GBP/USD rallied in the last hours climbing as high as 1.3442, above 1.3437 static resistance. The pair edged higher as the USD was punished by the DXY's drop. The dollar index is still under pressure in the short term. On the other hand, the British pound is strongly bullish. It has appreciated versus most of its rivals and not only versus the greenback.

Today and tomorrow, the UK banks will be closed. In the short term, the bias remains bullish. I don't think that the US HPI, S&P/CS Composite-20 HPI, and the Richmond Manufacturing Index will change the sentiment tomorrow.

We may have some volatility on Wednesday after the US will release the Goods Trade Balance, Prelim Wholesale Inventories, and the Pending Home Sales. Also, on Thursday, the Unemployment Claims could move the markets.

GBP/USD minor retreat

GBP/USD failed to reach and retest the 1.3374 support. Now, it challenges the 1.3437 resistance. In the short term, it could move somehow sideways if it fails to take out this upside obstacle.

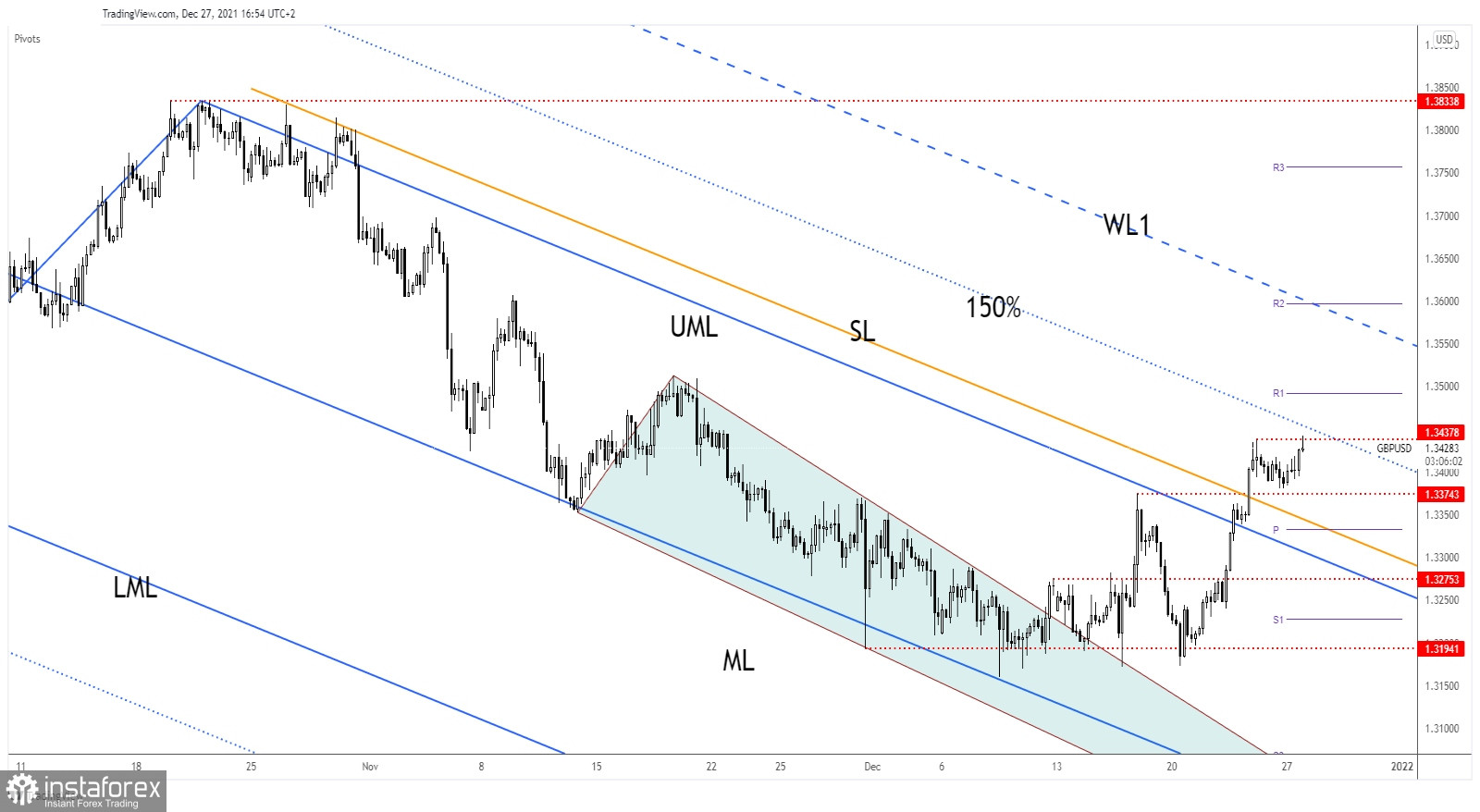

In addition, the pair stands right below the 150% Fibonacci line which is seen as a potential upside obstacle. Staying near this obstacle may announce an upside breakout and more gains.

GBP/USD prediction

After its previous rally, GBP/USD retreated a little trying to accumulate more bullish energy. In the short term, the bias remains bullish. It could climb higher anytime. Still, only a valid breakout above 1.3437 and above the 150% Fibonacci line may really activate an upwards continuation and could bring new long opportunities.

Moving sideways between 1.3437 and 1.3374 may represent an upside continuation pattern.