Crypto Industry News:

Turkish President Recep Tayyip Erdogan has reportedly confirmed the completion of the bill on cryptocurrencies, which will soon be referred to Parliament for implementation.

In an attempt to counter the declining value of the Turkish lira, President Erdogan, speaking at a press conference in Istanbul, shared his plans to implement a new economic model. As reported by local media, Erdogan said the cryptocurrency law is ready, adding:

"We will take steps on this by referring it to Parliament without delay."

Admitting to the recent episode of inflation in the country, Erdogan said the event was not related to mathematics but a matter of process, suggesting the possibility and potential for an increase in the value of the lira.

With the introduction of the new cryptocurrency law, the president predicts that Turkey will become one of the top 10 economies in the world. Speaking of rising prices in the region, he shared plans to track people who fluctuate currency prices several times a day.

Technical Market Outlook

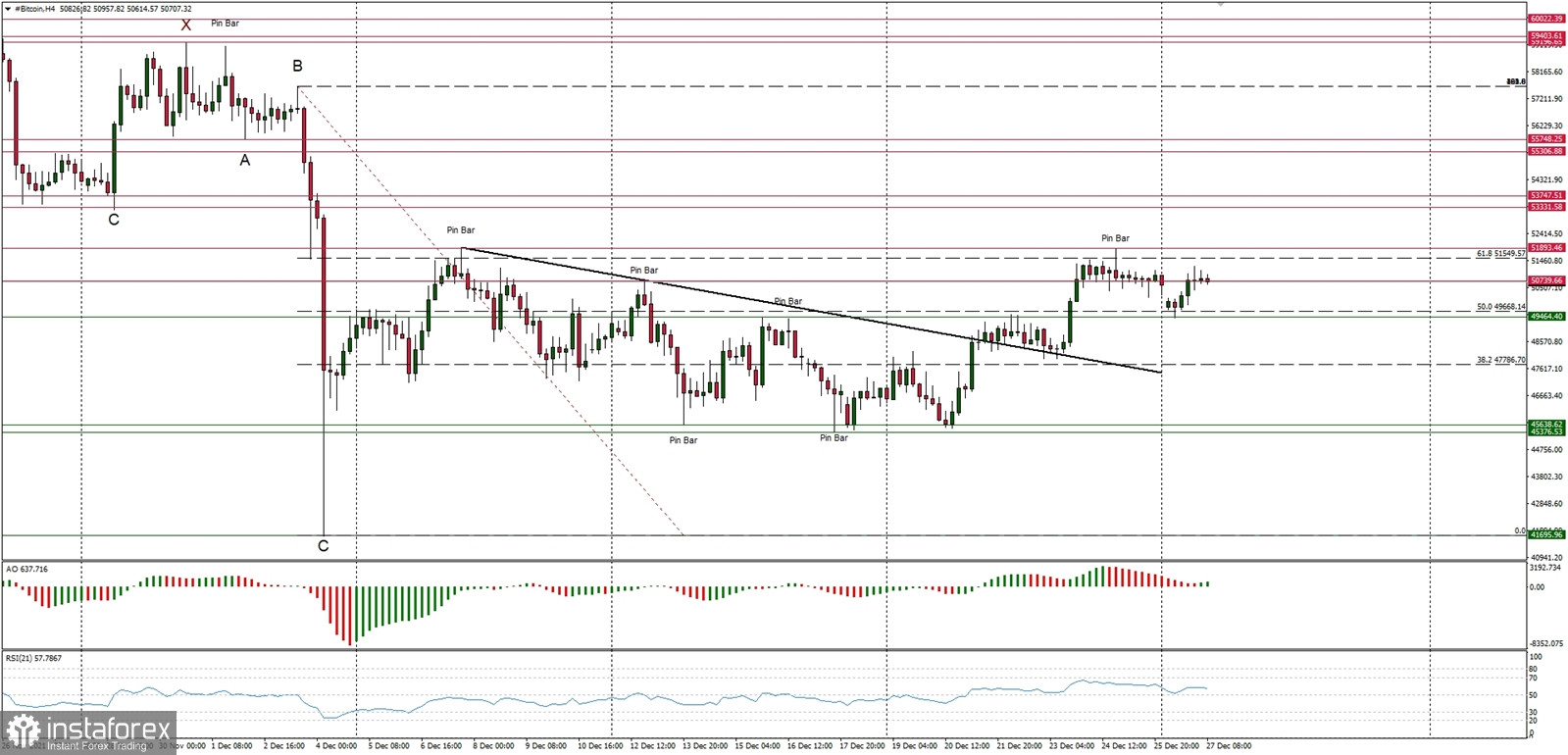

The BTC/USD pair bounce had been capped at the level of $51,893 again, so clearly the bulls have a problem with this technical resistance level. For now the market keeps to consolidate around the level of $50,793 as we start the last trading week of 2021. The local technical support is seen at $49,464. The key short-term technical resistance is located at the level of $51,913 (Pin Bar high) and $53,333. Despite the recent complex and time consuming corrective decline in form of ABCxABCxABC pattern, the larger time frame trend remains up and only a clear and sustained breakout below the wave C low at $41,678 would change the outlook to bearish again.

Weekly Pivot Points:

WR3 - $60,286

WR2 - $56,809

WR1 - $53,868

Weekly Pivot - $49,723

WS1 - $47,540

WS2 - $43,220

WS3 - $41,111

Trading Outlook:

The ABCxABCxABC complex corrective cycle might be terminated at the level of $41,678 and the market is ready to continue the up trend. According to the long-term charts the bulls are still in control of the Bitcoin market and the next long term target for Bitcoin is seen at the level of $70,000. This scenario is valid as long as the level of $39,474 is clearly broken on the daily time frame chart (daily candle close below $39,000 would be considered as a long-term trend change due to the lower low placement).