The dollar continues to decline against both commodity currencies and the yen on Thursday morning. The weakness of the dollar is confirmed by the fall of the last resistance in gold, the level of 1800 dollars per ounce has been overcome, and nothing prevents the movement to the historical maximum of November 2011.

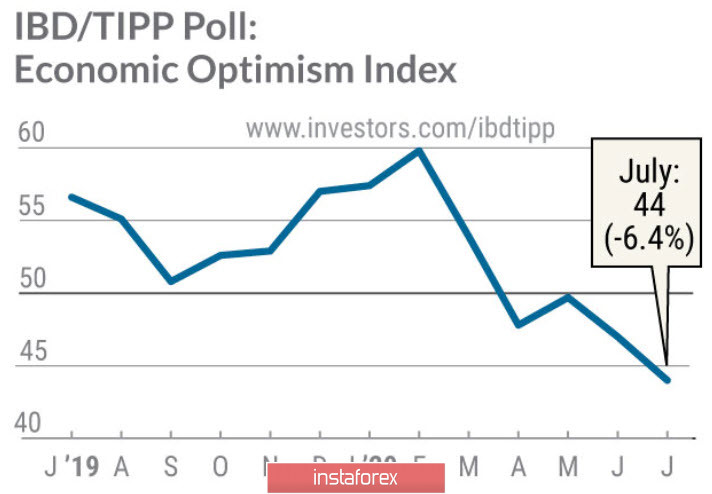

The IBD/TIPP economic optimism index, the main US consumer confidence survey, declined by 6.4% in July and is at its lowest level since September 2015. A decline in IBD/TIPP indicates that the Conference Board and University of Michigan surveys published near the end of the month will also be negative.

The six-month economic forecast has declined, as well as the confidence in Federal economic policy.

The decline in IBD/TIPP is a bad signal not only for the dollar, but also for global markets as a whole, as it deprives confidence in a speedy recovery. If the first wave of demand for risk in May-June was based on a slowdown in the spread of COVID-19, then the confidence is growing every day that the crisis is not a consequence of the epidemic and therefore, cannot be overcome in a short period, but carries all the signs of a deep systemic crisis.

Some of the activity surge in the past month is easily explained by deferred demand, which could not be implemented during the period of restrictive measures. Once this pent-up demand is satisfied, the key macroeconomic indicators have a chance to return to the negative dynamics.

EUR/USD

ECB Vice President, Luis De Guindos, assessed the state of affairs in the eurozone on Wednesday, saying that "recent data suggest that we can be more optimistic about economic growth." Despite the clear promise, the euro did not respond to the official's statement and resumed growth only after the publication of the stimulus package by the UK government.

Actually, there is nothing unexpected – a good recovery rate is observed, first of all, in the banking sector and the securities market. The spreads of most sovereign bonds since the end of April began to narrow and returned to the level of 2019, that is, investors are confident in this market segment, not least due to the launch of the ECB in March PEPP.

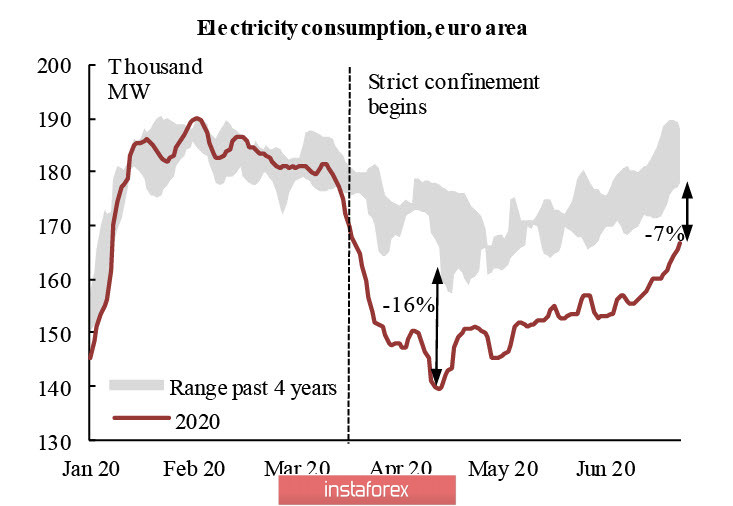

But with regard to industry, everything is much worse here. Electricity consumption remains well below the average annual level after the April failure.

On the other hand, Freight transportation fell by -5% in June, the general level of pollution by -10% (and hence the loading of industry), and, according to the European Commission (the quarterly report was published on July 7). It can be assumed that the second quarter will turn out to be worse than expected.

The EUR/USD pair managed to break through the resistance zone 1.1340/50. There is a chance that exiting from the consolidation zone will occur in the upward direction if the euro consolidates above this zone. The next goal is the maximum of June, that is, the level of 1.1421, and if you evaluate the overall picture from a technical perspective, testing this level is becoming more likely.

GBP/USD

Yesterday, the British government presented a new plan to support the country's economy in the context of a "post-pandemic recovery", under which it is planned to implement stimulus measures in the amount of 30 billion pounds.

The entire package is aimed at supporting the services market and the construction sector. Serious incentives will be introduced for hotels and restaurants, which will directly or indirectly affect 1.8 million people, the tax on purchases of real estate worth less than 500 thousand pounds will be abolished. For companies in the tourism and hotel business, the VAT rate is reduced from 20% to 5%, and employers will receive a one-time bonus of 1000 pounds for each new or previously dismissed, but returned employee.

British Finance Minister, Rishi Sunak, presenting his plan to the House of Commons, added that new measures to support the economy will be announced in the fall.

The pound immediately responded with growth, pulling up the euro as well. Here, we have an upward impulse. The probability of reaching 1.27 has slightly increased, but further growth is still in doubt. The zone of 1.2690/2710 is a fairly strong resistance, the most likely scenario is the formation of a peak near the specified range and a downward turn.