4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - upward.

CCI: 74.2307

The British pound starts a new trading week with an attempt to resume the upward movement. Since the pair is currently anchored above the moving average line, the blue bars of the Heiken Ashi indicator signaled a downward correction, which could already be completed. Thus, on the first trading day of the new week, the pound/dollar pair may try to resume an upward movement, according to the new trend. However, it is noteworthy that the pair failed to update the previous local maximum, which is also the Murray level of "5/8"-1.2512. Thus, it is not excluded that the downward movement will be resumed with a departure below the moving average.

For the British pound, the fundamental background still comes down to negotiations on an agreement that will be in effect between the UK and the European Union after December 31, 2020. Recall that not so long ago, both sides of the negotiation process confirmed that the "transition period" will not be extended, which means that after 2020, all current agreements will be canceled. The old ones will be canceled, however, the new ones still can't be signed. Last week, a new round of talks was launched between the groups of Michel Barnier and David Frost, however, the parties did not even wait for its completion, saying that there was no progress in the negotiations and there was no reason to continue them.

In addition to this negative information, last week it became known that GDP in the first quarter decreased by 1.7% y/y, although forecasts were slightly more optimistic. And despite all this information, the British pound still rose in price. We believe that in the current conditions, this strengthening of the British currency should not be given too much attention. We believe that there is no pronounced trend at the moment, and the United States and the UK are competing with each other, whose fundamental background will be worse. About the problems that America has faced recently, everyone has long been familiar with and aware of. Thus, we believe that neither the pound nor the dollar can have a clear advantage at this time. Based on these considerations, the pair may try to return to the area below the moving average line at the beginning of the new week. We also remind you that the macroeconomic background is still ignored in most cases and is ambiguous in almost all cases. For example, is almost 5 million Nonfarm Payrolls good or bad? Good! And if we take into account -21 million jobs a month earlier?

However, there is a small positive for the British pound. From July 10, restrictions on the entry of foreign citizens from more than 50 countries will be lifted in the UK. A little earlier, many quarantine measures were canceled or replaced with more lenient ones. This means that the British economy may begin to recover in the near future. It was decided to reopen restaurants and bars, and this week it is expected that a plan will be presented to open several other businesses, such as beauty salons or fitness centers. Also, the requirements for social distance have already been lowered, from two meters to one, but Boris Johnson said that if measures to prevent the second wave of the epidemic do not work, the authorities will be forced to re-introduce a full "lockdown". Many medical experts are already expecting a second wave of the epidemic, believing that the British will consider the quarantine completed and will not observe any security measures at all. In principle, many British media and periodicals have already called the opening day of pubs "super Saturday". According to forecasts, the Sun newspaper on this day, pubs could sell about 8.5 million liters of beer. Given the mentality of the British, for whom the pub is a second home, we can assume that the second wave of "coronavirus" may happen in the near future. After all, the British did not particularly zealously observe the quarantine and during its full operation, now the situation can only get worse.

Thus, the "coronavirus" continues to keep in fear, and at the slightest suspicion of a new outbreak of the epidemic, the UK authorities can begin to re-strengthen quarantine measures. On the first trading day of the week, the UK is scheduled to publish only the index of business activity in the construction sector, and in the US – the index of business activity in the service sector. We believe that both of these indicators are unlikely to have a serious impact on the mood of market participants. Thus, first of all, we still pay attention to technical factors. Overcoming the Murray level of "5/8" will allow traders to reconsider long positions, and the return of quotes below the moving average will change the current trend to a downward one.

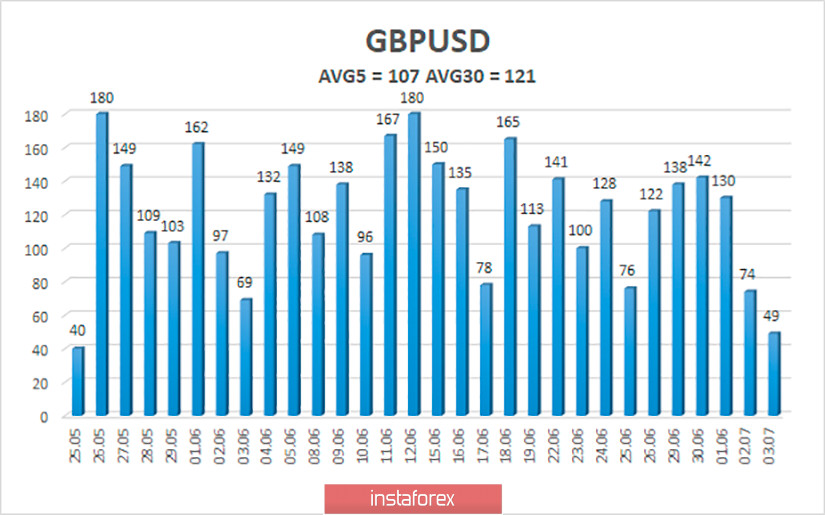

The average volatility of the GBP/USD pair continues to remain stable and is currently 107 points per day. For the pound/dollar pair, this indicator is "high". On Monday, July 6, thus, we expect movement within the channel, limited by the levels of 1.2373 and 1.2587. Turning the Heiken Ashi indicator down will indicate a new round of downward correction.

Nearest support levels:

S1 – 1.2451

S2 – 1.2390

S3 – 1.2329

Nearest resistance levels:

R1 – 1.2512

R2 – 1.2573

R3 – 1.2634

Trading recommendations:

The GBP/USD pair is fixed above the moving average on the 4-hour timeframe. Thus, today it is recommended to buy the pound/dollar pair with the goals of 1.2512 and 1.2573 and keep them open until the Heiken Ashi indicator turns down. It is recommended to sell the pair after the reverse consolidation of quotes below the moving average with the first goals of 1.2390 and 1.2329.