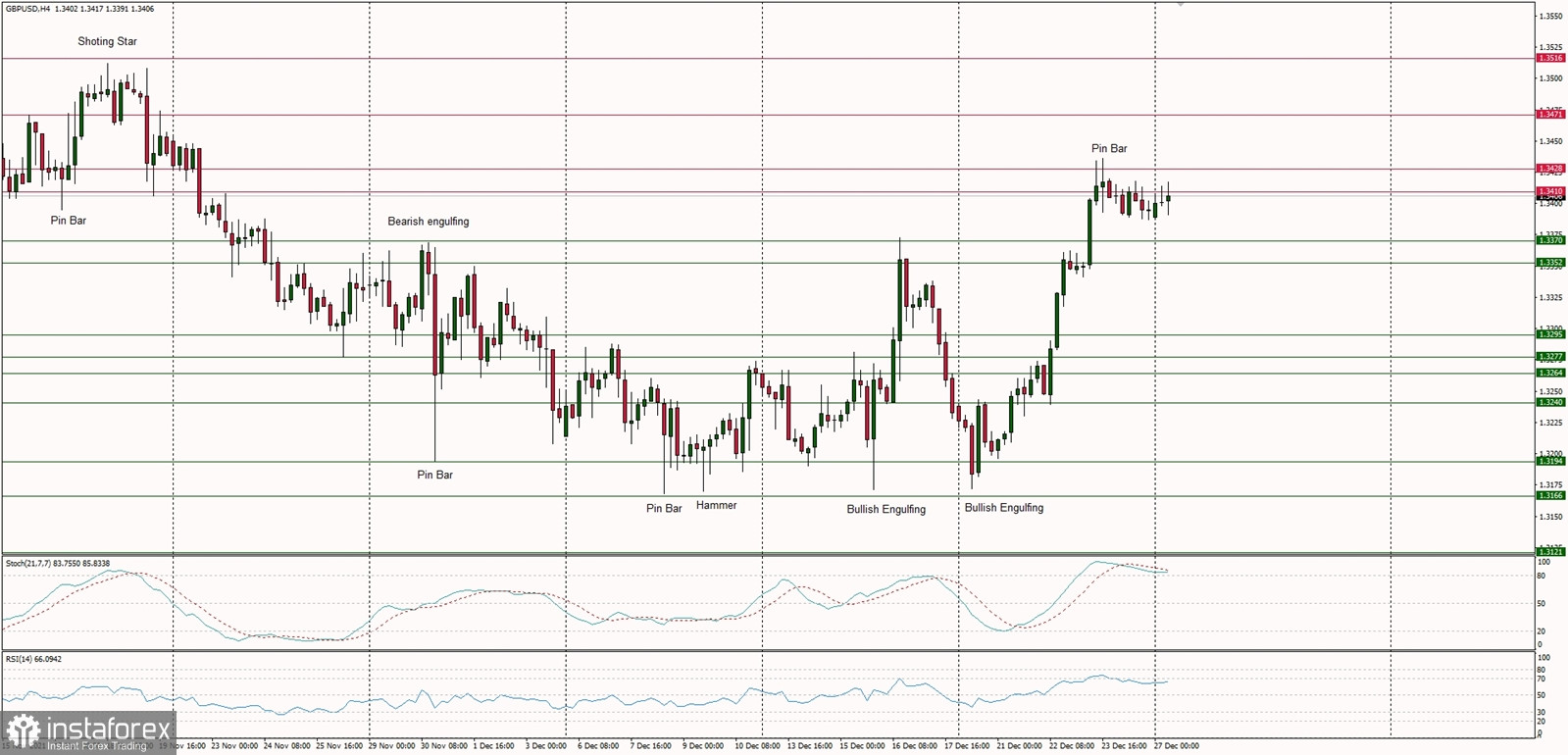

Technical Market Outlook

The GBP/USD pair has broken through the 61% Fibonacci retracement level seen at 1.3380, made a new local high at the level of 1.3436 and is currently consolidating the recent gains in a narrow range. The next target for bulls is seen at the level of 1.3471 and then at the swing top located at 1.3515. The strong and positive momentum support the short-term bullish outlook for GBP, however, the market conditions are now extremely overbought on the H4 time frame chart, so a pull-back towards the level of 1.3371 is welcome.

Weekly Pivot Points:

WR3 - 1.3774

WR2 - 1.3612

WR1 - 1.3524

Weekly Pivot - 1.3343

WS1 - 1.3248

WS2 - 1.3073

WS3 - 1.2991

Trading Outlook:

The down trend on a larger time frame charts is being continued, but only a sustained breakout above the level of 1.3514 would improve the outlook to more bullish with a target at 1.4200. 200 WMA had been violated already, so the market is in the down trend with a long-term target located at 1.2668 ( September 2020 lows).