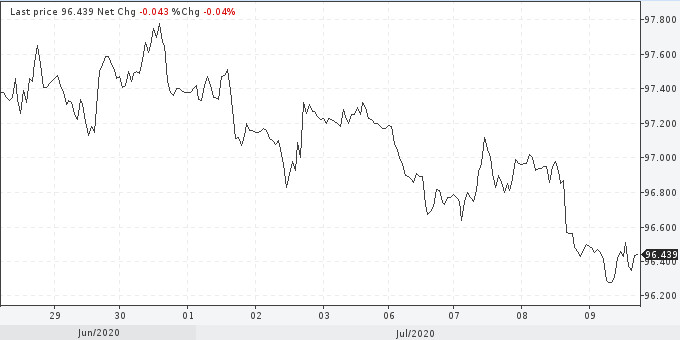

Contrary to hopes for growth, and despite the worsening epidemiological situation in the United States, the dollar index returned to the last month's minimum. Since early July, the indicator has lost 1.4% of its value. On Thursday, it tested the lower limit of the range at 96.34.

USDX

The pressure on the greenback is partly due to a moderate recovery in demand for risky assets. In many developed countries, there is an improvement in business and consumer activity, which increases the attractiveness of the financial assets of these countries. Even at the dawn of the coronavirus crisis, when the dollar was testing levels above 100 points, experts said that the decrease would mean the peak of the crisis. Perhaps this is happening now.

Meanwhile, the US financial authorities are increasingly doubting the steady recovery of the country's economy. Market players perceive the Fed's pessimism as a signal to further increase the asset buyback program. Such a policy further undermines the precarious position of the dollar.

Moreover, it is also worth paying attention to another important fact. The situation in the economy turned upside down. If earlier the US economy developed much faster than the Eurozone and accelerated in contrast to the slowdown in China, now it is the other way around. US economic dominance supported the dollar and allowed the Federal Reserve to raise interest rates, while other countries of such luxury could not afford to do the same.

This trend may linger for a long time, and the dollar will have to return to the positions won over the past six years. Some strategists have also begun talking about the potential for a 20% depreciation over the next few years. Everything is fine, but once again the coronavirus can destroy all predictions and illusions about this.

The United States recorded another record daily increase in the number of infected. This does not worry the markets much, but the situation is borderline. An outbreak can occur at any time, increasing demand for the US dollar.

Meanwhile, the negative factors for the greenback so far outweigh. Among them is the possible victory of Joseph Biden in the presidential election in November.

Opponent Donald Trump has stepped forward due to the incumbent president's inability to cope with a double crisis - a pandemic and protests against racism. Undoubtedly, the upcoming elections will have a huge impact on the greenback and global markets. This event will be more reflected in the next quarter. However, given that the situation in connection with the anticipated changes is starting to heat up now, the current quarter can also hook this event, pushing the greenback down.

Biden's presidency could result in higher taxes, lower minimum wages, tougher climate policies and other measures that would hit corporate profits and the attractiveness of local assets. The new team will want to increase spending on health care, infrastructure, and other areas that contribute to inflation. This is all later, and now everyone is interested in exactly when the dollar devaluation will occur.

The US dollar will sooner or later turn down due to the increasing pressure which is expected to be felt in the third quarter. The world is buried in dollar debt. This applies to both America and other countries of the world. Sustainable recovery requires a dollar devaluation.