Latest COT report (Commitments of Traders). Weekly outlook for GBP/USD

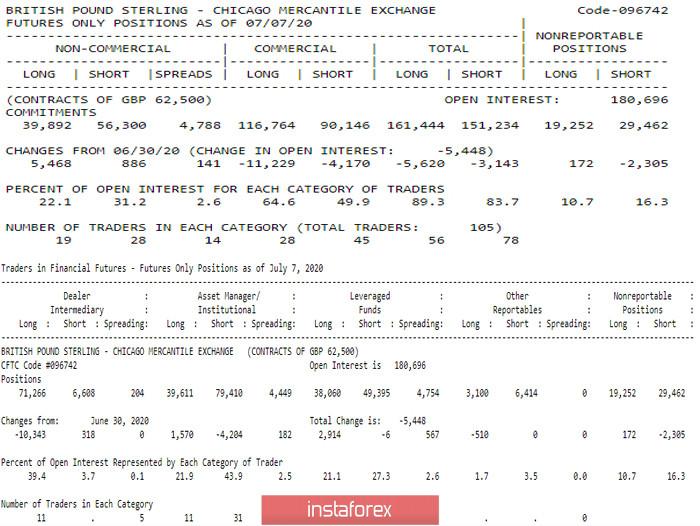

According to the COT report (Commitments of Traders dated 07/07/20), there was a decline in open interest in the pound (-5448) and it amounted to 180.696 at the time of the report. It should be noted that, regardless of what actions the market participants took, for example, the positions of Non-Commercial group showed a general increase, and the Commercial group actively liquidated positions in both directions, net positions declined for all leading players. The final net position for the pound has now the advantage of Long positions 10,210, the net position for Non-Commercial is 16,408 which belongs to the bearish direction, while bulls with a net position of 26,618 dominate Commercial. The percentage gap in the positions of the leading Dealers (Dealer Intermediary) remains at a high level, but is no longer at peak (39.4 against 3.7), the accountable group still holds the preponderance of power on the bearish side.

Main conclusion

The fight continues. As expected in the analysis of the previous report, the players to increase are trying to maintain their positions, and so, the decline process is stopped. Nevertheless, a turning point in the situation has not yet occurred and bears are still waiting for the right moment.

Technical picture

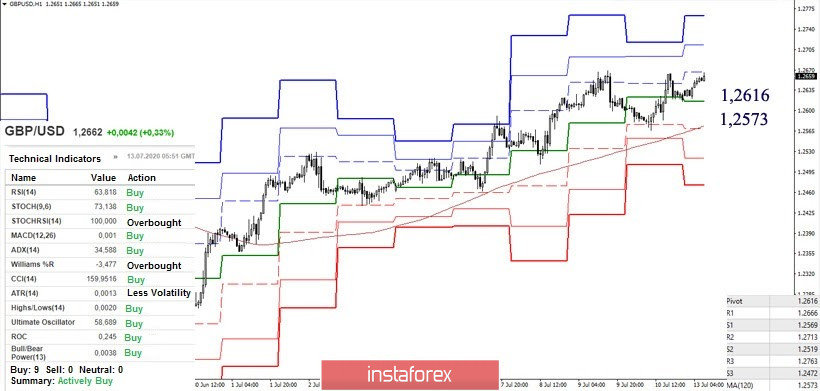

The players to increase have formed bullish candles at the weekly half in recent weeks, but remained in the zone of the weekly downward correction at the same time. The maximum correction extremum 1.2812 is now strengthened by the resistance of the weekly cloud (1.2736 - 1.2950). And only a reliable consolidation of the above will allow us to consider new upward prospects. On the other hand, players to decline are still holding back support led by a weekly golden cross (1.2440 - 1.2309) in the current situation, reinforcing daily obstacles - a cross and a cloud. Without breaking through these guidelines, talking about bearish dominance and the ability to continue to decline is early.

On lower time frames, last week's maximum extremum (1.2669) is currently being tested, which is strengthened by the first resistance of the classic Pivot levels (1.2666). Breaking through this level will open the way to R2 (1.2713) and R3 (1.2763). In the event of a rebound, a key support is located today in the region of 1.2616 (central Pivot level) - 1.2573 (weekly long-term trend + S1). A consolidation below will change the current balance of forces of lower time frames. The following intraday downsides are supported by the classic Pivot levels S2 (1.2519) and S3 (1.2472).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)