Technical analysis recommendations for EUR/USD and GBP/USD on June 30

EUR / USD

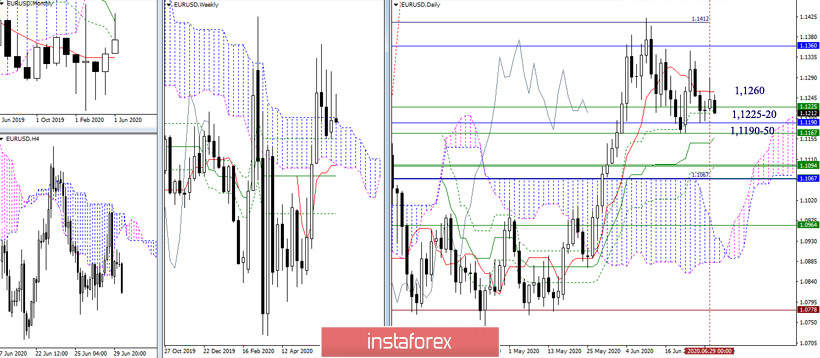

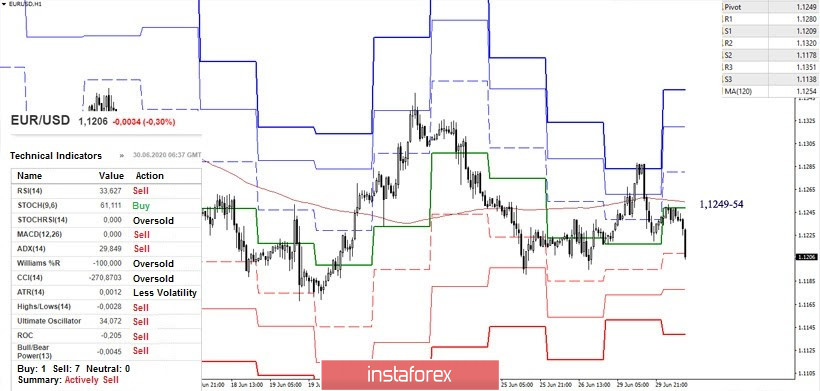

June will be closed today. During the month, an upward correction was made to the monthly medium-term trend (1.1360). After that, the players to decline managed to localize the correctional rise, and they are busy with the result of testing by now, which will be indicated in the form of a monthly candle, which has the character of rebound. Therefore, if an opponent today is not able to intervene in the process, then players to decline will seek to close the month with the longest upper shadow. This task is not simple, since the pair is now in the zone of attraction and influence of the upper border of the weekly cloud (1.1225) and the daily Fibo Kijun (1.1220). In addition, the area of 1.1190-50 (monthly Fibo Kijun + weekly Fibo Kijun + daily Kijun) can support bullish interests.

The preferences of the analyzed technical instruments at lower time intervals are on the players downside. Support and pivot points within the day are the classic Pivot levels S1 - 1.1209, S2 - 1.1178, S3 - 1.1138. To change the current balance of forces in the H1 format, players need to take hold on key levels that are now joining forces at 1.1249-54 (weekly long-term trend + central Pivot level). A consolidation above will not allow players to lower to close the month of June as optimistic as possible. Meanwhile, resistances of classic Pivot levels are located today at 1.1280 - 1.1320 - 1.1351.

GBP / USD

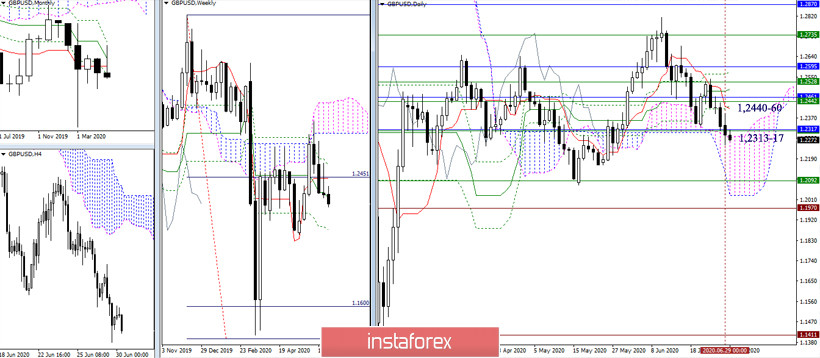

Yesterday, the bears updated their last weekly low and closed the day under important support 1.2313-17 (weekly Fibo Kijun + monthly Fibo Kijun + upper border of the daily cloud). Today, we close the month of June. It is important for downside players to maintain the result. If you can continue to decline, then this will be an additional bonus. The main thing now to keep the result is to prevent a return above the levels (1.2313-17) and not close the month above its opening (1.2338), as this will affect the final result of the month - the nature of the monthly candle.

At lower time intervals, the advantage belongs to the players to decline. The recovery of the upward trend will open the way to the support of the classic Pivot levels 1.2234 - 1.2174 - 1.2096. The key resistances on H1, allowing to influence the change in the current balance of forces and further prospects, are located today at 1.2312 (central Pivot level) and 1.2405 (weekly long-term trend).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)