To open long positions on GBP/USD, you need:

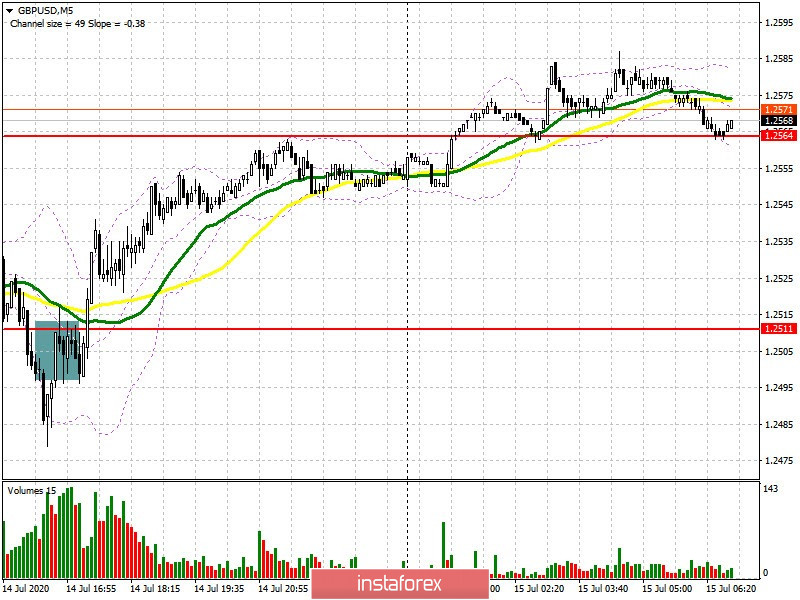

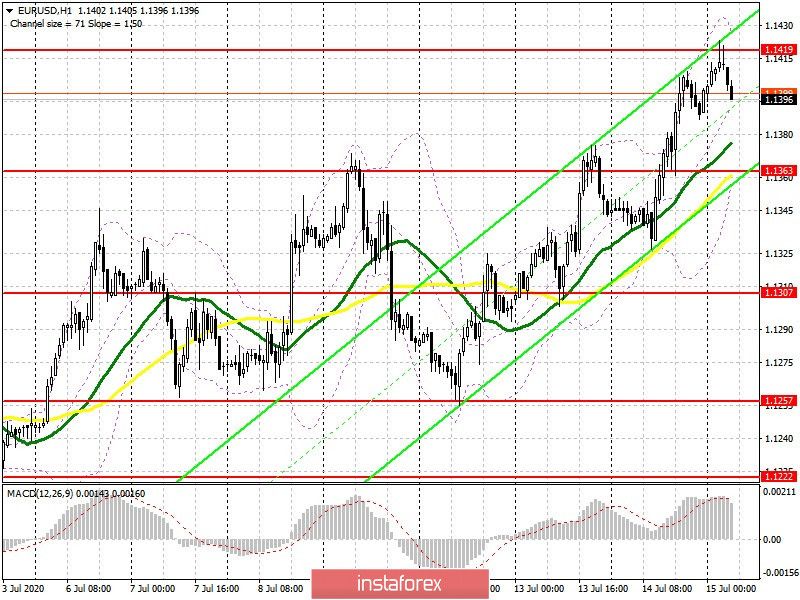

The bear's attempt to continue the downward trend below the level of 1.2511 turned out to be unsuccessful yesterday. If you look at the 5-minute chart, you will see that after the breakout of this range, which was prepared for the entire European session, sellers tried to gain a foothold below the level of 1.2511, but this did not lead to continuing the bear market. The bulls took advantage of good data on US inflation and almost completely regained all the positions lost after the UK GDP data. At the moment, the task of buyers is to protect the support of 1.2549, which will surely be tested today after the release of UK inflation data. Forming a false breakout on it will be a signal to buy the pound while expecting growth to continue to the resistance of 1.2615, consolidating on it will be an additional entry point into long positions. The main goal of the bulls is to return to the week's high in the area of 1.2666, where I recommend taking profits. If the bears are stronger and regain support of 1.2549, I advise you to postpone long positions until the low of 1.2482 is updated, or buy immediately on the rebound from support of 1.2435, based on a correction of 30-40 points within the day. In the COT report for July 7, it is indicated that during the week there was an increase in short non-commercial positions from the level of 55,414, to the level of 56,300. Long non-commercial positions rose from the level of 34,424 to the level of 39,892. As a result, the non-commercial net position decreased its negative value to -16,408, against -20,990, which indicates that the market is still under pressure after the bulls' unsuccessful attempt to continue the upward trend, but the picture is gradually shifting to the neutral side.

To open short positions on GBP/USD, you need:

Pound sellers need to be more aggressive in order to not miss the recently formed downward trend. The main task for the first half of the day is to return and consolidate below the support of 1.2549, which will increase pressure on the pair and lead to an update of the low of 1.2482. The intermediate support of 1.2435 is still the long-term goal, where I recommend taking profits. In case of a good report on inflation in the UK, the bears will have to protect the resistance of 1.2615 and form a false breakout there, which will be a signal to open short positions. Larger sellers will wait for the test of this week's high of 1.2666 and sell GBP/USD from there immediately on the rebound based on a correction of 30-40 points within the day. However, it should be understood that an update to the 1.2666 resistance will indicate a break in the downward correction and a return of the bull market.

Indicator signals:

Moving averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates an active opposition of players for the further direction of the market.

Note: the period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break in the upper limit of the indicator at 1.2585 will lead to a new wave of growth of the pound. If the pound falls, the lower border of the indicator around 1.2496 will provide support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.