To open long positions on GBPUSD, you need:

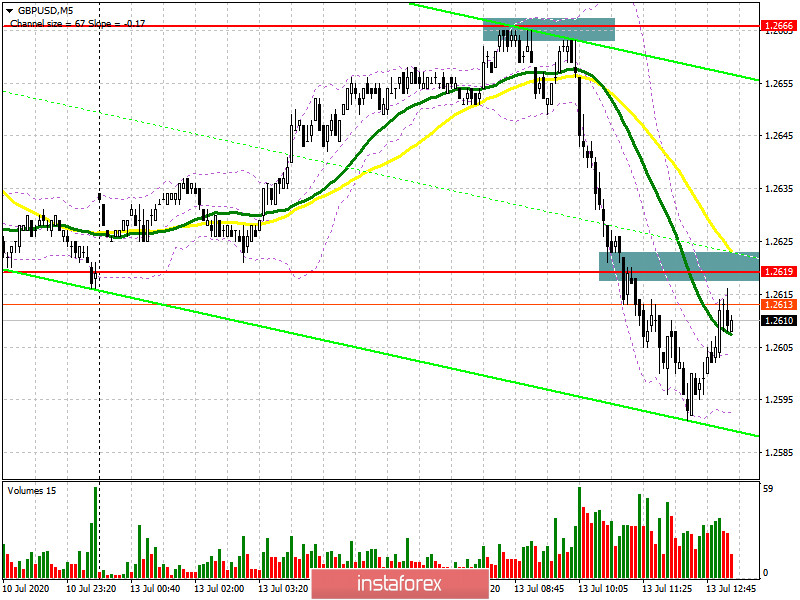

In the first half of the day, I paid attention to the resistance level of 1.2666, from which I recommended opening short positions when forming a false breakout. If you look at the 5-minute chart, you will see how the bears began to actively act when approaching this level at the beginning of the European session and already on the second wave of growth, they did not even allow the bulls to test the area of 1.2666. After that, an active decline in the pound began, and then there was a breakdown of the support of 1.2619, below which the bears are now trying to gain a foothold. If the pressure on the pound persists in the second half of the day, it is best to return to long positions only for a rebound from the support of 1.2569, which acts as the lower border of the side channel, in the expectation of a correction of 20-30 points within the day. An equally important task remains for buyers to return to the middle of the channel of 1.2619, below which they are currently trading. As soon as this happens, we can expect a second wave of growth to the maximum of 1.2666 and its breakdown, which opens up real prospects for updating the level of 1.2742, where I recommend fixing the profits.

To open short positions on GBPUSD, you need:

Bears need to keep the market under their control. The bottom-up test of the level of 1.2619 will be an additional signal to open short positions. However, it is important to understand that the movement of the pound down, after the repeated update of the area of 1.2619, should be quite rapid. Otherwise, the bulls will regain this area, which will cancel all plans for further reduction of the pound. While trading will be conducted below the range of 1.2619, you can also count on the continuation of the decline of GBP/USD in the area of the lower border of the side channel 1.2569, the break of which will open a direct road to the minimum of 1.2511, where I recommend fixing the profits. In the scenario of the bulls returning to the resistance of 1.2619, it is best to postpone short positions until the maximum of 1.2666 is updated or sell immediately for a rebound from the new area of 1.2742 in the expectation of a correction of 20-30 points within the day.

Signals of indicators:

Moving averages

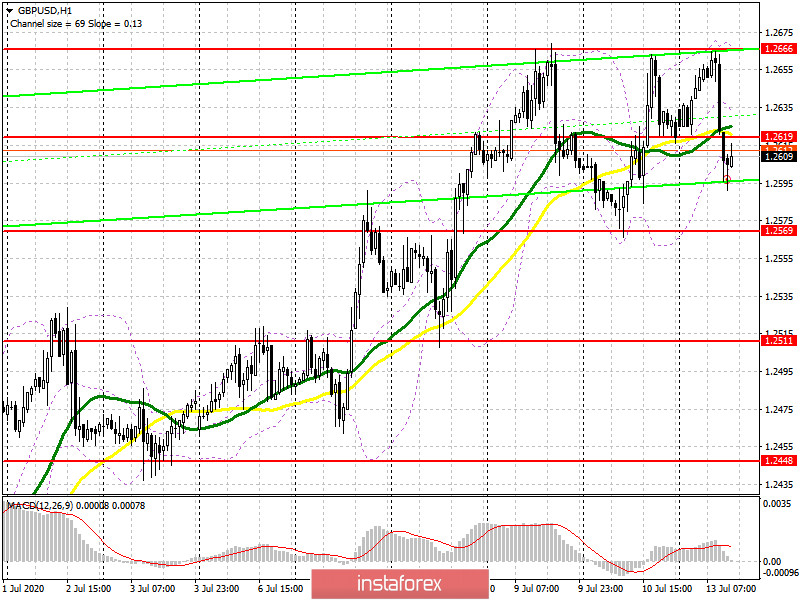

Trading is conducted in the area of 30 and 50 daily averages, which indicates the lateral nature of the market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

Breaking the upper limit in the area of 1.2666 will lead to a new wave of growth of the pound. A break in the lower border at 1.2595 will increase the pressure on the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20