Technical analysis recommendations for EUR/USD and GBP/USD on July 6

Due to the fact that Friday was a public holiday in the USA, COT reports are only expected to be published tonight, so an analysis and evaluation of the report data will be done tomorrow.

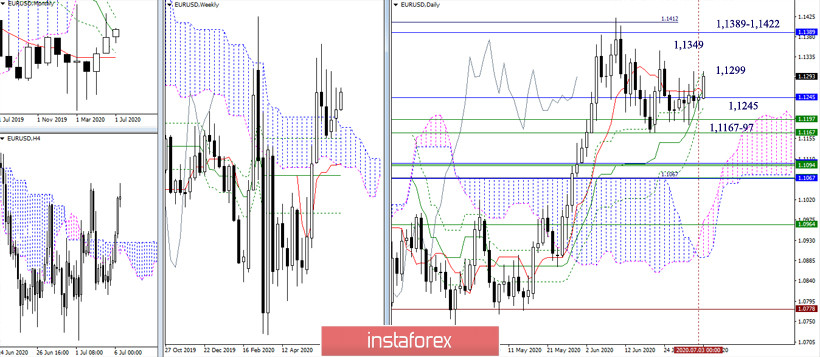

EUR / USD

The players to increase managed to close last week's trading in the bullish zone relative to the weekly cloud. As a result, they are currently trying to use this circumstance and strengthen their position. The closest bullish signs in this situation are 1.1299 (daily Fibo Kijun) - 1.1349 (intermediate maximum extreme) and the area 1.1389 - 1.1422 (correction extreme + monthly Fibo Kijun). The failure of the players to increase to leave the correction and consolidation zone will pass the initiative to the players to lower, who will most likely seek to deepen the downward correction by breaking through the important support and attraction levels of 1.1245 (monthly Kijun) and 1.1197-67 (weekly Senkou Span B + weekly Fibo Kijun).

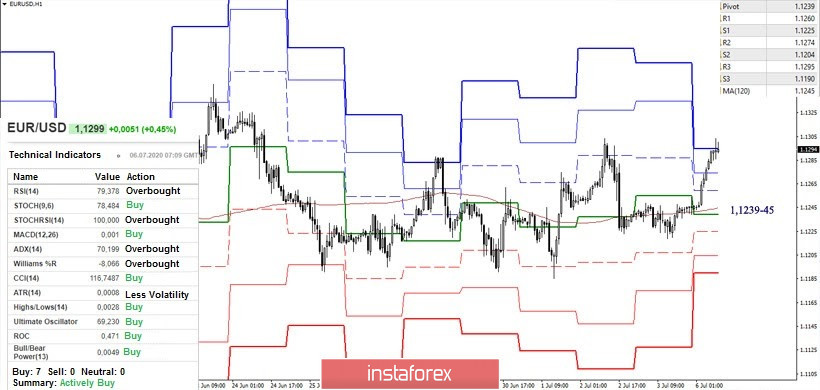

Players to increase, after capturing the key levels of H1, organized the rise to the upper borders of the zone of consolidation and sideways movement of the last few days. The final resistance of the classic pivot levels of the day (1.1295), which is strengthened by the daily Fibo Kijun (1.1299), is currently being tested. The next reference point is 1.1349. If the players on increase do not intend to achieve a change in the general current situation, then they have enough reason at the moment to complete the rise and return to the key H1 levels, which are located today at 1.1239-45 (central pivot level + weekly long-term trend).

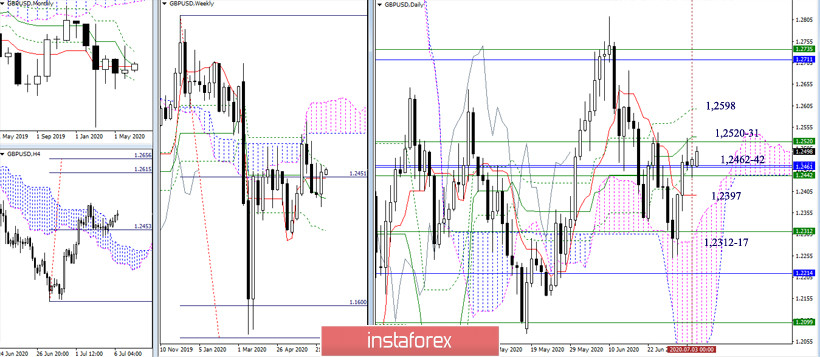

GBP / USD

Despite the bullish nature of the last weekly candle, the players to increase failed to renew the maximum of the previous week and leave the zone of attraction, which is formed by many strong levels of upper time intervals. The center of attraction is still the monthly cross of Ichimoku (1.2462) and the weekly Tenkan (1.2442). In this situation, other important levels can be noted at 1.2520-31 (daily Kijun + weekly Fibo Kijun) - 1.2598 (daily Fibo Kijun). This is resistance and the support is located at 1.2397 (daily Tenkan) - 1.2312 -17 (weekly Kijun + upper border of the daily cloud).

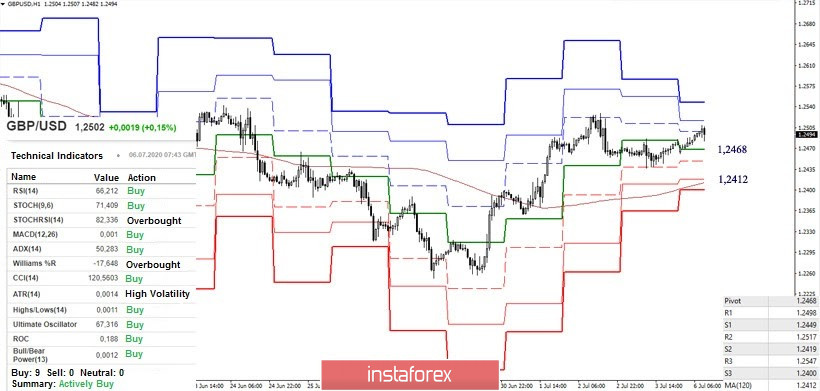

The players on the upside take advantage of the lower halves and they are currently supported by all the analyzed technical tools. A weakening factor is the pair being in the correction zone. The resistances within the day are at the classic pivot levels 1.2498 - 1.2517 - 1.2547, while the main supports for the lower halves are at 1.2468 (central Pivot level) and 1.2412 (weekly long-term trend).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)