On Tuesday, all the attention of investors was focused on the development of the conflict between the United States and China in the South China Sea. Investors completely switched to this topic, leaving for the publication of company reports for the second quarter.

The new aggravation in relations between Washington and Beijing, initiated by the first one, took control of financial markets, reminding its participants that some of its weakening was only temporary, since trade contradictions between China and the States did not disappear, but were only waiting for a new phase of development.

Against the backdrop of these events, the US dollar tried to strengthen its position against a basket of major currencies, but failed to do this because of continued persistent growth in the single European currency, which has a significant weight in it.

The growth of the euro/dollar pair actually happened due to the absence of any influential fundamental positive or is this not quite so?

The ZEW current economic conditions index for both the Federal Republic of Germany and the Eurozone turned out to be lower than expected. Thus, the German figure declined in July from 63.4 points to 59.3 points. The volume of industrial production in the eurozone in May amounted to 12.4% against -18.2 a period earlier. On an annualized basis, industrial production declined in May by 20.9% compared to a drop a year earlier by 28.7%. In general, we can say that the values of the indicators were even slightly better, however, far from normal.

In addition, the ZEW economic sentiment index for July for the eurozone turned out to be positive. The indicator added from 58.6 points to 59.6 points in June.

Consumer inflation data in Germany also showed a 0.6% monthly growth rate and 0.9% annualized growth, which turned out to be, although in line with the forecasts, perhaps the cause of demand for the euro.

In general, the statistics from the Federal Republic of Germany and the euro area were generally good, given the situation with the consequences of the coronavirus pandemic and the continued impact of this never-ending factor.

In our view, it was the economic data published on Tuesday that stimulated the appreciation of the single European currency, which is likely to continue in the future if the Eurozone economic recovery fund is adopted. It should also be noted that large-scale stimulus measures from the Fed more than overlap those from the ECB. The normalization of the situation in the world after the coronavirus pandemic will support the demand for risky assets and put pressure on the dollar, which again, as 11 years ago after the 2008-09 crisis, will become a funding currency with all the "weaknesses" due to the dollar.

Forecast of the day:

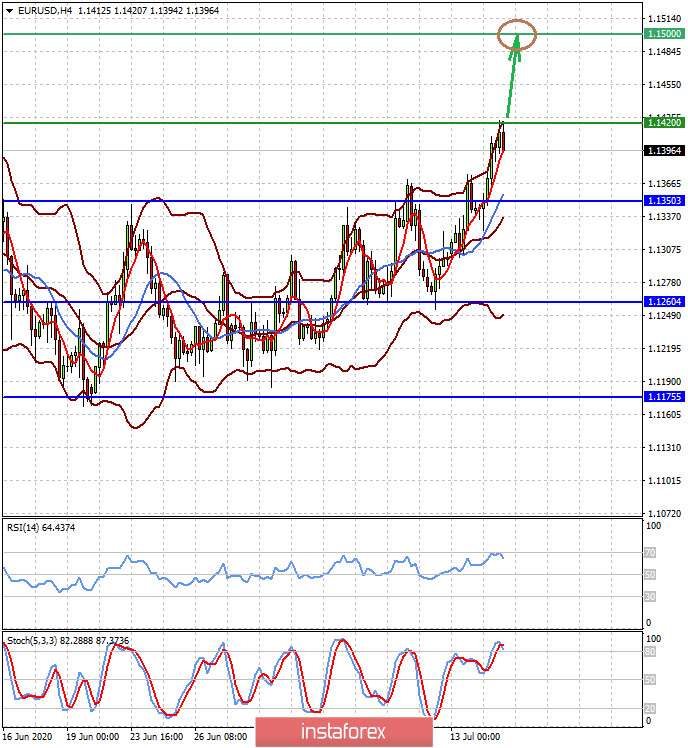

The EUR/USD pair has tested our target 1.1420 and can continue to grow if it breaks through in the wake of hopes that the EU will agree on a Recovery Fund and if demand for risky assets continues, as it weakens the US currency. In this case, the pair will rush around the level of 1.1500.

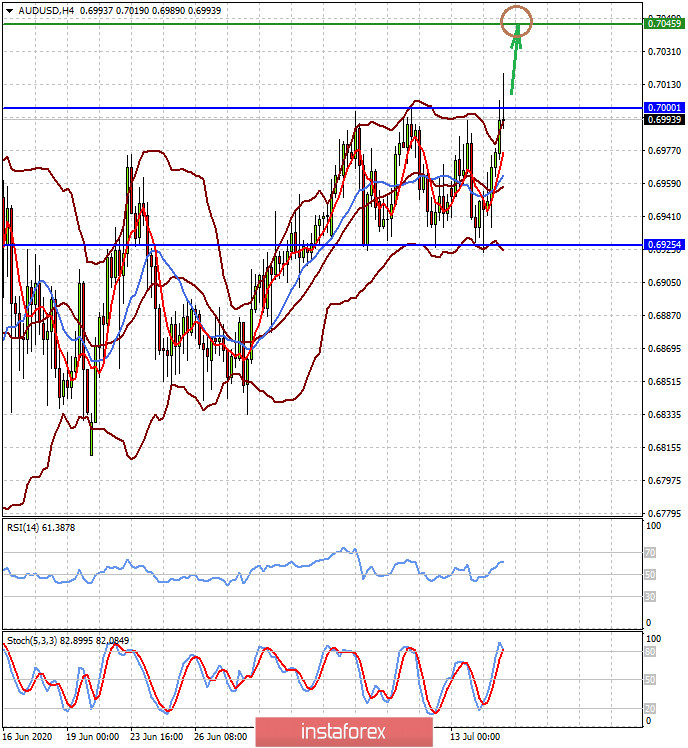

The AUD/USD pair is consolidating in the range of 0.6925-0.7000. So, price breaking through the upper level amid positive demand for risky assets will push the pair to 0.7045.