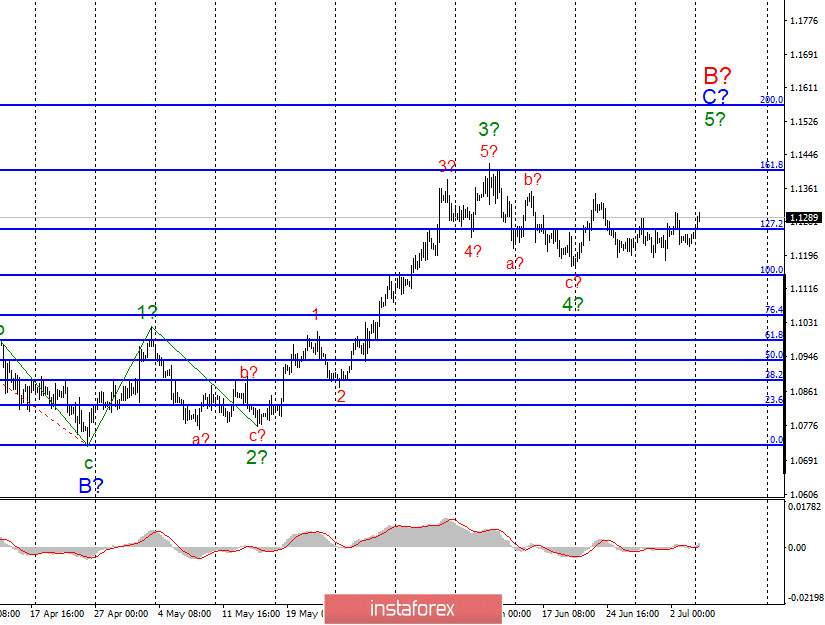

EUR/USD

On July 3, EUR/USD gained just a few pips. So, the ongoing wave structure remains intact. I still expect bullish wave 5 inside C and B to develop. If this prediction comes true, the pair will continue its climb from the current levels towards 161.8% and 200.0% Fibonacci correction. On the other hand, if wave 4 is broken successfully, it suggests that the market is not ready for building a new bullish wave.

Fundamental background

On Friday, the economic calendar was almost empty both in the EU and the US. Next day, there were a few reports. On July 4, the US celebrated the major national holiday, Independence Day. Thus, markets came to a standstill on Friday, anticipating the weekend. Earlier on Thursday, investors got to know a batch of important information which could have made a serious impact on the single currency and the US dollar. In fact, that information made no influence. First things first. Unemployment rates both in the US and the EU came out to be better than the consensus. The jobless rate in the EU was 7.4% and in the US – 11.1%. No doubt, these are still high figures, but obviously unemployment has reached its record peaks. The US Labor Department released nonfarm payrolls. The US private and public sectors added 4.8 million jobs in June. On the negative side, average hourly earnings dropped 1.2% month-on-month but grew 5% on a yearly basis, both metrics are worse than expected. On the whole, the government report revealed mixed scores. The US labor market is firmly on the path to recovery. Nevertheless, no one dares to predict when exactly the labor market will be back on track to show pre-pandemic rates. Previously, US Treasury Secretary Steven Mnuchin and Fed's Chairman Jerome Powell warned investors that the US economy is going through a painful and protracted recovery. Moreover, the national economy needs massive fiscal stimulus measures. Another thought is that the coronavirus poses a serious threat to the US economy. Indeed, the US reports 40,000 – 50,000 new cases on a daily basis. No wonder, such rampant infection rates could entail a new shutdown which is sure to wreck a fragile recovery. To sum up, the news environment corresponds to the ongoing wave structure.

Conclusions and trading tips

EUR/USD is likely to carry on with building the bullish wave C inside B. Thus, I would recommend long deals on EUR/USD with target levels placed at near 1.1406 and 1.1570 which correspond to 161.8% and 200.0% Fibonacci correction for each upward signal generated by MACD bearing in mind wave 5 in progress inside wave C and B.

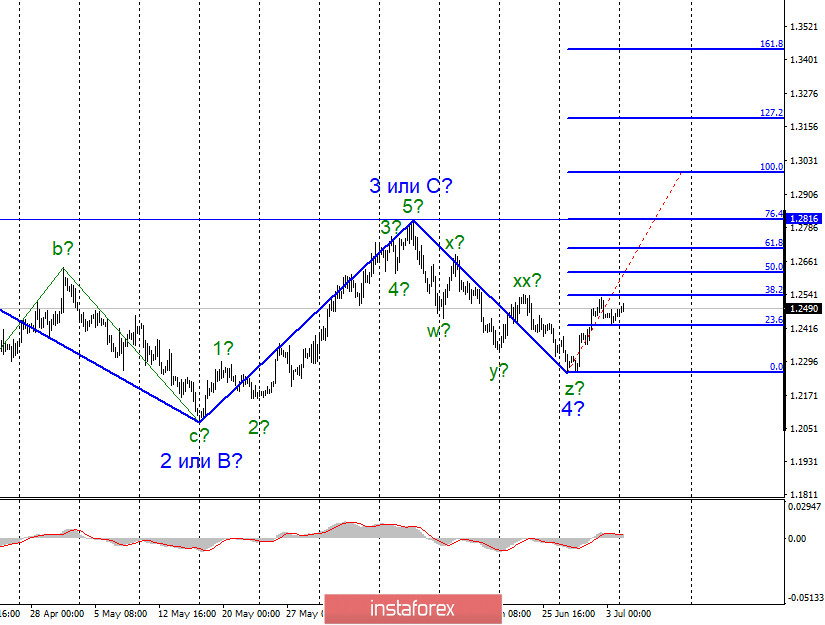

GBP/USD

On July 3, GBP/USD grew several pips and the whole wave structure underwent notable changes. Now I suggest that the overall trend originated on March 19 will look like a 5-wave structure without a clear-cut momentum. Apparently, the pair will make 5 waves in a series of zigzags. The same is expected about wave 4 which now looks like a series of three zigzags. In other words, I reckon that wave 5 is set to develop with targets placed at near the high of wave 3 or C.

Fundamental background

On Thursday, the UK presented the only report - the services PMI. The service sector emerged from the shadows in June with the PMI at 47.1. On the Brexit front, the next round of the trade talks between London and Brussels failed at the end of the last week. The parties did not find it appropriate to push ahead with the talks but just stated the lack of progress. Today, the market found out the UK construction PMI was beyond expectations. The index climbed to 55.3 in June. So, the British construction sector gained momentum in the wake of the crisis.

Conclusions and trading tips

GBP/USD complicated the ongoing wave structure which implies building a new bullish wave. If it comes true, I would recommend long deals on GBP/USD with target levels at about 1.2816 and 1.2990. This means that wave 3 or C has reached its peak which equals 100.0% of Fibonacci correction.