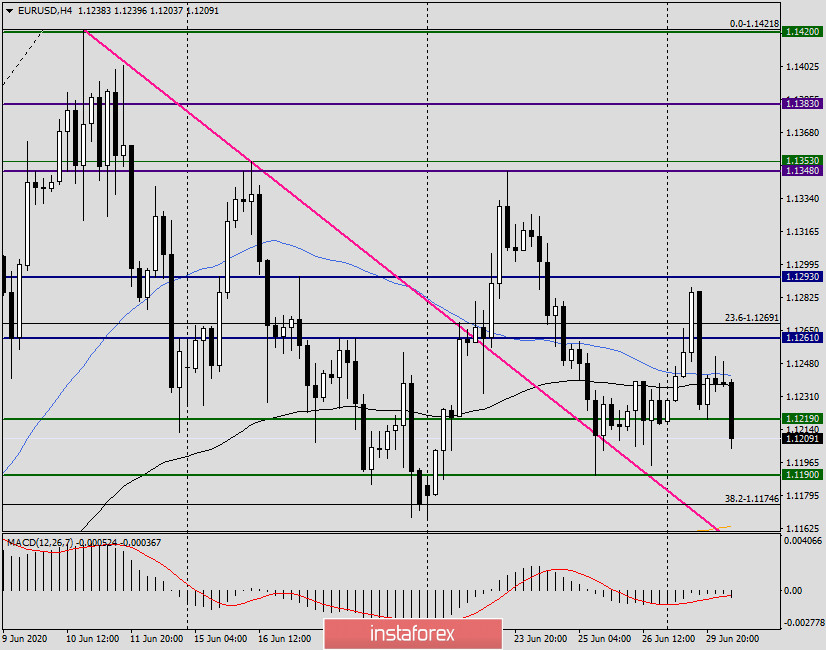

H4

In this timeframe, after yesterday's fall to 1.1219, the quote bounced slightly and consolidated for some time. At the moment of completion of the article, the pair demonstrates its readiness to test yesterday's lows once again, and if they are exceeded, it risks falling into the price zone of 1.1200-1.1190, where much will be decided regarding the further direction of the euro/dollar pair. At the same time, I do not exclude a short-term flight of the price to the level of 1.1165, where a strong 200 exponential moving average passes, as well as a broken pink resistance line of 1.1422-1.1353. The pair may find support near 1.1165 and at least bounce up, so those who are set to buy the euro/dollar, I recommend looking at the behavior of the price near 1.1165, and after the appearance of confirmation signals, try to buy with small goals, in the area of 1.1200-1.1225.

The main trading recommendation for EUR/USD remains sales, which I recommend considering after a short-term rise in the price zone of 1.1235-1.1245. In conclusion, I will once again note that the pair's departure higher, as well as the true breakdown of resistance at 1.1287, will put the bearish scenario in doubt. In the meantime, we are moving down.

Good luck and profitable deals!