The USD/JPY pair has registered an amazing rally since Friday. It has increased to as high as 114.37 where it has found resistance. Surprisingly or not, USD appreciated despite a plunge in DXY. The pair rallied only because the Yen was punished by the Japanese Yen Futures.

Fundamentally, the US data came in better than expected today, so the USD could remain strong. The Final GDP registered a 2.3% growth in Q3 versus 2.1% expected, while the CB Consumer Confidence was reported at 115.8 versus 111.1 expected. In addition, the Final GDP Price Index came in better than expected as well.

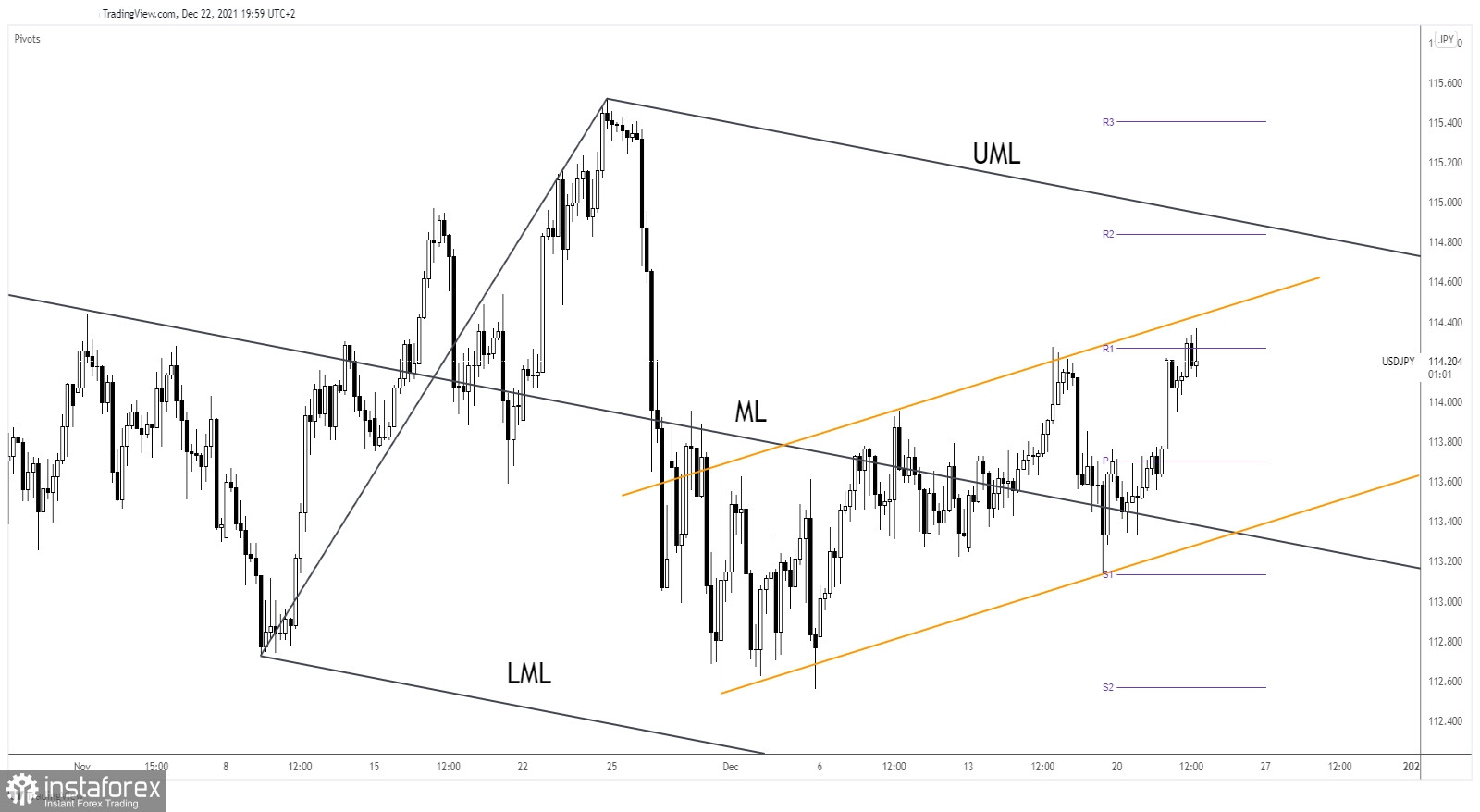

USD/JPY up channel

As you can see on the H4 chart, the USD/JPY pair rallied after failing to stabilize under the median line (ML) of the Descending Pitchfork. Now, it has found resistance at right above the weekly R1 (114.26), failing to reach and retest the channel's upside line.

Staying below the R1 may signal a temporary decline. It could come back down to test and retest the 114.00 psychological level or the 113.70 pivot point. In my opinion, only jumping, closing, and stabilizing above the R1 may signal an upside continuation of this momentum

USD/JPY outlook

The USD/JPY pair could decline a little after its amazing rally. A temporary retreat could help the buyers to catch a new upside movement. The price could extend its growth if the DXY stays higher and if the Yen Futures drop deeper.

After its false breakout with great separation above the R1, a short-term drop is possible.