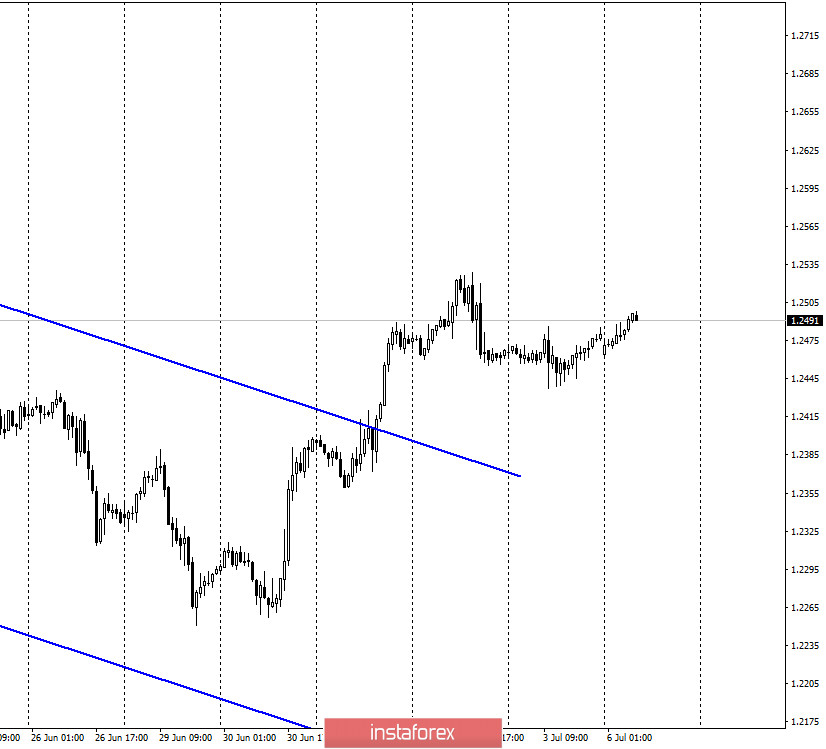

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair performed a reversal in favor of the US currency on Friday and began a very weak process of falling. And already tonight, a new growth process has begun. In general, I can say that the next failure of negotiations between Britain and the European Union on the future relationship, as well as the refusal of Boris Johnson to extend the duration of the transition period, negatively affect the British. However, in America, there is now a strong surge in cases of coronavirus, while the UK only came out of quarantine at the end of last week. Thus, in the current conditions, the growth of the British currency is really more logical. However, it is unlikely that traders will buy the pound in the long term, as the prospects for the UK itself and its economy remain quite vague. Much will depend on what and how the year ends for America. What will be the results of the presidential election, what will happen to the coronavirus epidemic in this country?

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair performed a fall to the corrective level of 50.0% (1.2444) and rebound from it with a reversal in favor of the British currency and the resumption of the growth process in the direction of the corrective level of 38.2% (1.2530). The pair's rebound from this level will work in favor of the US dollar and resume falling in the direction of 1.2444. Fixing quotes above the level of 38.2% will increase the chances of continuing growth in the direction of the next corrective level of 23.6% (1.2637).

GBP/USD – Daily.

On the daily chart, the pair's quotes closed above the Fibo level of 50.0% (1.2462), which now allows us to expect continued growth in the direction of the corrective level of 61.8% (1.2711).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.\

Overview of fundamentals:

On Friday, the UK released only the business activity index for the services sector, which was 47.1. However, the pound/dollar pair is now driven by other more important news. I am inclined to believe that the low demand for the dollar is now caused by high risks to the American economy due to a new wave of coronavirus in the United States.

News calendar for the US and UK:

UK - PMI for the construction sector (08:30 GMT).

US - PMI for services (13:45 GMT).

US - ISM composite index for non-manufacturing sector (14:00 GMT).

On July 6, all UK and US reports will again be linked to business activity in various sectors. Of course, the ISM index will be more important.

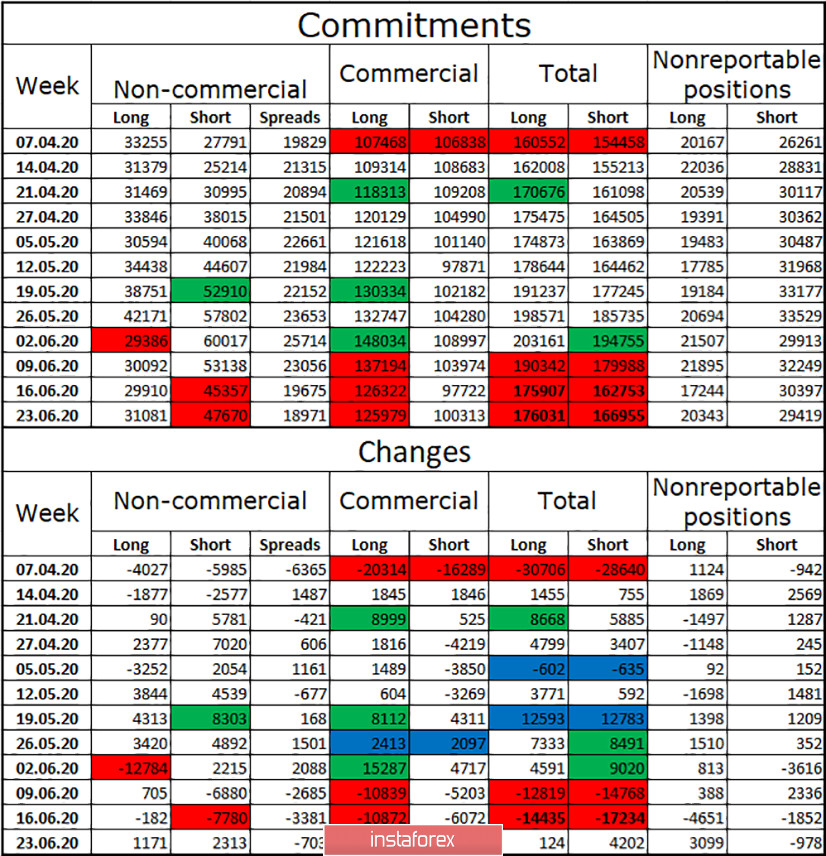

COT (Commitments of Traders) report:

The latest COT report for the British pound was even less interesting than the euro report. Major market players trading the British pound were even less active during the reporting week. In total, the Non-commercial group opened only 3,500 new contracts. A more or less normal value is the number of 10,000 or more contracts. Thus, globally, the mood of major market players has not changed at all. In the last 10 days, as in the case of the euro, the British pound first fell, then rose, then fell again. The Non-commercial group was even less active, opening 2,500 new short contracts and closing 343 long ones. Well, the general changes for all groups of traders are completely depressing. Thus, the overall conclusion is disappointing. No special changes in the mood of major market players during the reporting week can be noted. The new COT report was not released on Friday, as the US had a day off to celebrate Independence Day.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound today with the goals of 1.2444 and 1.2358, if the rebound from the level of 38.2% (1.2530) is completed. New purchases of the pair can be opened with the goal of 1.2637, if the pair completes a consolidation above the level of 1.2530.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.