Bitcoin rallied in yesterday's trading session after retesting the broken downtrend line. BTC/USD is trading at 51,031 level at the time of writing, below 51,533 yesterday's high. The crypto registered a 7.25% growth from 48,051.10 yesterday's low to 51,533 today's high.

In the last 24 hours, BTC/USD is up by 5.37% and by 6.73% in the last 7 days. The price action signaled that the downside movement is over and that the buyers could take full control, so the current rally was natural and expected.

BTC/USD To Regain Bullish Momentum!

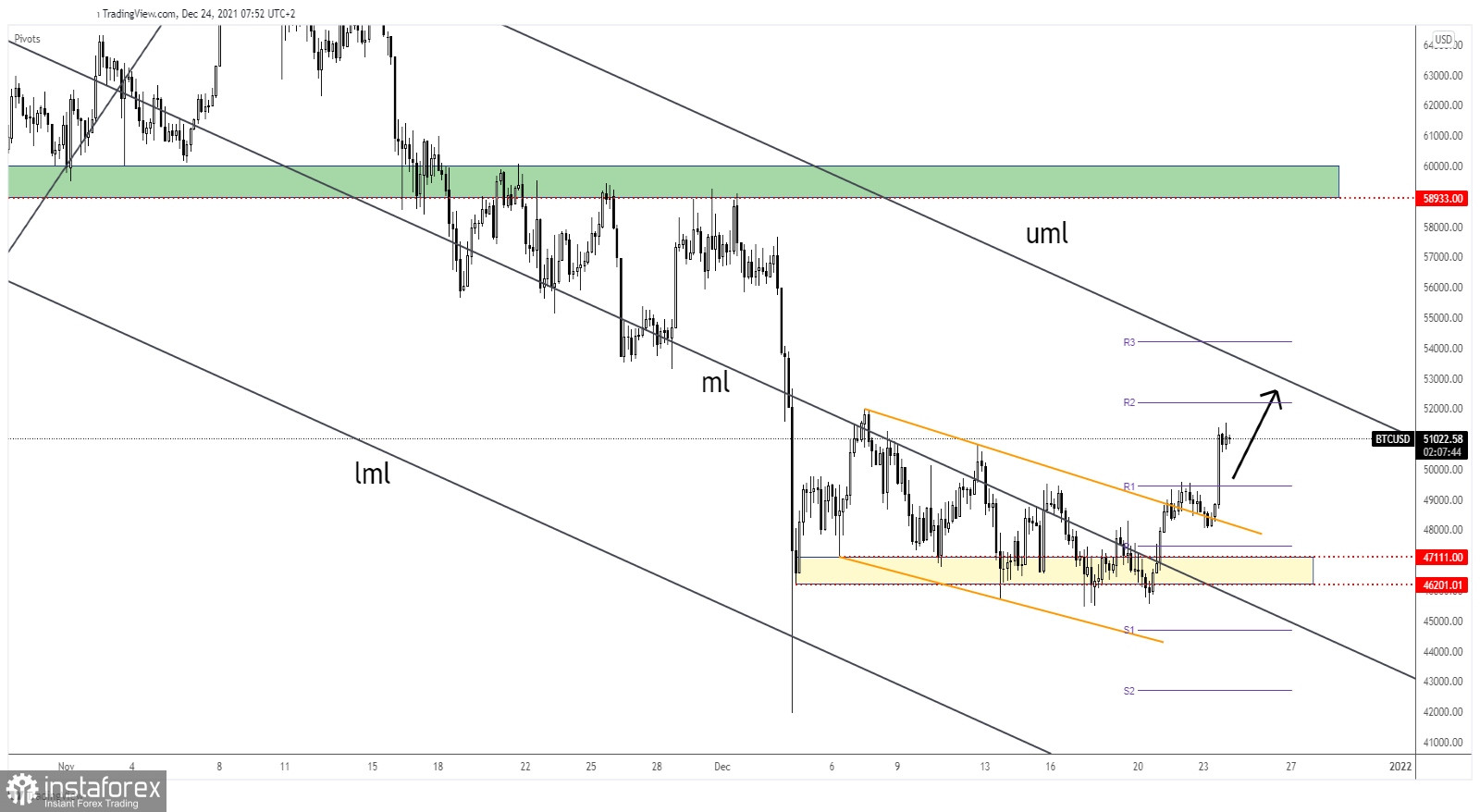

BTC/USD failed to stabilize below 46,201.01 and under the descending pitchfork's median line (ml) signaling that teh corrective phase ended. You already knew from my analyses that, Bitcoin could develop an important upside movement after escping from the minor channel and after taking out the resistance represented by the weekly R1 (49,462.81).

The price dropped a little to retest the broken downtrend line but it hs failed to stay below it announcing an upside momentum. Its aggressive breakout above the R1 confirmed potential further growth.

BTC/USD Outlook!

The breakout above the R1 and above the 49,600 former high represented a buying opportunity. The descending pitchfork's upper median line (uml) stands as a potential upside target. In the short term, a minor decline is in cards. BTC/USD could come back to test and retest the 50,000 psychological level before jumping higher.

A minor retreat or a consolidation could bring new long opportunities. A larger upwards movement could be activated by a valid breakout above the descending pitchfork's upper median line (uml).